[ad_1]

Because the month of June unfolds, traders who interact in crypto buying and selling will grapple with three main hurdles. Certainly, these obstacles may ship ripples throughout the crypto market.

These points embrace a regarding dip in buying and selling quantity, alarming liquidity points, and a considerable improve in promoting stress.

Buying and selling Quantity Plummets

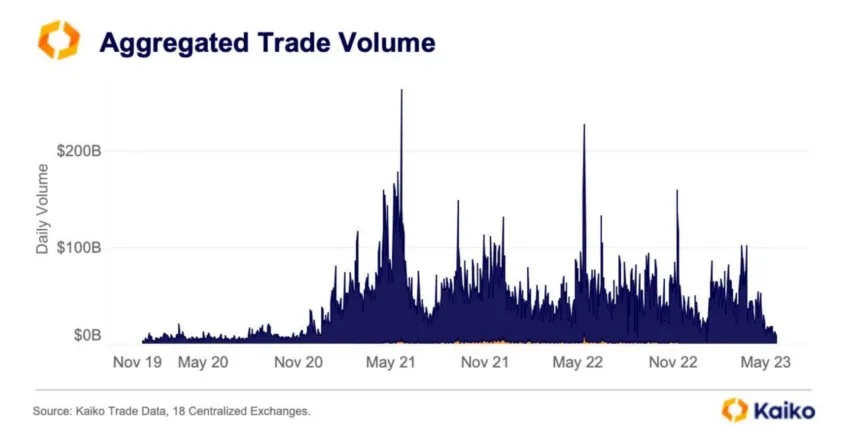

The buying and selling momentum and expectations had been excessive within the crypto market’s first quarter this 12 months. Nonetheless, a disturbing decline in buying and selling quantity throughout all main centralized exchanges has been noticed since.

Might’s aggregated every day buying and selling volumes have shrunken from an impressive $23 billion to a paltry $9 billion. This downtrend indicators a diminishing speculative curiosity and a rising apathy towards the crypto market.

“Day by day crypto buying and selling quantity is now the bottom that it has been since 2020. Market in combination is in a interval of apathy and capitulation by means of time – lack of speculative curiosity from the lots sparks alternative for these with a robust perception,” said analyst Will Clemente.

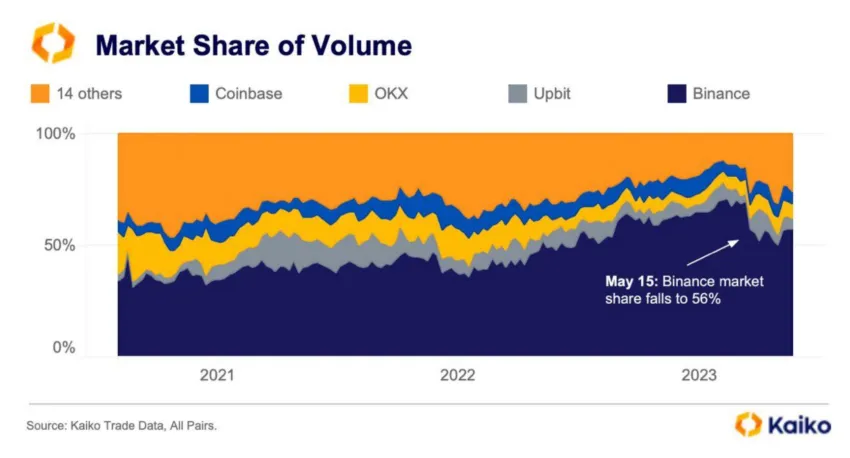

Concerning the breakdown of general buying and selling quantity by trade, Binance has experienced a slump. Its market share has plunged to 56%, a stark 15% drop from its peak within the second half of 2022.

Contrarily, this decline has favored exchanges within the different classes, which includes platforms reminiscent of Huobi, Kraken, and Kucoin.

With the regulatory panorama in the USA remaining unsure, offshore exchanges keep their dominance within the crypto buying and selling ecosystem. They make up a staggering 86% of your complete buying and selling quantity. This pattern is predicted to accentuate.

Surprisingly, even Coinbase, historically acknowledged as a compliant various to different crypto venues, announced the introduction of its personal offshore derivatives venue, the Coinbase Worldwide Trade.

Crypto Liquidity Disaster

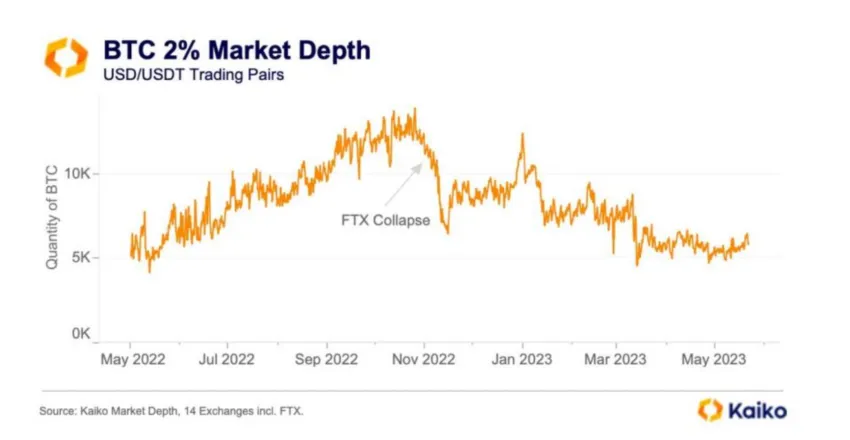

The second main challenge casting a shadow over the crypto market is a liquidity disaster. That is particularly vital for Bitcoin and Ethereum.

Regardless of the USD-denominated market depth remaining considerably secure. Liquidity has been flat as measured by coin-denominated 2% market depth, that means the depth of bids and asks inside 2% of the present buying and selling value. This displays an growing indifference towards the crypto market.

The continued liquidity decline has elicited statements from Jane Road and Bounce Crypto, two market makers, revealing plans to scale back their crypto operations within the US because of regulatory uncertainties. Jane Road went additional, asserting a worldwide scale-back of its crypto operations.

The implications of reduced liquidity within the crypto market are vital. Liquidity is a important side of any monetary market, together with crypto. It refers back to the ease with which belongings will be purchased or offered available in the market with out affecting the asset’s value.

Excessive liquidity ranges create a safer and environment friendly market. Subsequently, permitting members to enter simply and exit trades results in tighter spreads.

In distinction, low liquidity can hinder the power of market members to execute bigger trades with out incurring value impression, often known as slippage.

In sensible phrases, if a dealer needs to promote a big amount of crypto and there aren’t sufficient patrons, the worth could need to be lowered to make it interesting. This course of may create a downward value spiral, resulting in decrease costs and probably triggering a sell-off.

Surging Promoting Stress

The third drawback offered in June 2023 is the surge in selling pressure as Bitcoin dropped beneath $27,000.

Whereas the crypto neighborhood retains a watchful eye on essential value ranges, issues round liquidity have been amplified within the wake of legislative actions within the US.

Antoni Trenchev, managing associate of crypto lender Nexo, raised an attention-grabbing level.

“Bitcoin faces a lot of potential banana skins in June now the debt ceiling drama appears to be like to have handed. As soon as the Senate possible backs the debt-limit laws, the market faces a flood of treasury invoice issuance, which is able to possible draw liquidity away from threat belongings like Bitcoin,” said Trenchev.

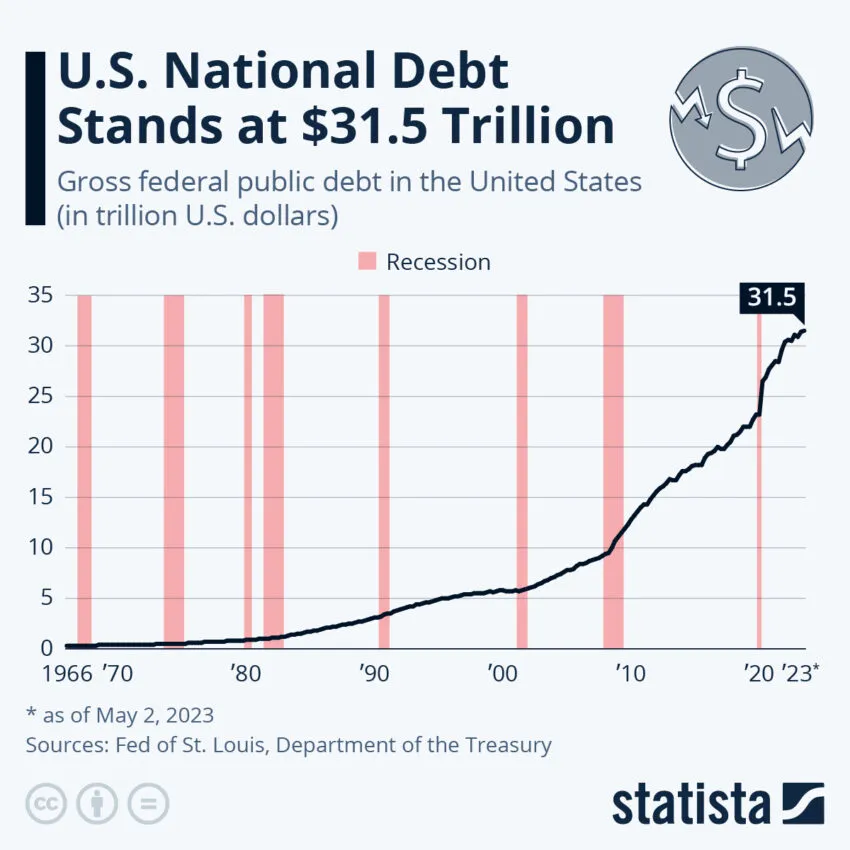

The US Home of Representatives just lately approved a deal to suspend the $31.5 trillion debt ceiling. This might outcome within the issuance of as much as $1 trillion in US Treasury payments, posing further stress on Bitcoin.

“For Bitcoin, it’s fairly easy: Keep above the 200-week shifting common round $26,300, and the bullish uptrend from the November low of $15,500 is unbroken. On the upside, get above $31,000, and issues would possibly begin to get actually attention-grabbing,” remarked Nexo’s Trenchev.

Nonetheless, Maartunn, Neighborhood Supervisor at CryptoQuant, believes that regardless of the latest spike in promoting stress much like earlier sell-offs, it might peak quickly and revert.

Disclaimer

Following the Belief Venture pointers, this function article presents opinions and views from business specialists or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially mirror these of BeInCrypto or its workers. Readers ought to confirm info independently and seek the advice of with knowledgeable earlier than making selections based mostly on this content material.

[ad_2]

Source link