[ad_1]

Crypto markets have gotten more and more unsure because the bias in direction of decreasing the danger of an ETH reversal turns into even deeper.

QCP Capital analysts expect nervousness within the cryptocurrency sector will proceed amid the escalation of the state of affairs within the Center East because the Iran-Israeli battle develops. As well as, many merchants at the moment are attempting to keep away from threat amid the weak efficiency of U.S. shares.

Funding for various contracts can also be typically detrimental, indicating that a lot long-term leverage has been worn out. On the similar time, analysts level out that there’s nonetheless a powerful demand for Bitcoin (BTC) within the crypto market, in distinction to Ethereum (ETH).

“Perp funding for BTC is flattish with the again finish of the curve holding regular at double digit yields.”

QCP Capital analysts

Given the present dynamics for important cryptocurrencies, specialists counsel “selecting bottoms very defensively” and shopping for BTC or ETH at a considerable low cost to the spot worth.

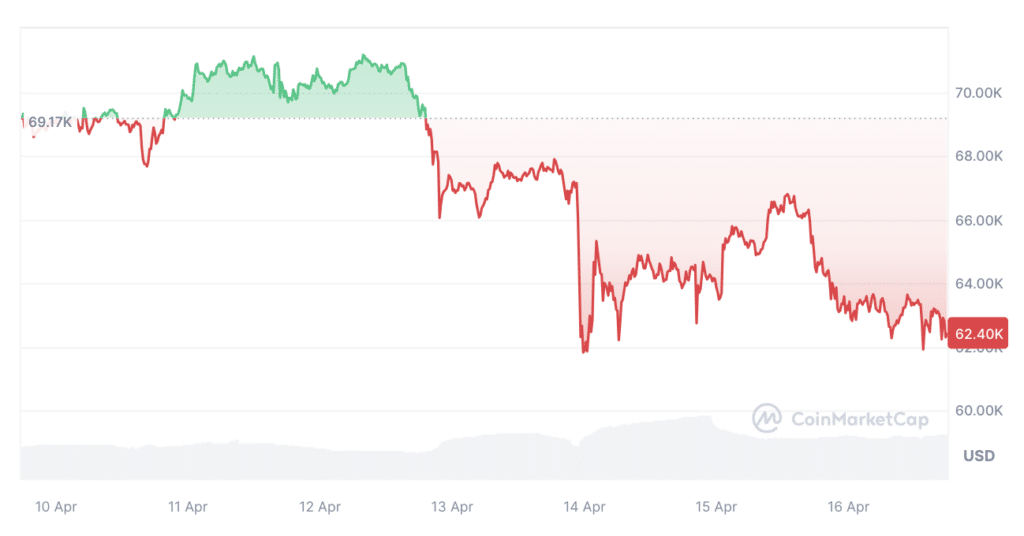

On the night time of April 14, Bitcoin’s worth collapsed amid information of Iran’s assault on Israel. BTC’s 8% drop beneath $62,000 marked its most outsized retreat since March 2023. In line with CoinMarketCap information, the value had recovered barely, reaching $62,300 at publication.

Final week, QCP Capital remained assured that the upcoming Bitcoin halving wouldn’t solely cut back the miners’ reward for a mined Bitcoin block to three.125 BTC however might additionally sharply improve demand for the primary cryptocurrency.

Different elements driving development included elevated inflows into spot ETFs and studies that Citadel, Goldman Sachs, UBS, and Citi have joined BlackRock‘s exchange-traded fund. BlackRock will act as a broker-dealer approved to create and redeem shares of the ETF.

[ad_2]

Source link