[ad_1]

The extravagant realm of buying and selling high-priced belongings has expanded past the unique area of artwork connoisseurs and into the crypto business. Amid the growth, many traders have turned their consideration to world artwork, NFTs, and luxurious objects like Rolex watches.

Nonetheless, as financial development begins to decelerate, the posh items market is experiencing the same downturn.

World Artwork Gross sales Take a Hit

According to the Washington Post, world artwork gross sales reached $67.8 billion in 2022, marking a 3% improve from the earlier 12 months. In distinction, 2021 witnessed a 30% surge in artwork gross sales in comparison with 2020. The inflow of $9 trillion in liquidity has undoubtedly performed a major function in bolstering the artwork market.

The US has been a major driver of the artwork market, with iconic items resembling Andy Warhol’s Shot Sage Blue Marilyn promoting for $195 million and Leonardo Da Vinci’s Salvator Mundi fetching $450 million in 2017.

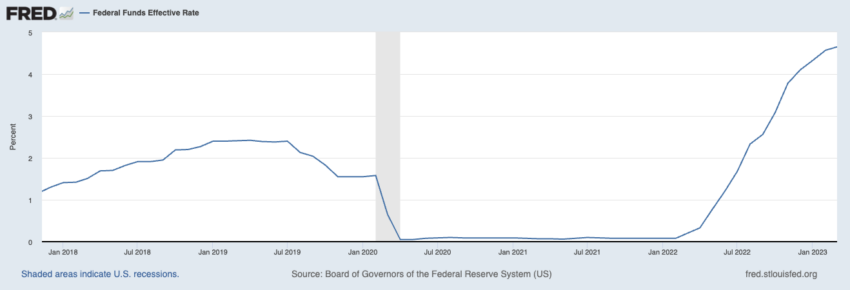

Nevertheless, the market started to lose steam in late 2022. Waning demand for lower-end work, considerations about recession, rampant inflation, and rising rates of interest have severely impacted this market.

Along with these components, youthful luxurious shoppers are additionally chopping again on spending.

Manufacturers like Burberry Group Plc and Gucci-owner Kering SA report that “aspirational consumers” – a youthful demographic – have gotten extra cautious with their expenditures as we head into 2023.

NFT Gross sales Undergo, However China Could Maintain the Key

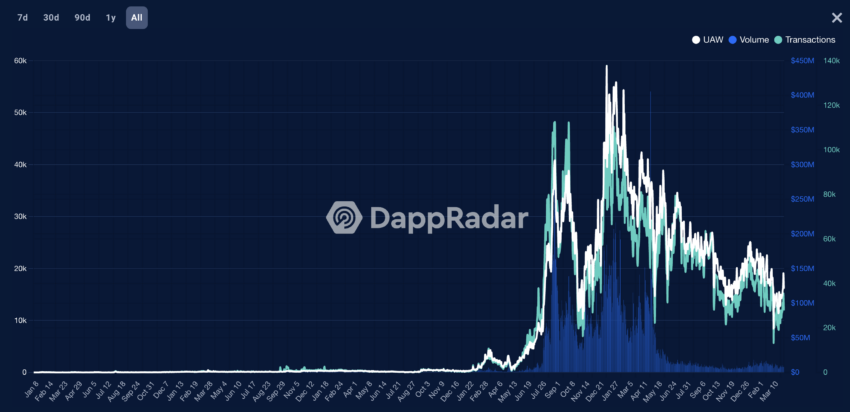

The decline in market enthusiasm is most evident within the NFT area. After skyrocketing from $20 million in gross sales in 2020 to $2.9 billion in 2021, art-related NFT gross sales dropped by roughly 50% in 2022.

Whereas younger individuals proceed to spend money on artwork, those that do sometimes possess over $1 million in belongings, together with actual property and personal companies. This distinguishes them from the “crypto bros” who entered the market through the growth.

The Washington Publish means that China may hold the key to revitalizing the artwork and luxurious markets. Following the 2008 monetary disaster, the Chinese language market performed a vital function within the restoration. Artwork gross sales bounced again in 2010.

Current occasions like Artwork Basel Hong Kong and optimistic alerts from manufacturers resembling Prada and Moncler point out a resurgence in luxurious purchasing. Bernstein analysts have additionally noticed Chinese language vogue fans starting to journey overseas as soon as extra.

For purveyors of high-end merchandise from Balenciaga to Basquiat, the hope is that Chinese consumers will unleash a new wave of “revenge spending” to revitalize the posh and different asset markets.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections based mostly on this content material.

[ad_2]

Source link