[ad_1]

A paradoxical situation is rising because the crypto market anticipates the potential approval of spot Bitcoin ETFs (exchange-traded funds) in early 2024. Whereas such approval may appear a harbinger of a bullish part for Bitcoin, a number of consultants recommend in any other case.

Their evaluation signifies a possible downturn in Bitcoin’s worth, with a forecasted decline to round $32,000 in January 2024.

Bitcoin ETFs and the “Promote-the-Information” Phenomenon

CryptoQuant, a famend analytics agency, famous that the market anticipates a 90% chance of spot Bitcoin ETF approvals by early January. This optimism, mirrored in 32 meetings between ETF issuers and the US Securities and Exchange Commission (SEC), suggests constructive dialogue. Nonetheless, it additionally units the stage for a traditional “sell-the-news” occasion.

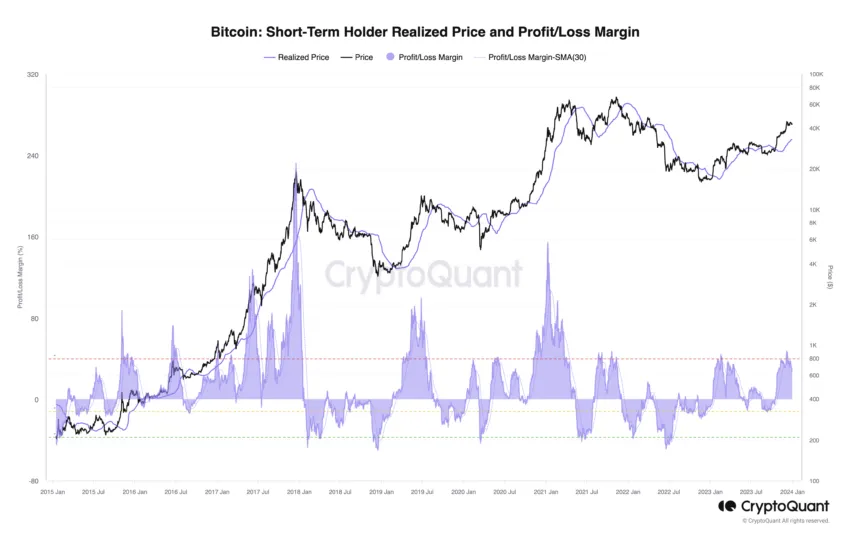

“There are growing odds that the ETF approval might be a ‘Promote-the-Information’ occasion as Bitcoin market contributors are sitting on excessive unrealized income. For instance, short-term Bitcoin holders are experiencing excessive unrealized revenue margins of 30%, which traditionally has preceded worth corrections,” analysts at CryptoQuant argued.

The latest announcement from Blackrock about seeding its ETF with $10 million is a bullish signal. Nonetheless, CryptoQuant highlighted the influence of miner conduct. With the latest surge in Bitcoin costs, miners are experiencing excessive unrealized income and have began growing their promoting actions, which might contribute to downward stress.

Learn extra: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

For these causes, CryptoQuant predicted that Bitcoin might decline to as little as $32,000, which is the place the short-term holder realized worth sits.

Cathie Wooden and Nic Carter Anticipate BTC Value to Decline

Cathie Wooden, CEO and CIO of ARK Make investments, additionally supplied a extra nuanced perspective. She acknowledged the opportunity of a short-term sell-off however stays bullish on Bitcoin’s long-term prospects.

“It wouldn’t be stunning if we noticed a promote on the information. That’s an expression available in the market when you could have plenty of anticipation a worth strikes up, the occasion occurs after which, particularly quick buying and selling organizations, promote on the information. However past that, I believe might be only a possibly a really short-term phenomenon,” Wooden concluded.

Wooden additionally cited the numerous influence that even a modest institutional funding might have on the worth of Bitcoin. She argued that “there are trillions of {dollars} in belongings to be allotted” in Bitcoin, if these establishments transfer 0.1%, that can “transfer the needle.” Wooden’s view is grounded in Bitcoin’s shortage and the anticipated inflow of institutional funds post-ETF approval.

Learn extra: Renowned Analysts Explain Why BTC Price Will Hit $1 Million After Bitcoin ETF Approval

Likewise, Nic Carter, funding associate at Fortress Island Ventures, highlighted a dichotomy within the market’s response to the spot Bitcoin ETF approval. Whereas agreeing with the short-term sell-off sentiment, he’s additionally optimistic concerning the medium-term results.

In keeping with Carter, the ETF would unlock new capital lessons, fostering structural flows that might profit Bitcoin. He downplayed the influence of the halving occasion in comparison with the ETF’s potential to draw new funding.

“We might even see a news-selling occasion right here. Nonetheless, over the medium time period, the ETF unlocks complete new lessons of capital that in any other case wouldn’t be capable to enter the market and haven’t been in a position to allocate to Bitcoin. So, I believe you will notice structural flows that might be constructive for Bitcoin,” Carter emphasised.

Learn extra: BTC Price Prediction 2024: What Will Happen After Bitcoin ETFs Approval?

Ali Martinez, World Head of Information at BeInCrypto, offered a historic perspective on Bitcoin. He famous that sturdy BTC performances in the direction of the yr’s finish have typically led to bearish tendencies in January. This sample means that January 2024 might see a spike in profit-taking. Subsequently, it aligns with the opposite analysts’ predictions of a worth drop.

Disclaimer

In adherence to the Trust Project pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please notice that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.

[ad_2]

Source link