[ad_1]

- Bitcoin has traded inside a slim vary between $30,000 and $31,500 for a month

- The crypto might endure one other correction earlier than eyeing increased ranges

- In the meantime, Ethereum has discovered it tough to surpass the $1,950 – $2,025 zone

has been buying and selling inside a comparatively slim vary between $30,000 and $31,500 for a couple of month, indicating a protracted interval of consolidation. Throughout this time, bulls and bears have been locked in a battle for management.

An identical scenario occurred in March 2023, though it lasted for a shorter period. The cryptocurrency exhibited elevated volatility after remaining inside the $26,000 to $28,000 vary. It broke by way of the $30,000 mark however confronted vital resistance in April. As promoting stress intensified, it dropped beneath $25,000 finally.

After a blended efficiency in April, it entered the summer season months with a correction, declining because of the impression of macroeconomic information because the Federal Reserve continued to boost rates of interest in Could. The market additionally skilled a downturn following the SEC’s lawsuit towards cryptocurrency exchanges in early June. Nonetheless, the detrimental impression of the SEC’s actions was shortly overcome by constructive information when BlackRock) filed for a spot ETF software.

Subsequently, with the Fed’s rate of interest hike in June and the numerous information of the ETF, the market returned to the $30,000 vary, which is taken into account a psychological assist stage for cryptocurrencies. The main target now lies on how Bitcoin will escape of this consolidation section.

Following final week’s launch of US information, consideration has shifted to the Federal Reserve. Though headline inflation has proven a downward development, inflation stays stubbornly excessive, resulting in expectations of a 25 foundation level rate of interest hike by the US Federal Reserve this month. The Fed’s rate of interest is a vital benchmark for threat markets, inserting stress on Bitcoin’s upward motion.

Furthermore, the summer season brings rising temperatures, probably rising mining prices. Moreover, the record-high mining problem for BTC has prompted miners to promote, creating one other hurdle for Bitcoin’s progress within the cryptocurrency market, regardless of favorable situations.

On a distinct word, the latest interim choice in favor of triggered a rally, however its impression on Bitcoin was restricted. This occasion primarily affected the altcoin market. Then again, Bitcoin confronted promoting stress when making an attempt to interrupt the $31,500 resistance stage, inflicting it to retreat to the decrease finish of the buying and selling vary and relinquish its latest good points.

Bitcoin is at present in a sound uptrend after latest constructive developments drove costs as much as $31,500. Nonetheless, some technical indicators counsel that Bitcoin might endure one other correction earlier than reaching increased ranges.

The weekly outlook signifies a possible break of the uptrend line within the close to future, resulting in a check beneath $25,000. This could possibly be attributed to a technical divergence with the bearish CCI indicator conflicting with the bullish worth motion. An identical discrepancy might also come up with the Stochastic RSI indicator except Bitcoin manages to beat the resistance at $31,000.

By way of assist and resistance ranges, the present worth motion signifies the primary assist zone within the $29,700 – $29,900 vary, aligning with the decrease boundary of the horizontal channel. Under this stage, a secondary assist line may be noticed at round $27,000.

On the upside, $31,500 stays a big resistance stage, whereas potential targets of $32,000, $34,000, and $36,000 might come into focus if there’s a additional improve in demand. Nonetheless, if Bitcoin every day closes beneath $31,500, it raises the danger of coming into a corrective development that would lengthen beneath $25,000.

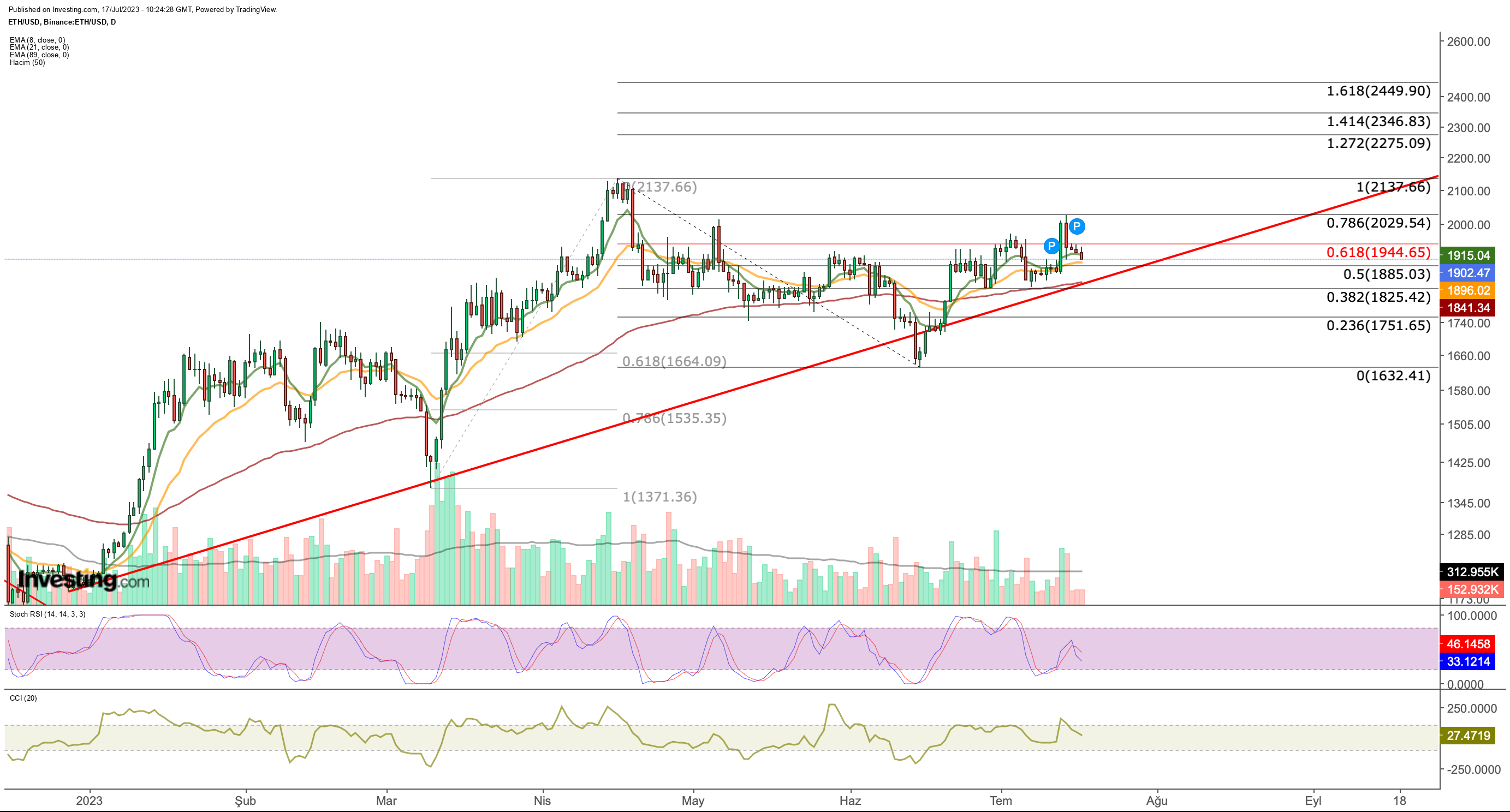

Ethereum Outlook

underwent a notable correction from April to June, reaching as little as $1,600. Whereas this downturn affected ETH’s bullish momentum for 2023, cryptocurrency continues to comply with the broader development.

ETH discovered it difficult to surpass the resistance zone between $1,950 and $2,025. This week, monitoring the assist stage inside the vary of $1,900 to $1,915 will probably be essential. A breach beneath this area might result in a decline in direction of $1,840, with additional draw back potential in direction of the $1,700 mark.

On the upside, affirmation of a every day closing worth above $2,030 can be vital. If this state of affairs unfolds, Ethereum may probably proceed its upward momentum, focusing on the vary of $2,275 to $2,450, surpassing the earlier peak in April at $2,135.

***

Entry first-hand market information, components affecting shares, and complete evaluation. Make the most of this chance by subscribing and unlocking the potential of InvestingPro to reinforce your funding selections.

And now, you should purchase the subscription at a fraction of the common worth. Our exclusive summer discount sale has been prolonged!

InvestingPro is again on sale!

Get pleasure from unimaginable reductions on our subscription plans:

- Month-to-month: Save 20% and get the pliability of a month-to-month subscription.

- Annual: Save an incredible 50% and safe your monetary future with a full yr of InvestingPro at an unbeatable worth.

- Bi-Annual (Net Particular): Save an incredible 52% and maximize your earnings with our unique net provide.

Do not miss this limited-time alternative to entry cutting-edge instruments, real-time market evaluation, and skilled opinions.

Be part of InvestingPro right now and unleash your funding potential. Hurry, the Summer Sale will not final eternally!

Disclaimer: This text is written for informational functions solely; it’s not meant to encourage the acquisition of belongings in any method, nor does it represent a solicitation, provide, suggestion, recommendation, counseling, or suggestion to speculate. We remind you that each one belongings are thought of from totally different views and are extraordinarily dangerous, so the funding choice and the related threat are the traders’.

[ad_2]

Source link