[ad_1]

Government Abstract: Yield farming propelled the DeFi sector to a $150 billion market within the span of simply 18 months. What does the area seem like after the latest crypto winter?

On this new sector report, we’ll have a look at the highest yield farming firms in DeFi. We’ll additionally cowl our funding thesis on this sector, that will help you establish the highest alternatives.

Trade Overview

Yield farming has been variously described because the lifeblood or rocket gas of the DeFi ecosystem.

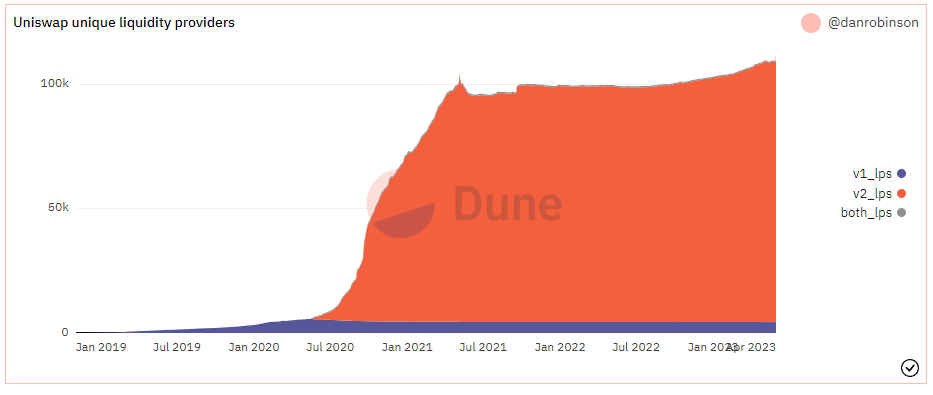

It first emerged as an investing technique in 2020, with “liquidity mining” on the Compound protocol. Buyers deposited crypto belongings into Compound to earn curiosity or “yield.” In simply two months, the Whole Worth Locked (TVL) in DeFi went up by $2 billion.

Yield farming supplied excessive returns, at a time when conventional banks had been providing extraordinarily low rates of interest. Over the subsequent two years, yield farming attracted over $150 billion into DeFi protocols, firmly establishing it because the “subsequent large factor” in crypto. According to Nansen, the expansion within the subject between 2020 and 2022 was over 6,900%.

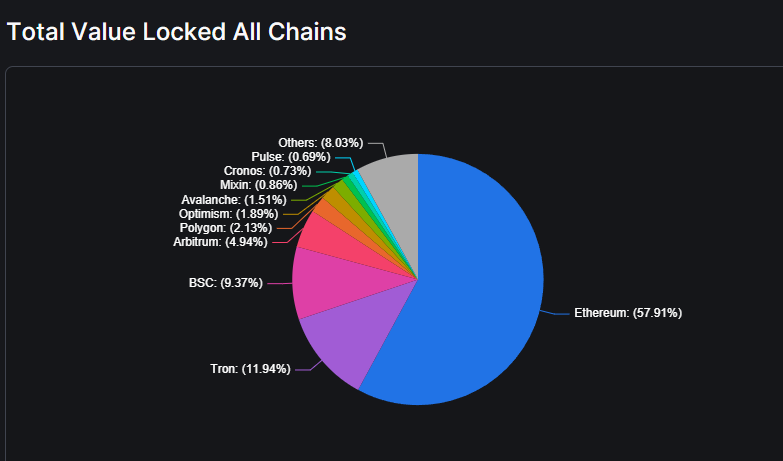

Though there was a 76% decline in DeFi protocols since 2022, the sector continues to be valued at $47.3 billion in TVL. The Ethereum blockchain hosts greater than 57% of all DeFi yield farming exercise, adopted by Tron (11.94%) and Binance Good Chain (9.37%).

Among the many high protocols, there may be appreciable variety. Decentralized exchanges are probably the most dominant platforms for yield farming, led by Uniswap and Curve Finance. DeFi lending is one other hotbed of exercise, primarily centered on protocols like Aave.

Stablecoins proceed to play a decisive position within the evolution of DeFi and yield farming. Given their low volatility, cash like USDC and USDT have emerged as common farming and staking choices.

Capitalizing on this development, many DeFi protocols are within the technique of launching native stablecoins. Curve Finance was the primary to realize this milestone with the issuance of crvUSD on the Ethereum mainnet in May 2023.

In a time of rising conventional yields, does yield farming and the broader DeFi scene nonetheless retain any worth for buyers? To handle this query, let’s take a better have a look at the highest six yield farming firms in DeFi.

High Yield Farming Firms

| Firm | Ticker | Market Cap | TVL | Charges (annualized) | Median APY |

| Uniswap | UNI | $3.83b | $4.12b | $457.57m | 6.01% (V3)

1.66% (V2) |

| Aave | AAVE | $929.48m | $3.83b | $65.18m | 0.96% (V2)

1.40% (V3) |

| Synthetix Community | SNX | $744m | $415.22m | $46.42m | N/A |

| Curve Finance | CRV | $673.64m | $4.22b | $6.55m | 0.99% |

| PancakeSwap | CAKE | $331.55m | $1.94b | $234.24m | 14.81% (V3)

4.93% (V1) |

| yearn.finance | YFI | $215.93m | $449.24m | N/A | 3.23% |

Funding Thesis

So long as buyers are holding crypto, there shall be a requirement to earn curiosity on that crypto. Many buyers will wish to put their crypto to work with the businesses listed above, just like placing your cash to work in a standard financial savings account.

These yield farming firms soak up cash from liquidity suppliers (LPs), who present the capital to make their merchandise work. Whereas changing into an LP is one technique to earn cash by yield farming — and there are numerous others — we expect the best investing strategy is to purchase and maintain the tokens of high yield farming firms.

We imagine that investing within the tokens themselves (shopping for and holding UNI, for instance), is like making a standard funding in an organization’s inventory. If the corporate does properly over the long run, we anticipate the token worth (like a inventory) to understand in worth.

Right here’s why we’re nonetheless bullish on yield farming as an asset class:

The Promise of Excessive APY

Yield farming rewards can typically cross absurd ranges, reaching as excessive as 3,000% APY. This is a significant component that pulls in lots of buyers regardless of the steep dangers concerned in staking funds throughout extremely risky cryptos and different derivatives. (Our rule of thumb: if an APY appears too good to be true, it often is.)

Environment friendly Utilization of Idle Capital

At Bitcoin Market Journal, we encourage a long-term, buy-and-hold strategy. Yield farming permits buyers to place their crypto to good use, as a substitute of letting them sit idle in a chilly pockets. The DeFi market has each higher-risk and lower-risk staking choices. This lets you decide alternatives that match your threat tolerance.

The Perks of Holding Governance Tokens

Most DeFi protocols reward LPs with their very own tokens. A few of these “governance tokens” include particular perks and extra advantages. On a well-established firm with excessive TVL, governance rights can grant entry to extra revenues from buying and selling charges. Voting rights additionally grant you the facility to have a say sooner or later trajectory of the businesses.

Advantages of Diversification and Market Publicity

Diversification and threat mitigation are equally necessary in each conventional and cryptocurrency investing. Yield farming permits you to enhance your publicity to thrilling new DeFi initiatives and tokens. It may give early entry to an progressive new firm and unlock huge ROI. Spreading your funds throughout a number of firms and farming swimming pools can be an effective way to diversify.

A Potential Hedge Towards Market Volatility

DeFi protocols have proven outstanding resilience within the ongoing crypto winter. At the same time as centralized exchanges collapse, DEXs proceed clean operations with minimal hiccups. Many yield farming firms proceed to supply APYs which can be properly above what you’ll discover at conventional financial savings accounts and treasury bonds. For buyers who’re snug with crypto markets, yield farming gives a wise technique to beat excessive inflation.

Who’s Investing: Institutional Backing

Cryptocurrency fanatics and builders hail DeFi as the way forward for finance. Even main organizations just like the OECD and IMF acknowledge its potential to revolutionize the fashionable monetary system. And primarily based on latest funding traits within the area, it appears as if institutional buyers and VCs agree with that evaluation.

Uniswap, the biggest DEX providing yield farming and staking providers, has obtained over $176 million in total funding. The funding was led by Polychain Capital and Andreessen Horowitz throughout two rounds and included different buyers like Paradigm, SV Angel, and Variant.

Likewise, Aave has been fairly busy within the fundraising circuit over time with 9 funding rounds yielding $49 million from buyers like Blockchain Capital, Three Arrows Capital, and Commonplace Crypto.

Keep in mind our thesis: you can also “make investments” in these platforms just by shopping for and holding their native tokens.

High Yield Farming Platforms

Uniswap (UNI)

Uniswap (UNI)

TVL: $4.12b

UNI Value: $5.04

Each day Lively Customers (30-day avg): 83.45k

Buying and selling Quantity (annualized): $400.95b

Twitter Followers: 1m

Uniswap is without doubt one of the hottest decentralized exchanges on the Ethereum blockchain. Based and launched in 2018 by Hayden Adams, the DEX has attracted funding from Paradigm, USV, and Andreessen Horowitz (a16z).

Uniswap is designed for buying and selling/exchanging ERC-20 tokens, and decentralized lending. There isn’t any shopping for or promoting concerned. The protocol governance is dealt with by holders of the UNI token. Uniswap rewards LPs with a share of the buying and selling charges generated on the platform.

As one of many largest DEX platforms with a TVL of $4 billion, Uniswap is a extremely enticing platform for yield farming. When it comes to sheer dimension, median APY, and market place, it’s laborious to argue in opposition to the long-term potential of Uniswap.

Nevertheless, the shortage of any form of KYC course of does increase some issues within the present local weather. Regulators are getting actively involved within the crypto ecosystem and have a tendency to have a dim view of privacy-oriented platforms like Uniswap.

Aave (AAVE)

Aave (AAVE)

TVL: $3.83b

AAVE Value: $64.41

Each day Lively Customers (30-day avg): 1.81k

Lively Loans (annualized): $2.56b

Twitter Followers: 534k

Aave is a decentralized platform devoted to the lending and borrowing of cryptocurrency. Though it was initially launched on the Ethereum blockchain, Aave has since expanded its presence to different blockchains like Avalanche and Concord.

The Aave challenge was launched in 2017 underneath the title ETHLend by Stani Kulechov, a Finnish legislation scholar. In 2018, it was rebranded as Aave, which implies “ghost” in Finnish. Right here, the LPs are lenders who earn curiosity earnings within the type of “aTokens.”

The protocol additionally has a local governance token referred to as AAVE. Loans on Aave are overcollateralized to scale back the danger of defaults. To get a mortgage, debtors must pledge different crypto belongings value greater than the loaned quantity.

Aave is well one of many high 10 DeFi platforms when it comes to whole worth locked. And it serves a transparent goal within the crypto ecosystem. It permits holders an opportunity to quickly pawn their holdings to realize publicity to a different token with out having to promote.

However this type of exercise has restricted use exterior the world of DeFi. And like all different DeFi initiatives, there may be appreciable threat of regulatory motion as a result of decentralized nature of the protocol’s operations.

Synthetix Community (SNX)

Synthetix Community (SNX)

TVL: $415.22m

SNX Value: $2.34

Each day Lively Customers (30-day avg): 452

Buying and selling Quantity (annualized): $59.14b

Twitter Followers: 230.2k

Synthetix is a non-custodial alternate protocol constructed on Ethereum’s layer-2 scaling resolution referred to as Optimism. The DeFi protocol was launched by Australian cryptocurrency fanatic Kain Warwick in 2016. It was referred to as Havven earlier than rebranding to Synthetix Community in 2018.

Synthetix is a extremely progressive DeFi platform that capabilities like a derivatives market in conventional finance. Customers can commerce not directly in a variety of commodities, cash, and fiat currencies with out immediately holding them.

These derivatives on the community are referred to as Synths. They observe the worth of the underlying asset, which could possibly be gold, US {dollars}, and even bitcoin. The protocols that observe these costs are referred to as Oracles. The native token on the platform is known as SNX.

Resulting from its first-mover standing within the derivatives aspect of crypto, Synthetix Community actually has loads of endurance in the long run. Its principal attract is its potential to supply publicity to new belongings with out possession.

Crypto customers even have an opportunity to hedge in opposition to volatility in adversarial market circumstances by holding brief positions on synths. We saw this in action in 2022, because the community racked up $1m in every day charges and a 100% surge in SNX worth on account of huge buying and selling volumes.

Curve Finance (CRV)

Curve Finance (CRV)

TVL: $4.22b

CRV Value: $0.818

Each day Lively Customers (30-day avg): NA

Buying and selling Quantity (annualized): NA

Twitter Followers: 345k

Curve Finance is the second largest DEX platform by quantity after Uniswap. Launched in 2020 by Michael Egorov, Curve is a non-custodial alternate protocol focusing closely on stablecoin liquidity swimming pools.

The protocol launched on the Ethereum blockchain at a time when stablecoins like Tether and USDC had been already surging in recognition. With its promise of low charges, low threat of slippage, and environment friendly stablecoin buying and selling alternatives, Curve quickly attracted LPs.

Other than stablecoins, the liquidity swimming pools on Curve additionally comply with wrapped variations of common cryptocurrencies. This mix permits Curve to remain forward of different DEXs when it comes to charges and effectivity whereas nonetheless decreasing the danger of volatility.

The native token on the platform is known as CRV. It’s each the governance token and the reward for yield farming. Since stablecoins proceed to play a crucial position within the crypto area, Curve appears to have extra progress and lasting potential than different DEX alternate options.

PancakeSwap (CAKE)

PancakeSwap (CAKE)

TVL: $1.94b

CAKE Value: $1.63

Each day Lively Customers (30-day avg): 142k

Buying and selling Quantity (annualized): $65.9b

Twitter Followers: 1.6m

PancakeSwap is a decentralized alternate that shares its DNA with Uniswap. Initially a fork of Uniswap, the brand new protocol was adopted and deployed on the Binance Good Chain (BSC). Though it’s a Uniswap fork, PancakeSwap exists independently on the BSC.

The excessive gasoline charges and gradual transactions that plagued the previous Ethereum community in 2020 prompted the event group to make the change to Binance. This allowed PancakeSwap to draw extra customers with its environment friendly and cost-effective options.

The native token on the platform is known as CAKE. PancakeSwap capabilities as an easy DEX the place LPs earn rewards for staking and yield farming. The protocol pays a proportion of buying and selling charges to LPs in CAKE.

The one main limitation of PancakeSwap is its absence from different common blockchains like Ethereum. Being on the BSC has some main disadvantages, like the lack to commerce in any tokens that aren’t BEP-20.

Nevertheless, when it comes to dimension, out there options, and reliability, PancakeSwap is without doubt one of the higher choices on the market. With its presence on Binance, the protocol has glorious progress alternatives forward of it.

yearn.finance (YFI)

yearn.finance (YFI)

TVL: $449.24m

YFI Value: $6472.27

Each day Lively Customers (30-day avg): NA

Buying and selling Quantity (annualized): NA

Twitter Followers: N/A

yearn.finance is a gaggle of 4 completely different protocols that run on the Ethereum blockchain. The challenge was launched in 2020 by an impartial developer from South Africa referred to as Andre Cronje. The protocol was launched and launched with none exterior help.

Other than the Ethereum blockchain, the protocols additionally assist good contracts on DeFi platforms like Curve and Balancer. It is usually out there on Fantom and Arbitrum. Cronje created yearn to make yield farming and DeFi lending simpler and extra accessible for everybody.

The primary yield farming protocol on yearn.finance is known as “Vaults.” Different merchandise embody yCRV, veYFI, and yBribe. The latter is an progressive instrument that permits YFI holders to promote their vote within the DAO to the very best bidder.

As a beginner-friendly DeFi platform, yearn.finance may play a crucial position sooner or later. Nevertheless, its fortunes are tied to the broader market circumstances. In a sustained bear market, yearn fails to supply any distinctive rewards. It is usually one of many smaller DeFi protocols by TVL, additional rising the danger to these utilizing its vaults.

Investor Takeaway

The yield farming area has actually misplaced a few of its sheen within the crypto market crash of 2022. Nevertheless, it isn’t all doom and gloom: the collapse of centralized exchanges like FTX, and the continued SEC lawsuits in opposition to Binance and Coinbase, may make DeFi extra enticing to buyers worldwide.

And the continued clean functioning of main DEX platforms and protocols is a testomony to the resilience of this mannequin. Regardless of a two-thirds decline in TVL, yield farming in DeFi nonetheless retains appreciable investor curiosity. Near $50 billion continues to be locked away in liquidity swimming pools throughout a big selection of protocols on Ethereum and different main blockchains.

Nevertheless, uncertainty persists throughout the DeFi area as a result of impending arrival of latest rules. From the EU to North America, regulators are taking an ever nearer have a look at your complete crypto ecosystem, and DeFi could possibly be subsequent.

With a lot variability and uncertainty within the system, we advise warning and due diligence for any newcomers to the scene. rule of thumb is to slender your funding concerns to the tokens with probably the most customers and highest TVL.

Don’t miss out on crypto investing information. Subscribe to Bitcoin Market Journal and continue to learn day-after-day.

[ad_2]

Source link