[ad_1]

Ethereum balances on exchanges have reached a five-year low, XRP rose 10% this week on SEC case information. RNDR and INJ present robust beneficial properties.

ETH

The worth of Ethereum rose round 2% this week as cryptocurrency costs remained subdued.

Nonetheless, knowledge from Glassnode confirmed that Ethereum held on exchanges was at a five-year low. The quantity of ETH held on exchanges has decreased since 2020 however accelerated after the Proof-of-Stake (PoS) transition in September 2022. The present degree stands at 17.8 million, the bottom since April 2018. That can also be in step with Bitcoin, because the variety of BTC held throughout exchanges additionally dropped sharply between October and December 2022.

CryptoSlate additionally reported that withdrawals have outpaced deposits for a lot of the 12 months with 1.59 billion ETH being taken off exchanges. Nonetheless, Bitcoin has seen a rise in its trade balances as the worth rose this 12 months.

Crypto often strikes to exchanges if traders need to money out their holdings into fiat cash. The rise in BTC hints that it’s used extra by merchants, whereas ETH holders see a longer-term upside.

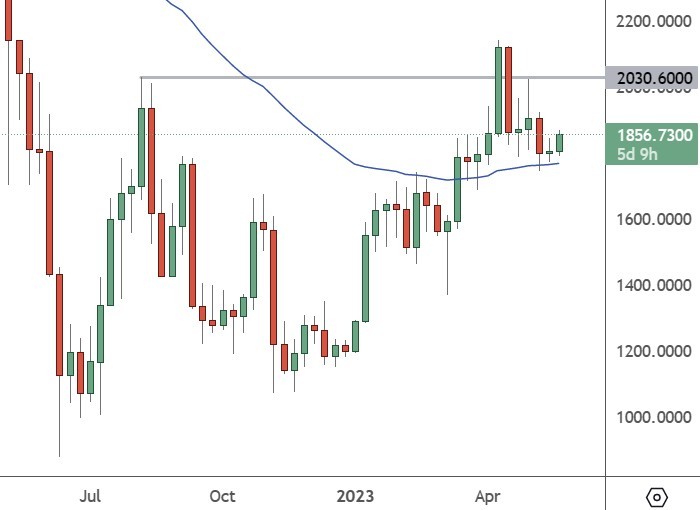

The worth of ETH has risen to $1,856 after a current downturn with the resistance at $2,000 being the primary goal.

XRP

The worth of XRP was buying and selling at $0.46 after this week’s rise with the massive resistance forward at $0.548.

XRP holders are nonetheless awaiting an finish to the long-running case with the Securities and Trade Fee (SEC) however are hopeful of a profitable decision. One lawyer says the continued court docket battle with Ripple executives may very well be over for the regulator if the case goes to a jury.

John Deaton, a pro-XRP lawyer, has been following the case since its submitting in 2020, and says new electronic mail particulars counsel employees on the SEC appear to have indicated there are “cheap grounds” to imagine XRP is just not a safety.

“Exhibit 220 is an element SEC emails: XRP is talked about and that there are cheap grounds XRP doesn’t fulfill ALL Howey elements. HUGE,” Deaton tweeted.

“Since noticing this, I’ve been racking my mind about two issues: 1) why wouldn’t Ripple attorneys make a a lot greater deal about this (and never simply embody it in a footnote); and a pair of) how did I miss it earlier than as we speak (though to be honest I’ve learn hundreds of pages and do have a job)?” he added.

Deaton stated it’s doubtless the truth that the knowledge was not a direct quote from an SEC official. Regardless of the confusion, Ripple’s XRP coin noticed a value increase as hopes continued to construct over a positive settlement.

RNDR

The Render token was up nearly 50% this week as synthetic intelligence investments stay fashionable.

The transfer greater in AI cash was pushed by information that OpenAI had now launched the official model of its AI-driven chatbot, ChatGPT, on Apple’s App Retailer. There was additionally a rumor of an Android model to comply with. The announcement on Might 18 confirmed the ChatGPT app introducing syncing of person chat historical past between the net model and the app, and that includes voice enter facilitated by OpenAI’s Whisper.

The Render Network is constructed on the Ethereum blockchain and is the main supplier of decentralized GPU-based rendering. Google’s current developer convention leaned closely on its ChatGPT rival Bard chatbot. However the firm additionally announced the combination of AI with Google Maps by way of its immersive options.

The immersive view answer permits AI to carry Road View and aerial photographs collectively for 3D world fashions. Customers can then use AI to get up to date details about routes akin to bike lanes or climate forecasts.

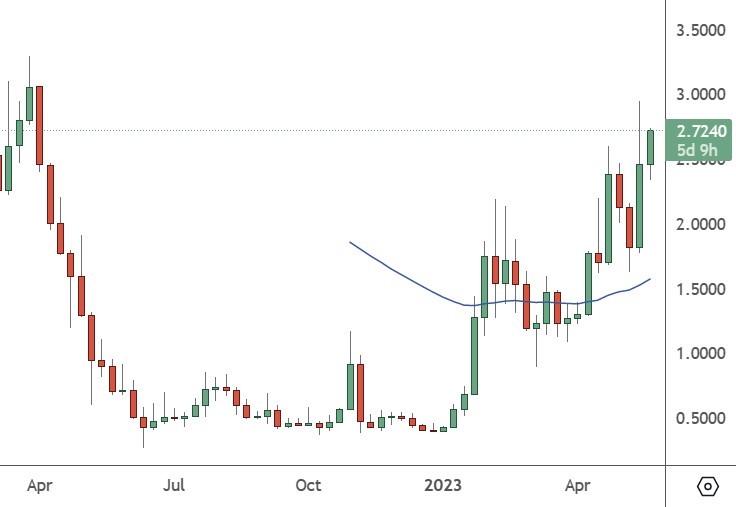

The worth of RNDR was buying and selling at $2.72 after a current push-through resistance and will head for the $3.25 degree.

INJ

Injective was one other undertaking displaying beneficial properties this week with an 11% value advance.

Injective lately launched liquid staking for its native INJ token. stINJ (the official liquid-staked type of INJ) was delivered by Stride, which is an app chain specializing in liquid staking. Customers can unlock extra liquidity and yield era alternatives within the undertaking and it additionally introduces extra use circumstances and utility for INJ. Customers had been additionally set to obtain an airdrop of Stride (STRD) with the launch.

Staking usually requires customers to lock up their tokens to safe a Proof-of-Stake (PoS) community. Nonetheless, as soon as tokens are locked, they cannot be used for DeFi efforts akin to buying and selling and lending. Liquid staking seeks to unravel this drawback by permitting customers to stake their INJ tokens and keep their liquidity.

The worth of INJ is buying and selling at $6.91 after lately seeing highs close to the $10.00 degree. The undertaking has a market cap of $688 million and is ranked at quantity 75 within the checklist of cryptocurrencies.

Disclaimer: info contained herein is supplied with out contemplating your private circumstances, subsequently shouldn’t be construed as monetary recommendation, funding suggestion or a suggestion of, or solicitation for, any transactions in cryptocurrencies.

[ad_2]

Source link