[ad_1]

- ETH’s fall has triggered holders to rethink their perception within the coin’s potential.

- The MVRV ratio confirmed that altcoin was undervalued.

Lengthy-term holders of Ethereum [ETH] have signaled that also they are involved concerning the cryptocurrency’s potential, AMBCrypto found.

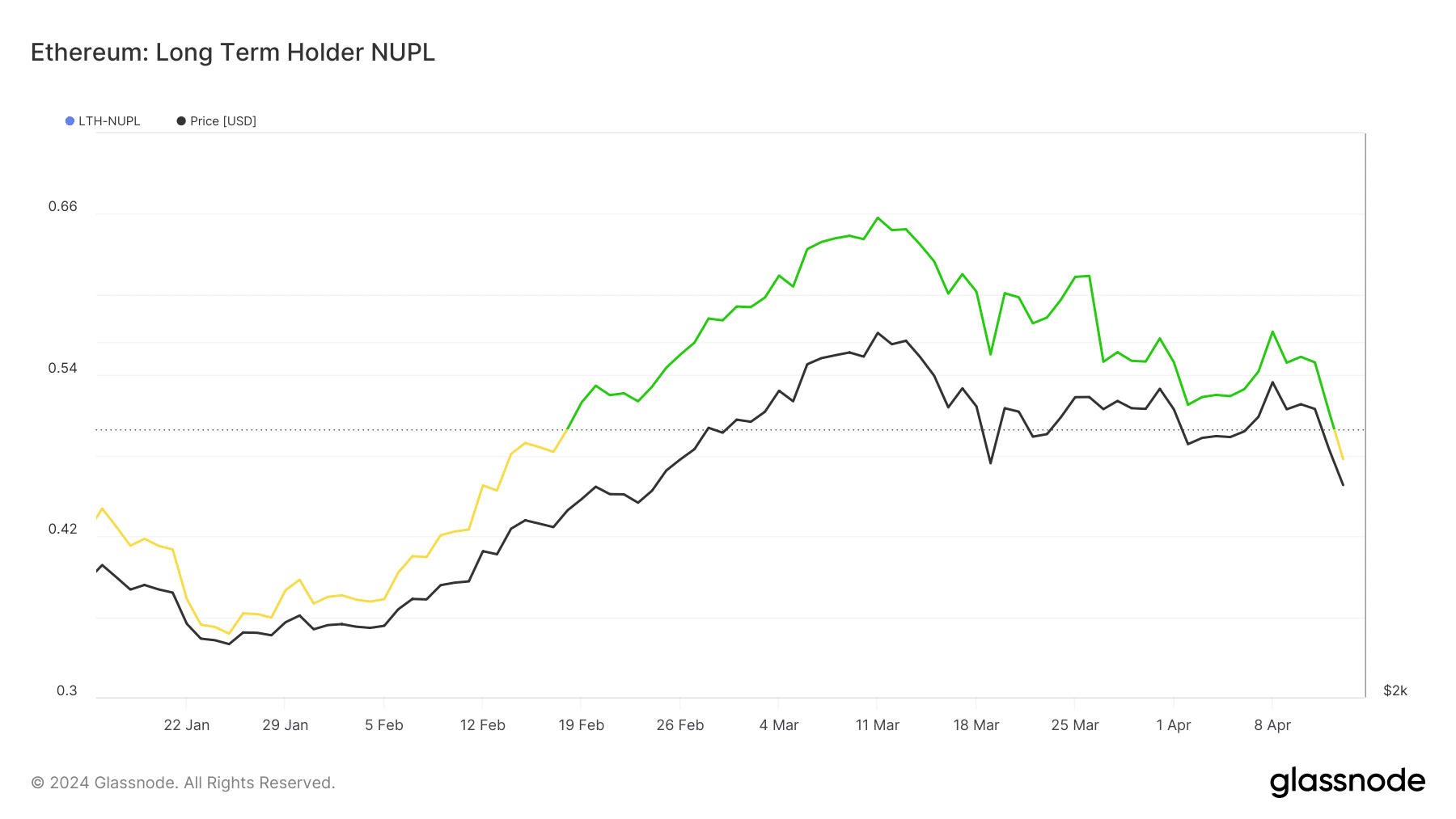

We discovered after inspecting the Lengthy-Time period Holders Internet Unrealized Revenue/Loss (LTH-NUPL). The metric considers the habits of traders with a UTXO of no less than 155 days.

Holders are usually not calm

If the metric shows pink, then traders are scared that the cryptocurrency may capitulate. Shade blue suggests euphoria or greed.

At press time, the LTH-NUPL had moved from inexperienced to yellow. Inexperienced signifies the point of view that the worth may proceed to understand. However with Ethereum at yellow, it signifies that holders of the altcoins are actually anxious and unsure about its potential.

The change in sentiment could possibly be linked to ETH’s value motion. On the twelfth of April, the cryptocurrency crashed under $3,200. When market individuals thought that the collapse was over, one other one occurred.

This time, it was the unsettling state within the Middle East that despatched ETH to $2,850. Nevertheless, press time knowledge confirmed that the worth has reclaimed $3,000 once more.

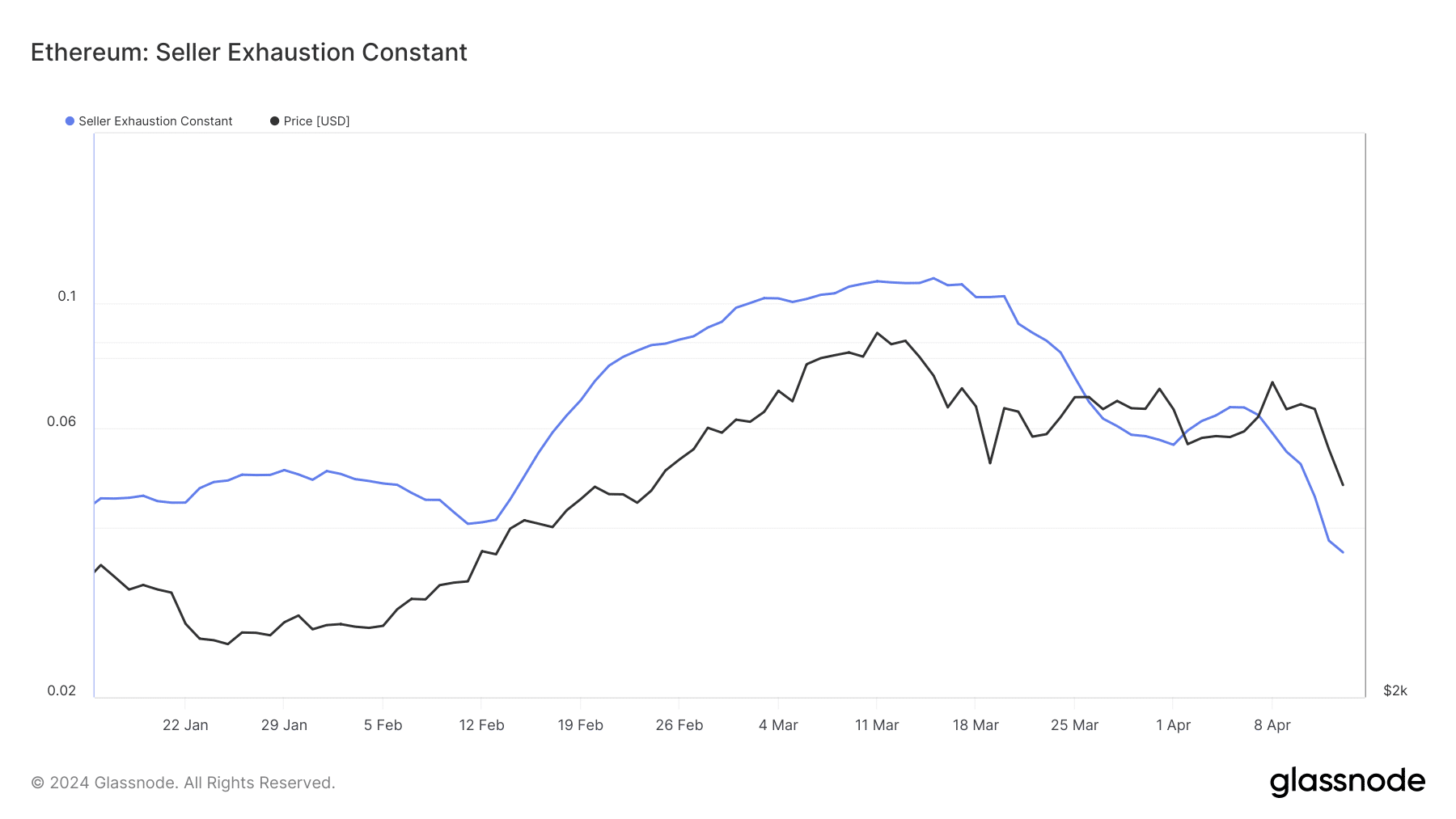

However will the worth be increased than this within the quick time period? AMBCrypto evaluated the chance by assessing the Vendor Exhaustion Fixed.

Promoting strain might take ETH to a different stage

A rise within the Vendor Exhaustion Fixed indicated that sellers are operating out of steam. If this was the case, the worth of ETH is likely to be gearing up for a major upside.

Nevertheless, knowledge from Glassnode confirmed that the metric dropped to 0.036, which means that bears weren’t out of the way in which but. Ought to the studying proceed to go decrease, ETH’s value may also fall.

On this occasion, Ethereum holders may transfer from being optimistic to displaying their fears. The value of the cryptocurrency is also affected, and one other decline towards $2,800 could possibly be subsequent.

Conversely, a spike within the metric may change the state of things for the higher. If this occurs, ETH may attempt revisiting $3,200 to $3,500 inside a brief interval.

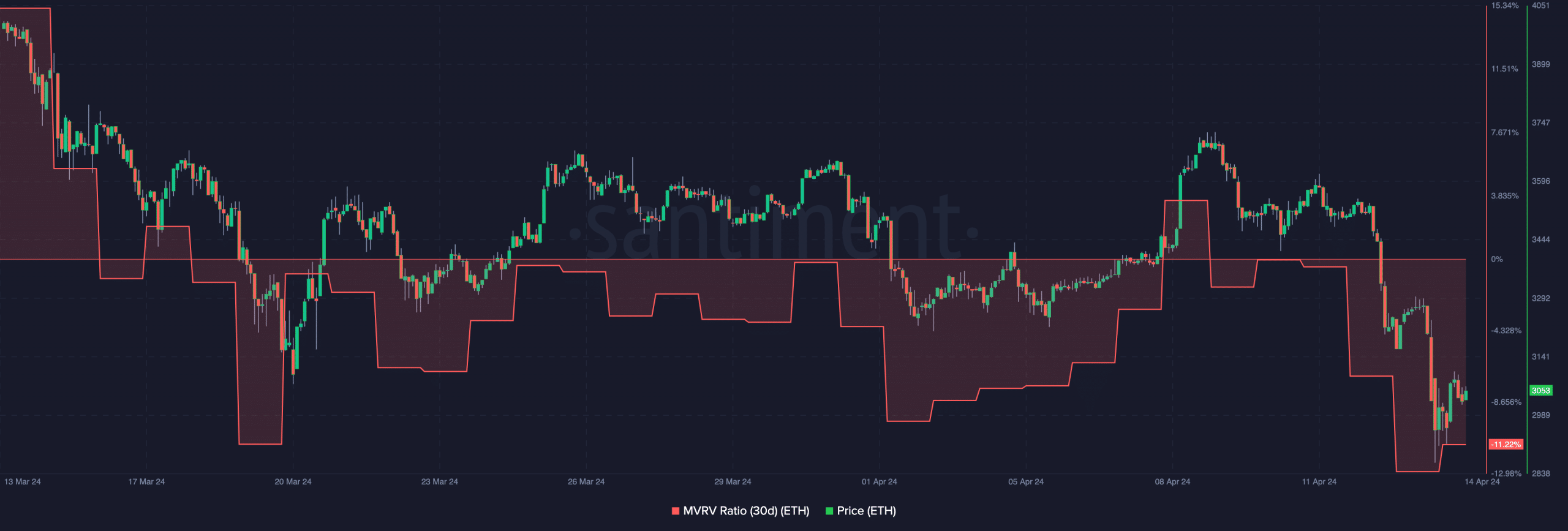

Moreover, the Market Worth to Realized Worth (MVRV) ratio advised a potential bounce for ETH. At press time, the 30-day MVRV ratio was -11.22%.

This studying was proof that almost all ETH holders who collected not too long ago had been at a loss. Nevertheless, the MVRV ratio additionally reveals if an asset is undervalued, at truthful worth, or overvalued.

Because the metric was unfavorable, it advised that Ethereum was in an undervalued state. Take as an illustration— the twentieth of March when the metric was across the identical spot, and the worth was $3,100.

Learn Ethereum’s [ETH] Price Prediction 2024-2025

Days later, the worth of the cryptocurrency rallied to $3,669. There have been different situations the place an analogous factor occurred.

Subsequently, the long-term potential of ETH may stay bullish and holders may ultimately put two toes ahead.

[ad_2]

Source link