[ad_1]

- Lido’s market dominance has fallen to its lowest within the final 12 months.

- The protocol has seen a major uptick in withdrawals.

The market share of liquid staking protocol Lido Finance [LDO] within the Ether staking market has plummeted to a one-year low.

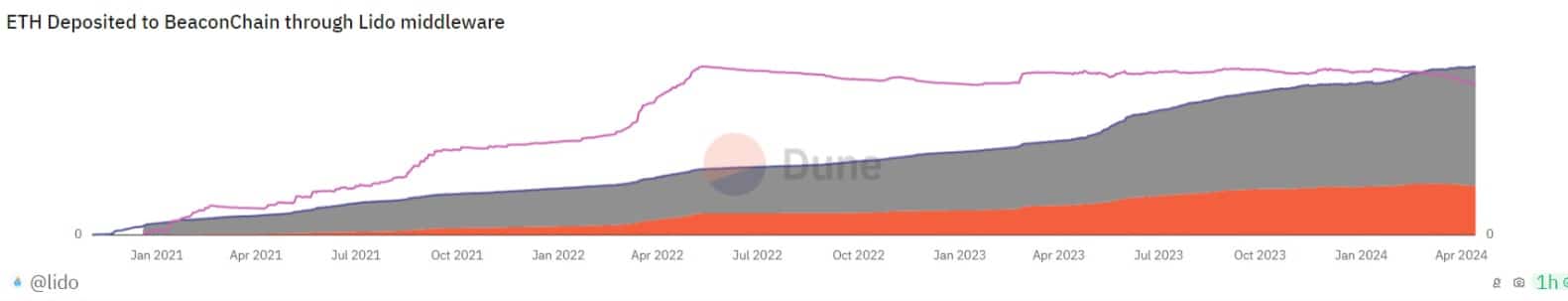

In keeping with a Dune Analytics dashboard, the share of ETH deposited to the beacon chain by means of Lido middleware was at 29.1% at press time. The final time it was below 30% was in February 2023.

On a year-to-date (YTD) foundation, Lido’s market share has dropped by 8%. This decline is because of a spike in withdrawals from the liquid-staking protocol within the final month.

On-chain information from Dune Analytics confirmed that since twelfth March, withdrawals from Lido have exceeded the deposits made by means of the protocol.

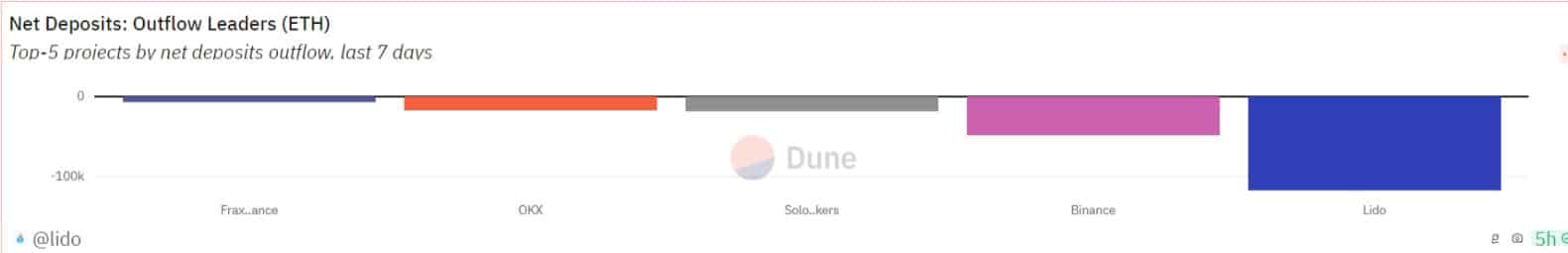

Rating because the staking platform with probably the most outflows within the final week, withdrawals from Lido have totaled 117,000 ETH at press time, valued at 35.69 million USD.

Lido has witnessed a spike in withdrawals because the Annual Share Price (APR) supplied to customers staking on the platform has dropped.

As of the tenth of April, the person APR assessed on a seven-day shifting common was 3.28%, having declined by 14% for the reason that eleventh of March.

What you need to anticipate from LDO

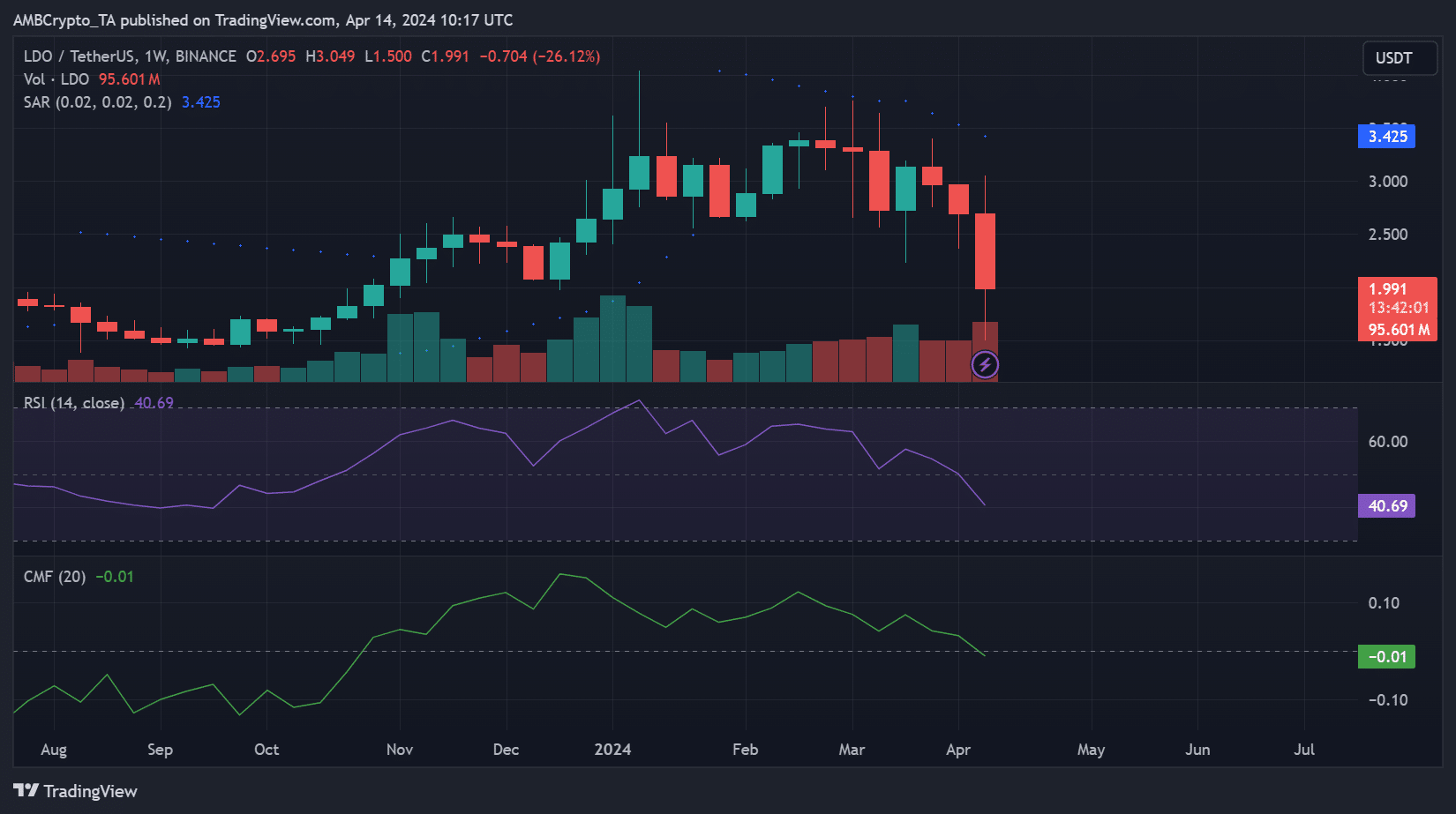

At press time, the protocol’s native token LDO exchanged fingers at $2.61. Within the final month, its worth has dropped by over 20%, in keeping with CoinMarketCap’s information.

Its efficiency on a weekly chart hinted at the potential of an extra decline within the midterm.

Its Chaikin Cash Movement (CMF), which measures the move of cash into and out of the asset, had breached the zero line at press time and was poised to development downward.

A CMF worth under zero is an indication of market weak spot. It suggests a rally in liquidity outflow from the market and a spike in promoting stress.

Confirming the hike in LDO distribution, its Relative Energy Index (RSI) was 40.69 and additional declining on the time of writing.

This RSI worth confirmed that market contributors most well-liked to promote their LDO holdings fairly than accumulate extra tokens.

Additional, the dotted strains of LDO’s Parabolic SAR indicator rested above its worth at press time.

Reasonable or not, right here’s LDO’s market cap in BTC’s terms

This indicator measures the potential reversal factors in an asset’s worth path. When its dotted strains relaxation above an asset’s worth, it’s a bearish sign.

It confirms that an asset’s worth is in decline, and the autumn will proceed if sentiment stays the identical.

[ad_2]

Source link