[ad_1]

- LINK gained traction after the venture disclosed the replace with ETH cross-chain transfers.

- The worth of the token may drop under $14 within the quick time period.

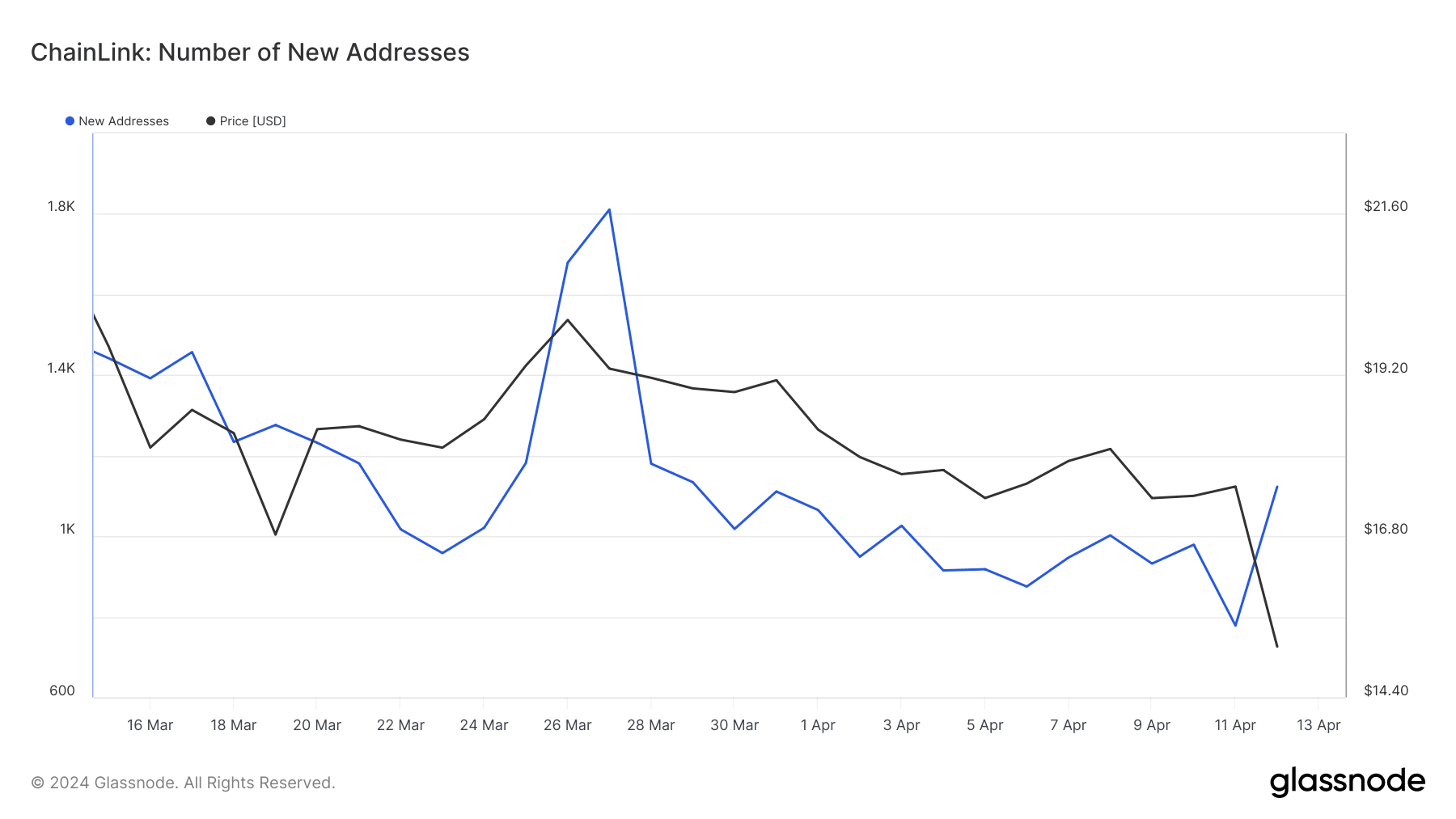

The variety of new Chainlink [LINK] addresses has been growing because the eleventh of April, AMBCrypto found. Based on Glassnode, new addresses on the community had been 778 on the tenth of April.

However as of this writing, that quantity had increased to 1123. An increase in new entrants right into a community is an indication of improved adoption, which might enhance demand for the token concerned.

Extra bridges, extra growth

Since hitting a yearly excessive in March, Chainlink had discovered it tough to draw newbies to its ecosystem till just lately. Nonetheless, there have been causes connected to the rise.

Based on AMBCrypto’s findings, it was no coincidence that the metric started to rise after the venture’s latest integration with Ethereum [ETH].

On the identical day LINK’s new addresses started to extend, Chainlink put out an announcement, noting that the CCIP has been prolonged to ETH and a few Layer-2 networks underneath the blockchain.

CCIP is an acronym for Cross-Chain Interoperability Protocol. This protocol enhances the bridging of property on a number of blockchains. Within the latest announcement, Chainlink explained,

“This improve implies that CCIP now helps the cross-chain switch of native ETH between completely different blockchain networks, beginning with Ethereum, Arbitrum, and Optimism, which is made doable by WETH lock and unlock token swimming pools.”

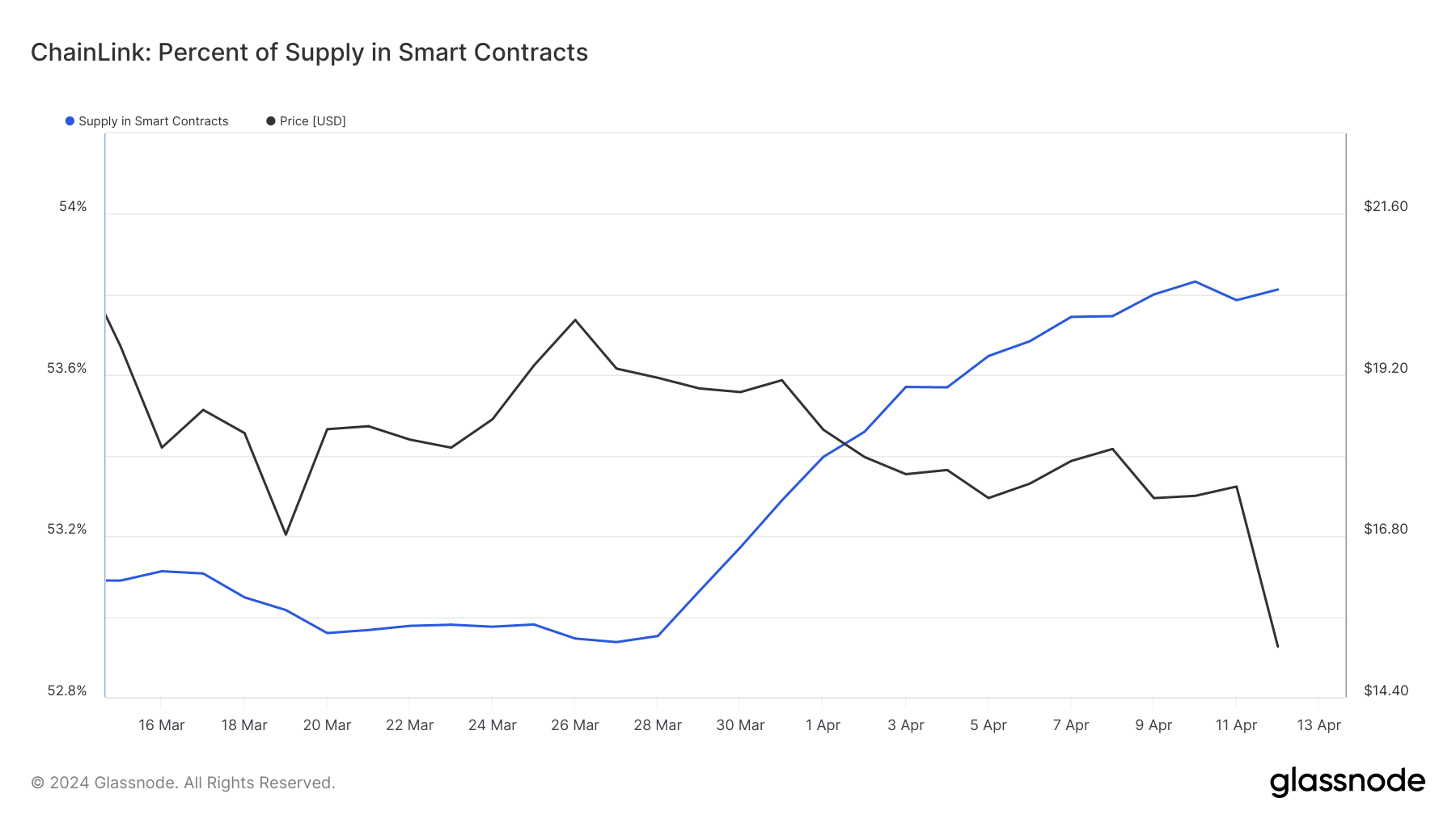

Nonetheless, a rise in traction was not the one after-effect of the event. AMBCrypto’s additional examination confirmed that there was a change within the good contract provide.

For these uninitiated, the introduction of Ethereum was what made it straightforward for different tasks to permit good contracts improvement.

On-chain knowledge confirmed Chainlink’s provide in good contracts was about 52% initially of April. Nonetheless, the provision had elevated to 53.81% at press time.

Some issues take time

With the rise, LINK holders may be capable to bridge extra property to different chains, together with Ethereum. However within the quick time period, LINK’s value might need to deal with the turbulence available in the market.

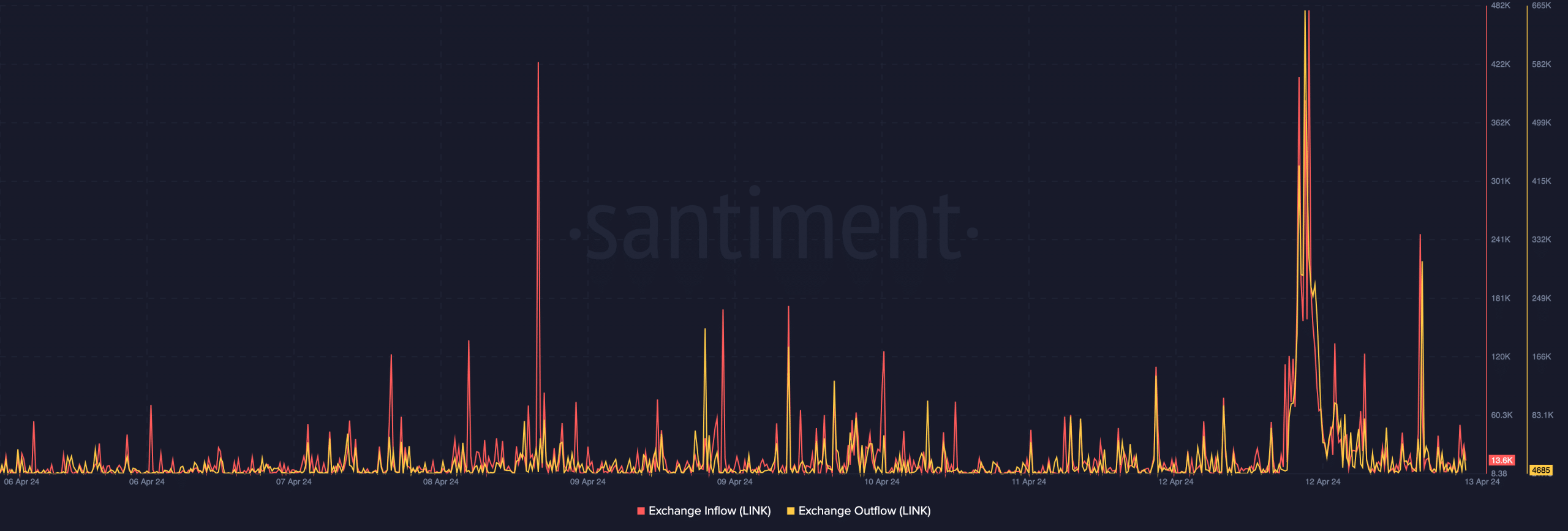

This was due to the state of the alternate influx and outflow. When alternate influx will increase, it means merchants are considering promoting their property. However a lower suggests in any other case.

For alternate outflow, a rise implies a call to carry for doubtlessly higher positive factors. At press time, LINK’s alternate outflow was 4086 whereas the influx was over 13,000 tokens.

Reasonable or not, right here’s LINK’s market cap in ETH terms

This disparity in these metrics was a testomony to the sell-offs happening available in the market. Ought to the influx proceed to outpace the outflow, LINK’s value may fall under $14.

Nonetheless, if bears determine to halt promoting, and bulls accumulate, the value may bounce.

[ad_2]

Source link