[ad_1]

- Bitcoin, Ethereum, and Solana fell important on the worth charts

- Nearly $1 billion value of positions had been liquidated within the final 24 hours

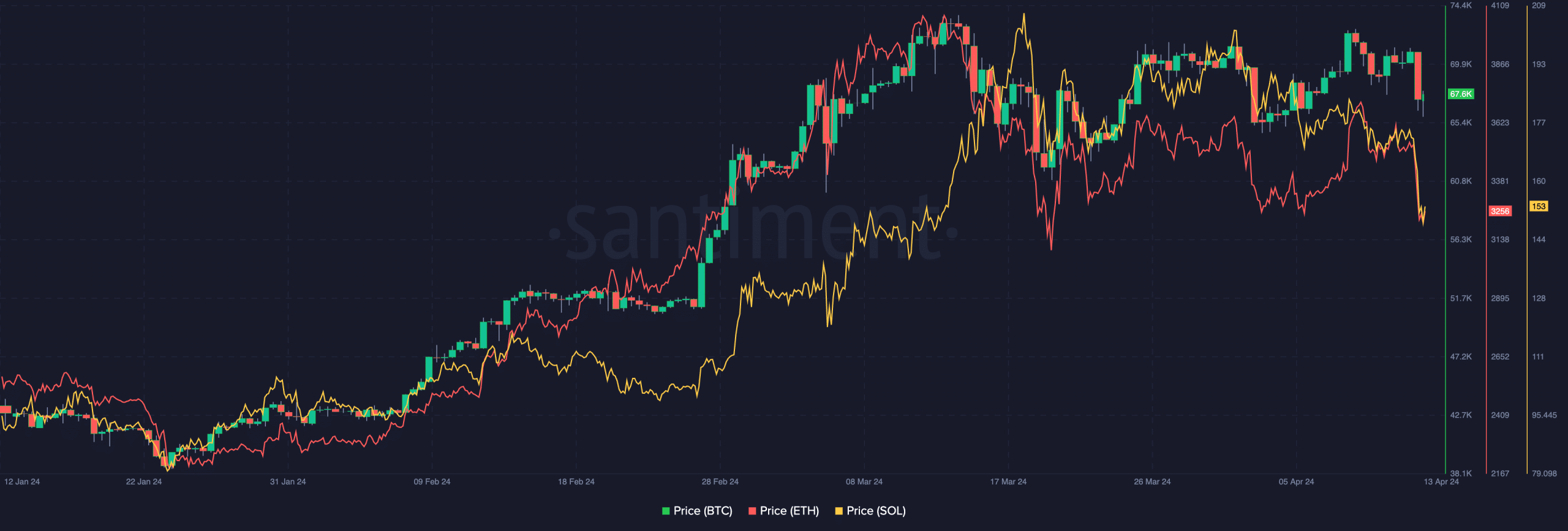

Following a surge in its worth over the previous week, Bitcoin [BTC] recorded a major correction during the last 24 hours. Over the mentioned interval, the cryptocurrency’s worth fell by 4.95%, with BTC buying and selling at $67,829.94 on the time of writing. Bitcoin fell on the again of conventional markets tanking owing to the geopolitical uncertainty related to Iran probably attacking Israel. Accordingly, each the S&P500 and Nasdaq fell, with the worth of conventional protected havens like gold appreciating.

The decline in Bitcoin’s worth had a cascading impact, resulting in different cryptocurrencies depreciating on the charts too as effectively.

One other one bites the mud

Because of the excessive correlation with Bitcoin, Ethereum [ETH] and Solana [SOL]‘s costs additionally fell dramatically and suffered a worse destiny. SOL fell by 11.93% during the last 24 hours and ETH declined by 8.33% over the identical interval. Due to the identical, each SOL and ETH broke previous their beforehand established larger lows, disrupting their ongoing bullish pattern on the charts.

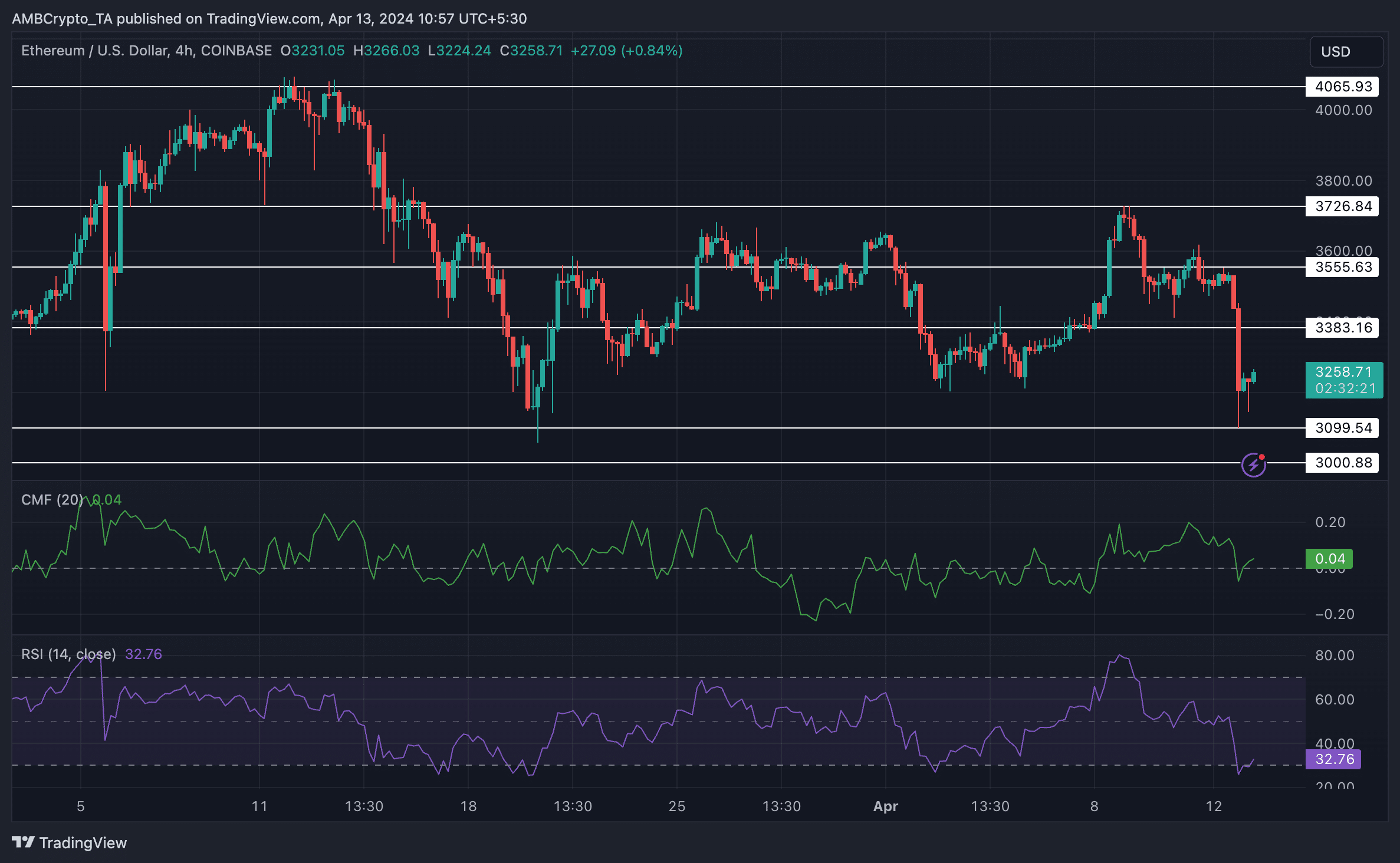

In actual fact, the worth of ETH fell all the best way to $3099 throughout this drawdown. Nonetheless, after testing this stage, it managed to climb again as much as $3256.96, on the time of writing.

Beforehand, Ethereum had examined this stage on 20 March. If Ethereum follows an identical trajectory going ahead, it might attain the $3384-level quickly.

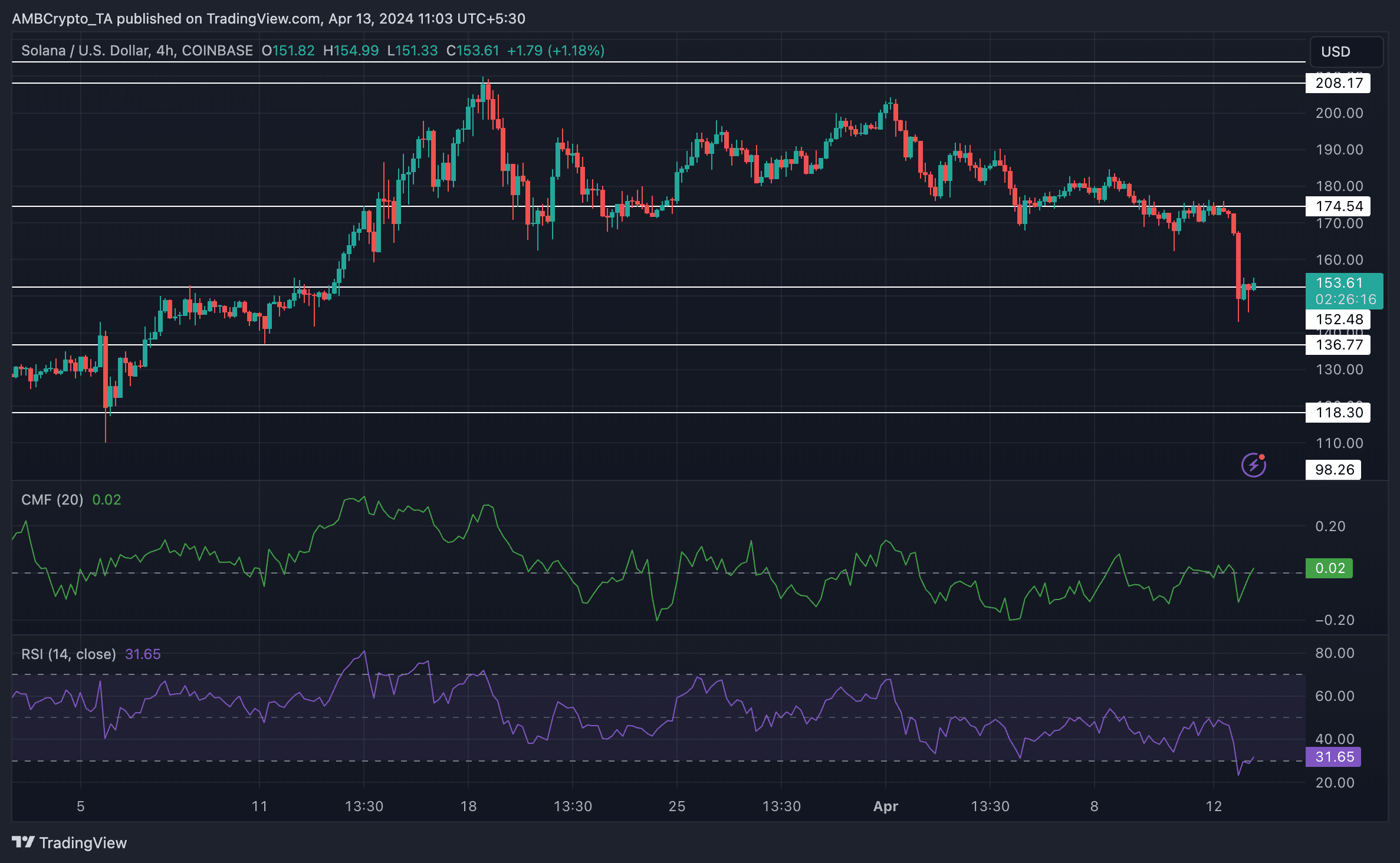

Solana traced an identical trajectory. Regardless that the correction was pretty current, the worth motion of Solana since 1 April hinted at a possible decline in worth. Because the starting of the month, SOL had exhibited a number of decrease lows and decrease highs, indicative of a bearish pattern.

With the intention to rally, a large resurgence in bullish momentum could be required for each ETH and SOL.

Are whales in charge?

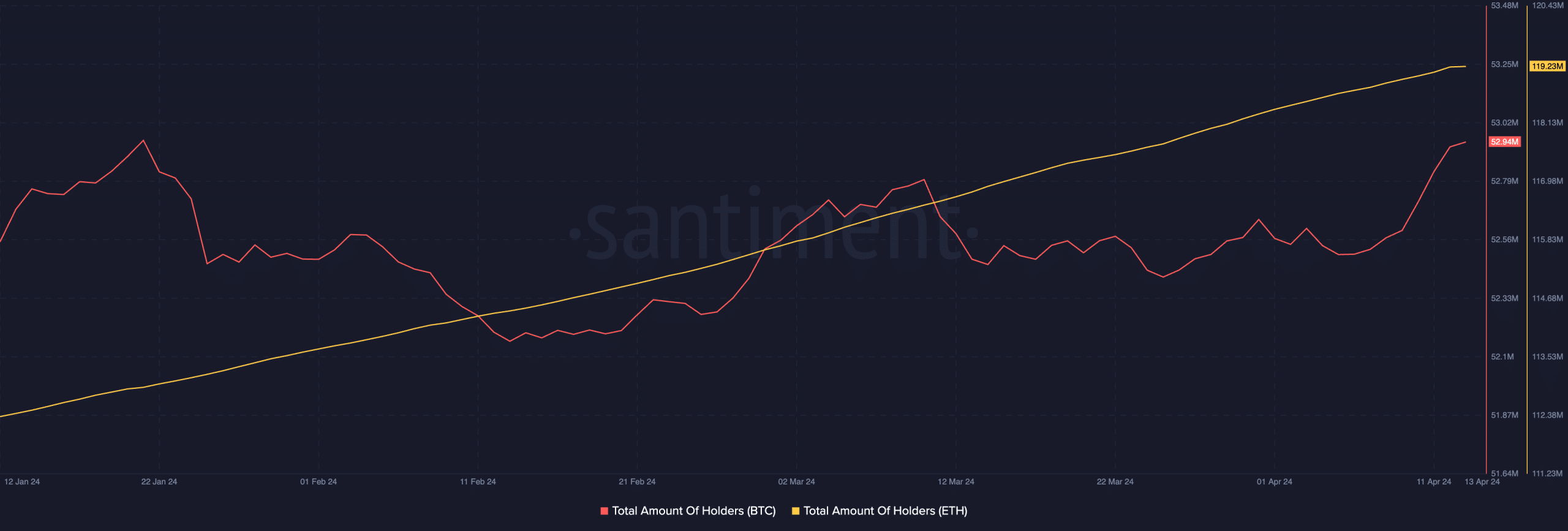

Regardless of these worth corrections, nonetheless, curiosity in BTC and ETH stays excessive. In actual fact, AMBCrypto’s evaluation of Santiment’s information revealed that the variety of addresses holding BTC and ETH grew materially over the previous couple of weeks.

This indicated that the current decline in costs might have been brought on by the habits of some whales who had been indulging in profit-taking.

How are merchants holding up?

Within the final 24 hours, $947 million value of positions had been liquidated. Out of this, $824.94 million had been lengthy positions. Merchants that had been bullish on BTC, ETH and SOL misplaced probably the most sum of money. At this time limit, nonetheless, it’s too quickly to say which course BTC will head in, particularly with the halving simply over the horizon.

[ad_2]

Source link