[ad_1]

The DeFi ecosystem is on edge as Uniswap, a number one decentralized finance platform, faces scrutiny from the US Securities and Trade Fee (SEC).

The issuance of a Wells Discover to Uniswap’s CEO, Hayden Adams, alerts a possible regulatory storm for the DeFi market sector.

A Battle That Might Form DeFi’s Future

In response to Nicola Massella, Authorized Companion at STORM Companions, this new lawsuit has despatched ripples by the DeFi sector, underscoring the gravity of the state of affairs. The SEC’s allegations that Uniswap operated as an unregistered securities broker and alternate have raised considerations.

“This motion in opposition to Uniswap marks the SEC’s first aggressive transfer in direction of a number one entity within the DeFi sector,” Massella advised BeInCrypto.

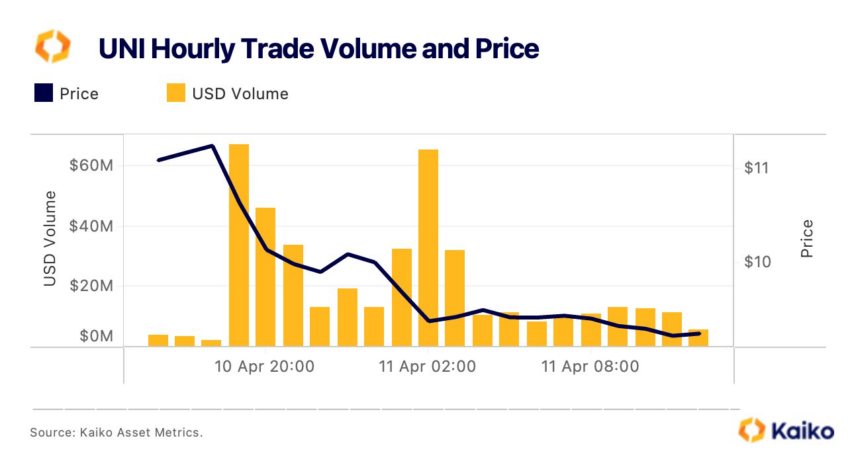

Furthermore, the standing of Uniswap’s native token, UNI, as a possible security provides one other layer of complexity. Analysts at Kaiko noted that the price of UNI dropped by 15%, and buying and selling volumes surged following the announcement. In the meantime, Santiment reported a “important quantity of FUD” from merchants surrounding Uniswap.

Given the significance of this dispute, Massella anticipates it is going to outline additional the authorized boundaries of DeFi operations within the US. Certainly, on the coronary heart of this authorized dispute is the classification of DeFi platforms.

Operators argue they’re expertise service suppliers, facilitating impartial crypto-asset transactions with out exerting management. This mannequin, they contend, differs basically from conventional buying and selling venues, rendering current monetary laws inapplicable.

Conversely, the SEC is predicted to advocate for DeFi platforms to adjust to the identical regulatory frameworks that govern securities brokers and different monetary entities.

Learn extra: Crypto Regulation: What Are the Benefits and Drawbacks?

The decision of SEC v. Uniswap is poised to be a landmark moment for the DeFi sector within the US. It is going to make clear the authorized standing of DeFi platforms and set a precedent that might both encourage innovation and progress inside the sector or impose important restrictions below the pretext of shopper safety and market integrity.

Disclaimer

In adherence to the Trust Project pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please observe that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.

[ad_2]

Source link