[ad_1]

- Ethereum famous a decline in bullish conviction within the Futures market

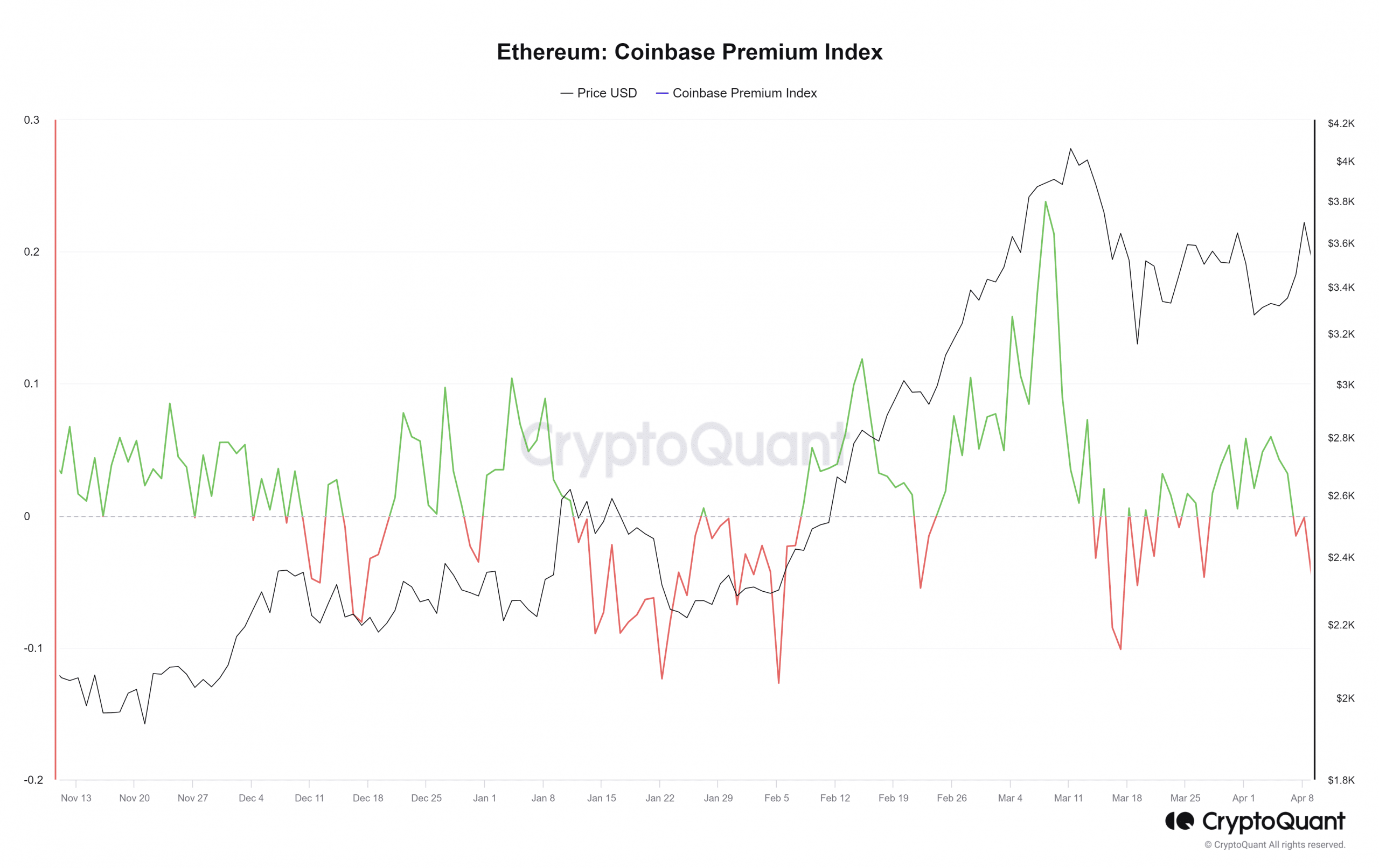

- Coinbase Premium Index confirmed merchants from the U.S are adamant concerning the altcoin

Ethereum [ETH] rallied swiftly from $3.2k to $3.7k, making a 16.2% transfer in three days. Nevertheless, the bulls had been rebuffed on the identical near-term resistance from a month in the past – $3.7k.

The native high coincided with a massive influx of ETH to exchanges on 8 April, in keeping with AMBCrypto’s newest evaluation. Whereas the sentiment had been bullish, it has begun to shift during the last 24 hours.

U.S buyers refuse to consider in ETH’s rally

Supply: CryptoQuant

The Coinbase Premium Index represents the % distinction in costs (USDT pair) between Binance and Coinbase. This index has fallen since 5 April to indicate that Binance ETH costs had been better.

In different phrases, it mirrored a scarcity of bullish enthusiasm from U.S buyers, since they’ll’t commerce on Binance and must depend on Coinbase. Therefore, regardless of the sharp bounce to $3.7k, sentiment west of the Atlantic has been muted.

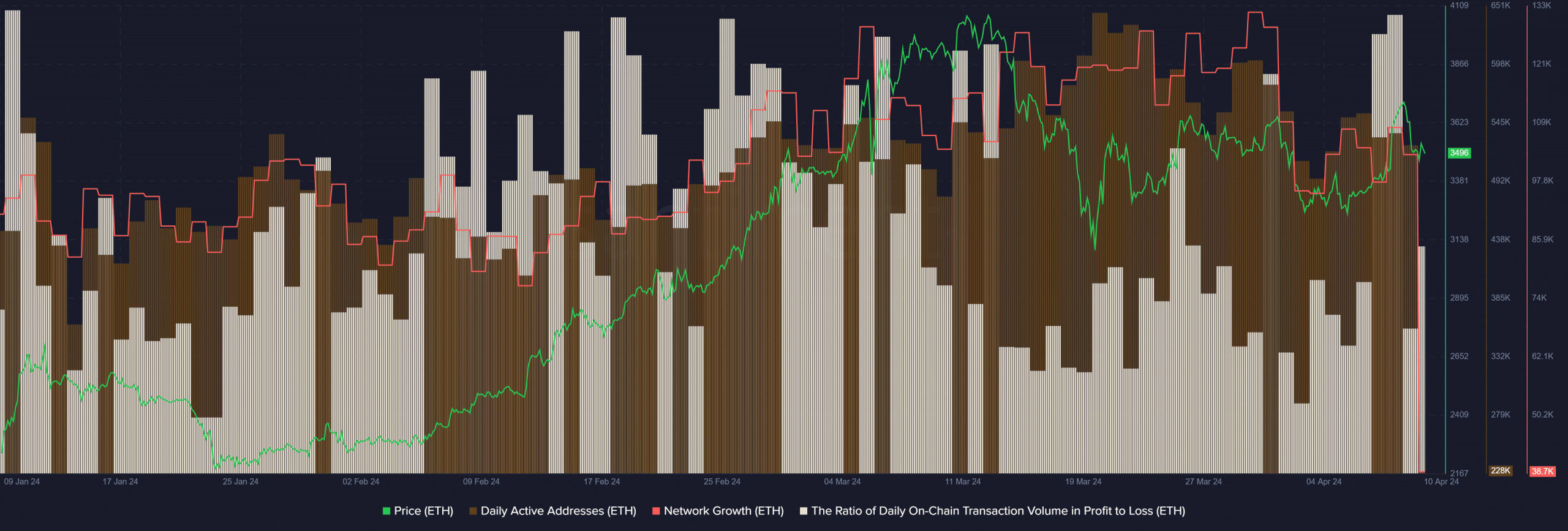

Supply: Santiment

The ratio of every day on-chain transaction quantity in revenue to loss metric from Santiment leapt to three.01 on 8 April. Since February, this metric has confronted a glass ceiling at 3. Due to this fact, merchants may control this metric’s every day readings to know if a short-term value despair is likely to be inbound.

Each day lively addresses and community progress metrics noticed a hunch on 30 March. They continued to development decrease over the previous ten days. This was an indication of a scarcity of consumer adoption and natural demand for Ethereum. It raised the query – What’s the short-term sentiment like within the spot and Futures ETH markets?

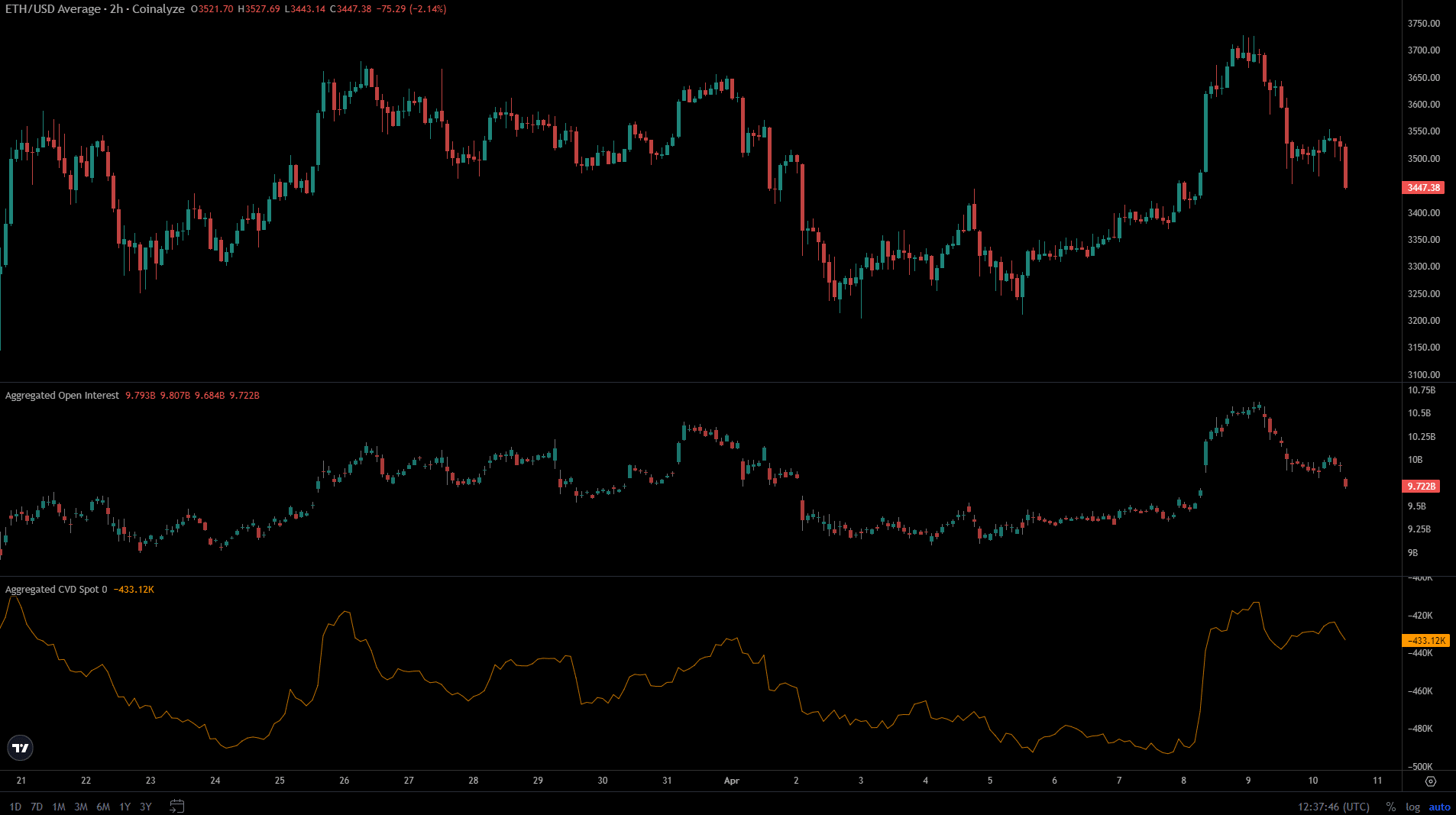

Open Curiosity information supported thought of bearish market sentiment

Supply: Coinalyze

When ETH confronted rejection at $3.7k, the Open Curiosity additionally took a flip south. Over the past 36 hours, the OI has fallen from $10.6 billion to $9.72 billion. A drop in costs, alongside the Open Curiosity, appeared to be an indication of bearish sentiment.

Learn Ethereum’s [ETH] Price Prediction 2024-25

The spot CVD additionally started to fall decrease, but it surely has not retraced all of the positive factors it made for the reason that eighth. That being stated, the interval from 26 March to eight April noticed Ethereum’s spot CVD development south. It highlighted that spot market individuals weren’t bullishly satisfied but, however there was an opportunity of a turnaround ought to ETH break previous the $3.7k-mark.

[ad_2]

Source link