[ad_1]

- Historic design proven by the MVRV ratio, led ETH to bounce.

- Whereas merchants booked some income, the OI indicated that extra was shut.

On the eighth of April, Ethereum [ETH] defied the college of thought that it was a gradual transfer this cycle as its market cap jumped by over 9%. This enhance positioned its market cap at over $440 billion.

Throughout this time, the altcoin’s value surpassed $3, 700 earlier than its slight drop. However that was not the most important spotlight.

The previous is usually the current

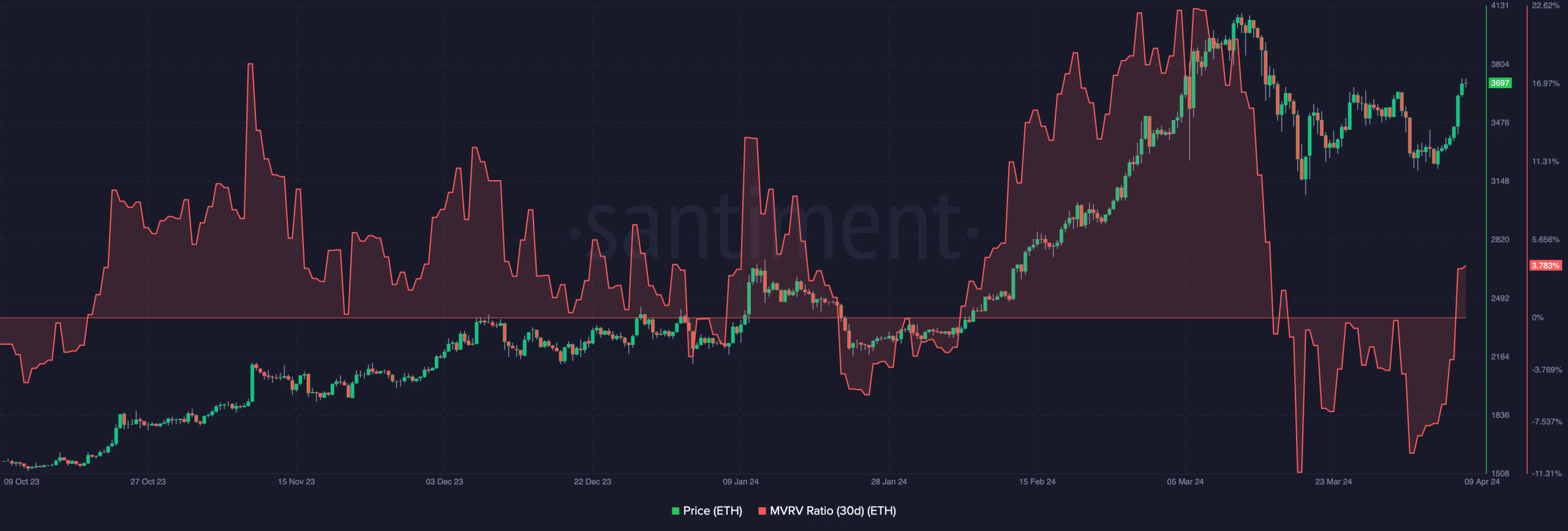

AMBCrypto analyzed Ethereum’s on-chain situation and noticed the Market Worth to Realized Worth (MVRV) ratio. This ratio offers insights into merchants’ shopping for and promoting conduct. It might probably additionally assist to identify the bottoms and tops of an asset.

Between the first and seventh of April, ETH’s 30-day MVRV ratio was detrimental, suggesting an uncommon shopping for alternative within the area. This prediction was primarily based on the cryptocurrency’s historical past.

For example, the ratio was -4.90 in October 2023 whereas ETH modified fingers at $1,566. Weeks later, the worth crossed $2,000. An analogous state of affairs additionally occurred in January as ETH moved from $2,237 to $4,088.

On each events, the worth elevated by 21.7% and 45.27% respectively. This time, Ethereum has solely elevated by 7.89%. Ought to the historic sample repeat itself, the worth may rally toward $4,648 over the subsequent few weeks.

However which may solely be the case if the market doesn’t expertise excessive volatility that might trigger costs to nosedive. If that is so, then the bullish prediction could be invalidated.

Is it time for surplus good points?

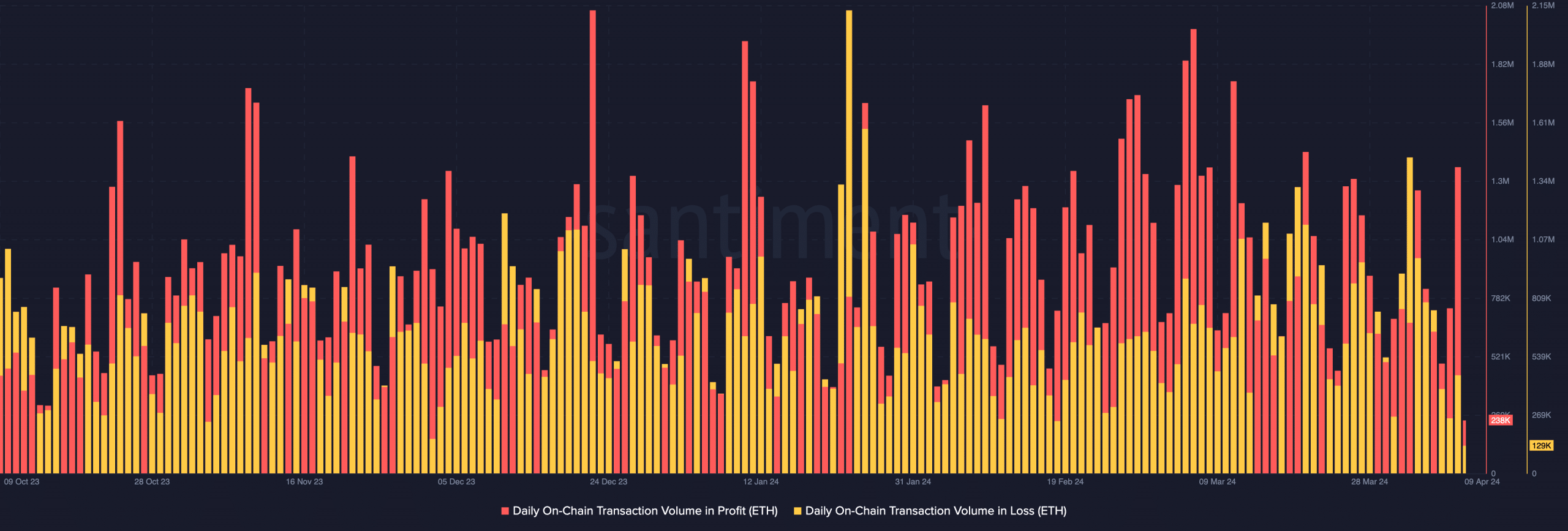

Within the meantime, merchants took benefit of the worth enhance to comprehend some income. This was one thing that ETH holders couldn’t boast of in latest weeks.

A take a look at the every day on-chain transaction quantity in loss showed that it was $129,000. Then again, the on-chain transaction quantity in revenue was about 238,000.

If the worth of the cryptocurrency continues to extend, then the amount in revenue might be double these within the crimson. However will Ethereum give in to the rally?

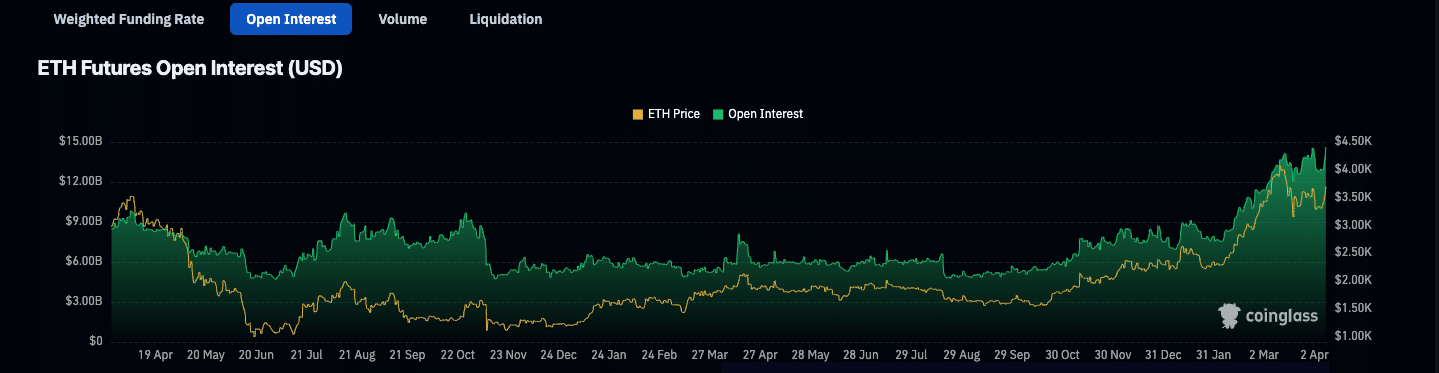

To determine this risk, AMBCrypto appeared on the Open Curiosity (OI). In response to data from Coinglass, ETH’s OI jumped to $14.41 billion.

OI measures merchants’ exercise primarily based on internet positioning. If the OI decreases, it implies a rise in positions closed. Then again, a rise within the metric suggests a surge in liquidity added to open positions.

Due to this fact, the rise within the final 24 hours meant that extra contracts had been opened, with patrons being the aggressive ones.

Learn Ethereum’s [ETH] Price Prediction 2024-2025

ETH’s value and the OI, it appears that evidently the convergence would possibly set off a big value motion.

From a buying and selling perspective, the massive OI alongside the rising worth would possibly result in a breakout. Ought to this be the case, ETH’s rise above $4,000 might be subsequent.

[ad_2]

Source link