[ad_1]

- Ethereum’s futures open curiosity present that the coin will reclaim its all-time excessive within the mid-term.

- Its key indicators additionally confirmed the rise in bullish sentiment within the coin’s spot market.

Main coin Ethereum [ETH] could also be poised for one more vital rally within the mid-term, pseudonymous CryptoQuant analyst ShayanBTC famous in a brand new report.

The report assessed the coin’s futures market and located that regardless of the final market consolidation in March, ETH’s funding charges have remained constructive, and its open curiosity has continued to climb.

Funding charges are utilized in perpetual futures contracts to make sure that the contract value stays near the spot value.

When an asset’s contract value is larger than its spot value, merchants who maintain lengthy positions pay a price to merchants shorting the asset. Funding charges return constructive values when this occurs.

Conversely, when the contract value is decrease than the spot value, brief merchants pay a price to merchants holding lengthy positions, resulting in adverse funding charges.

In accordance with the analyst, as ETH makes an attempt to reclaim the $4,000 value mark, there was a “corresponding spike within the funding charges metric.”

The report added,

“This means an aggressive execution of lengthy positions by members.”

Coinglass knowledge confirmed that the coin’s funding fee was a constructive 0.024% at press time. When an asset’s funding fee is constructive and grows, extra merchants maintain lengthy positions. This implies extra market members predict the asset’s value to rise within the brief/mid-term than these anticipating a decline.

Concerning the coin’s futures open curiosity, its double-digit value rally prior to now week has brought about this additionally to develop. Per Coinglass knowledge, ETH’s futures open curiosity was $15 billion as of this writing. Within the final seven days, this had grown by 7%.

In accordance with the report:

“Contemplating these metrics, the market seems poised for one more vital transfer within the mid-term, with the potential for lengthy positions to be reinstated within the perpetual market. This implies a beneficial outlook for Ethereum’s value trajectory, doubtlessly pushing it in the direction of its all-time excessive.”

Are the bulls regaining their power?

March was considerably marked by bearish sentiments, which brought about ETH’s value to consolidate inside a decent vary.

Nevertheless, readings from some indicators noticed on a 1-day chart confirmed that the rally within the coin’s value within the final week confirmed that the bulls at the moment are making an attempt to re-enter the market.

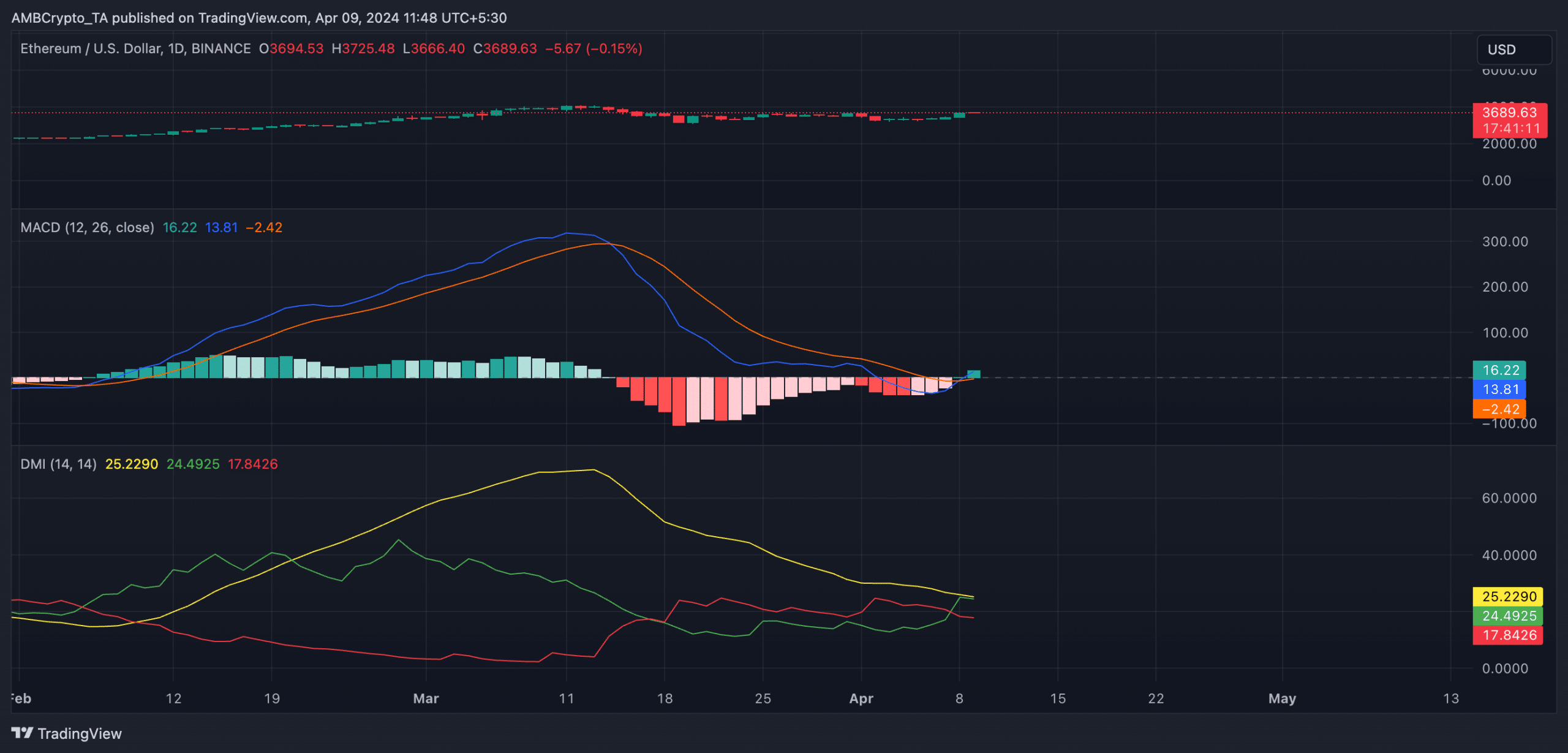

For instance, for the primary time since fifteenth March, ETH’s MACD line rested above its sign line.

When an asset’s MACD line crosses above its sign line, it means that its shorter-term shifting common is beginning to transfer upward faster than its longer-term shifting common. This means a rise in bullish momentum within the brief time period.

Learn Ethereum’s [ETH] Price Prediction 2024-25

Additionally, ETH’s Directional Motion Index (DMI) confirmed that its constructive directional index (inexperienced) crossed above its adverse index (purple) on seventh April.

This confirmed the change in sentiment from bearish to bullish.

[ad_2]

Source link