[ad_1]

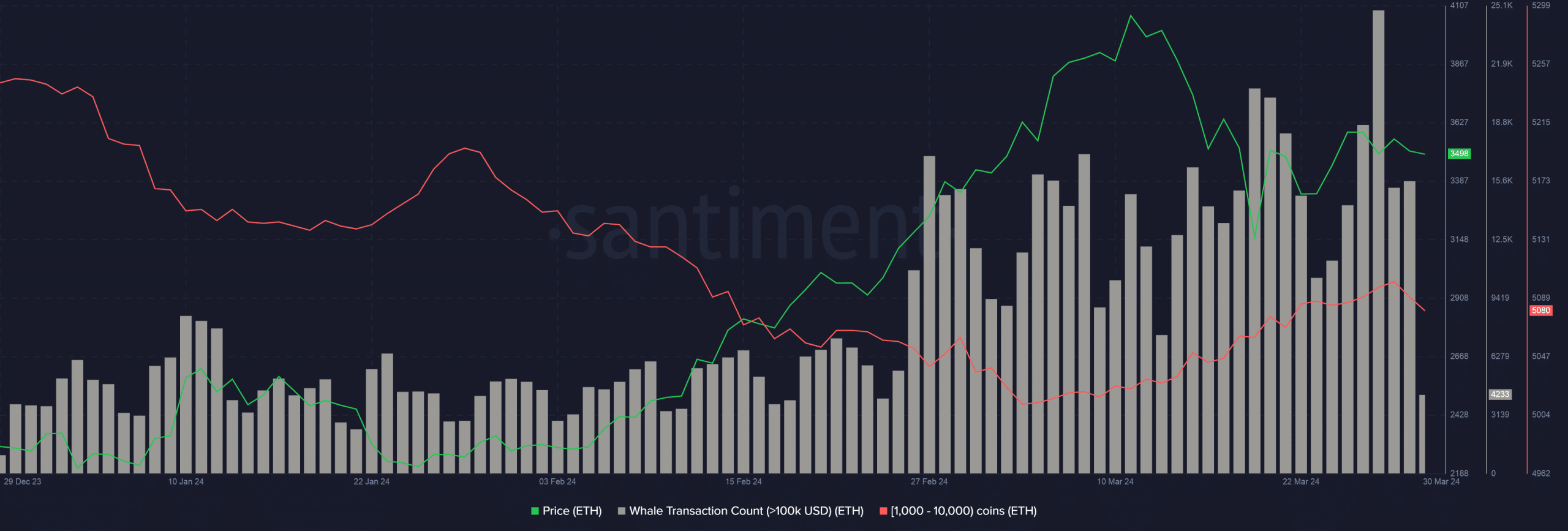

- Whale transactions price over $100,000 rose considerably in March.

- The optimism might be flowing from CFTC labelling ETH as a commodity.

Regardless of crucial occasions just like the Dencun Upgrade, Ethereum [ETH] underperformed in March, with only a marginal improve of 0.79% over the 30-day interval. The second-largest cryptocurrency confronted sturdy resistance on the $4,000 mark, dropping to $3.500 as of this writing.

However the stoop didn’t deter giant buyers of the coin, who continued so as to add Ethereum publicity to their portfolios.

Whales belief ETH to go large

In accordance with AMBCrypto’s evaluation of Santiment’s information, whale transactions price over $100,000 rose considerably all through the month. These transactions resulted in a pointy improve in small whale wallets which usually maintain between 1,000 – 10,000 cash.

This nature of accumulation is called “purchase the dip.” The technique includes shopping for belongings throughout short-term worth drops to learn from potential future worth will increase.

Pushed by analysis and enterprise acumen, this plan is often adopted for fundamentally-strong belongings with long-term progress potential.

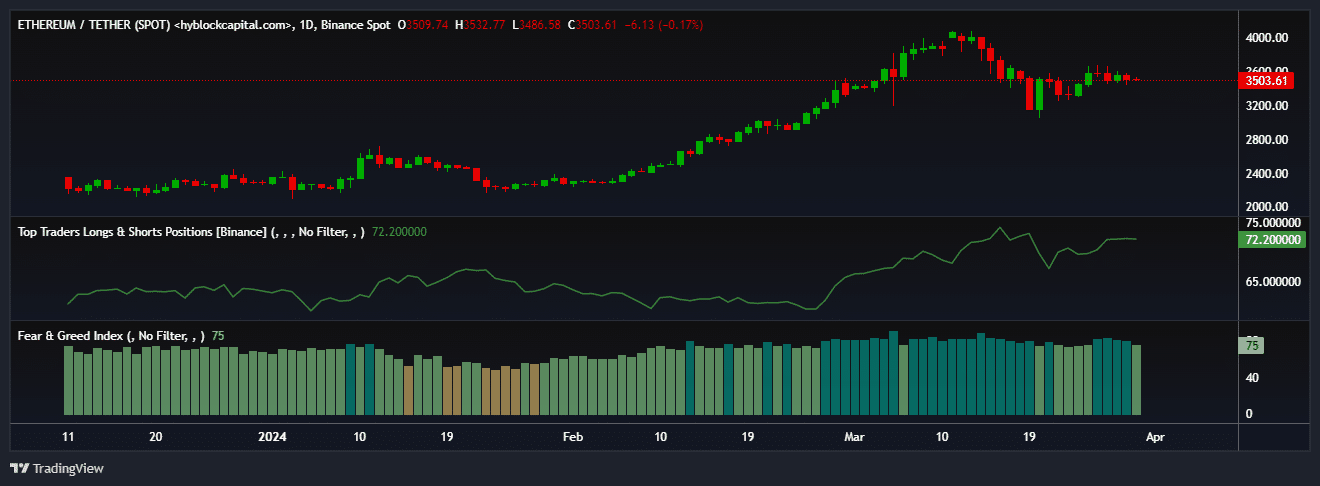

The extent of bullishness was additionally mirrored within the rising lengthy publicity within the derivatives markets. As per AMBCrypto’s evaluation of Hyblock Capital’s information, about 72% of complete whale positions on crypto trade Binance had been betting on ETH to rise.

Whales’ bullish technique appeared to have been picked up by the broader market. The overall temper was certainly one of “Greed” as per the Concern and Greed Index. Sometimes, such sentiments result in FOMO, drawing in additional buyers and including to the shopping for strain.

However what was motivating whales to be bullish on ETH?

Possibilities of spot ETF approval enhancing?

In current weeks, a number of pessimism had set in surrounding the approval of Ether spot ETFs. The percentages had been getting lowered attributable to rising risk of the U.S. Securities and Change Fee (SEC) deeming Ether as a safety.

Is your portfolio inexperienced? Take a look at the ETH Profit Calculator

Nevertheless, U.S. derivatives market regulator, Commodities Futures Buying and selling Fee (CFTC) referred ETH as a commodity within the current KuCoin lawsuit.

This might have rekindled buyers’ hopes that an Ether spot ETF would finally see the sunshine of day. If authorised, spot ETFs have the potential to do for ETH what Bitcoin has been witnessing since mid-January.

[ad_2]

Source link