[ad_1]

Writing efficient decentralized purposes in Ethereum is on the similar time simple and arduous. The simple half everyone knows: slightly than needing to create your individual blockchain, handle difficult database code, cope with networking and NAT traversal, or any of the opposite complexities involving writing a peer-to-peer app from scratch, you’ll be able to write code in a easy, high-level programming language like Serpent or Mutan (or LLL in case you choose mucking round a bit lower-level), with the simplicity of a toy scripting language however the energy and safety of a full blockchain backing it up. A whole implementation of a fundamental title registry might be performed in two traces of code that embody the important logic of this system: if not contract.storage[msg.data[0]]: contract.storage[msg.data[0]] = msg.knowledge[1]. Use the zeroth knowledge merchandise within the message as a key and the primary as a worth; if the bottom line is not but taken then set the important thing to the specified worth. A telephone guide that you could add entries to, however the place entries, as soon as made, can’t be modified. Nonetheless, there’s additionally a tough half: decentralized purposes are prone to contain logic that’s basically complicated, and there’s no method that any simplifications to the programming surroundings can ever take away that truth (nonetheless, libraries constructed on high of the programming language would possibly alleviate particular points). Moreover, any dapps doing something really attention-grabbing is prone to contain cryptographic protocols and economics, and everyone knows how complicated these are.

The aim of this text can be to undergo a contract that is a vital part of a totally decentralized cryptoeconomic ecosystem: a decentralized oracle. The oracle can be carried out utilizing the SchellingCoin protocol, described in a previous blog post. The core thought behind the protocol is that everybody “votes” on a specific worth (on this case, we’ll use wei per US cent for example, as that may find yourself very helpful in monetary contracts), and everybody who submitted a vote that’s between the twenty fifth and 75 percentile (ie. near median) receives a reward. The median is taken to be the “true worth”. In an effort to improve safety, every spherical is finished through a two-step dedication protocol: within the first part, everybody selects a worth P which is the worth they are going to be voting for, and submits H = sha3([msg.sender, P]) to the contract, and within the second part everybody submits the P that they chose and the contract accepts solely these values that match the beforehand supplied hash. Rewarding and analysis is then performed on the finish.

The explanation why it really works is that this. Throughout the first part, everyone seems to be so to talk “in the dead of night”; they have no idea what the others can be submitting, seeing maybe solely hashes of different votes. The one info they’ve is that they’re presupposed to be submitting the worth of a US cent in wei. Thus, realizing solely that the one worth that different individuals’s solutions are going to be biased in the direction of is the precise wei/UScent, the rational option to vote for with a view to maximize one’s probability of being near-median is the wei/UScent itself. Therefore, it is in everybody’s greatest pursuits to return collectively and all present their greatest estimate of the wei/UScent value. An attention-grabbing philosophical level is that that is additionally the identical method that proof-of-work blockchains work, besides that in that case what you’re voting on is the time order of transactions as a substitute of some specific numeric worth; this reasonably strongly means that this protocol is prone to be viable not less than for some purposes.

After all, in actuality varied sorts of particular eventualities and assaults are doable, and the truth that the worth of any asset is very often managed by a small variety of centralized exchanges makes issues harder. For instance, one possible failure mode is that if there’s a market share cut up between the BTC/USD on Bitstamp, Bitfinex and MtGox, and MtGox is the most well-liked trade, then the incentives would possibly drive all of the votes to combination across the GOX-BTC/USD value particularly, and at that time it’s solely unclear what would occur when MtGox will get hacked and the worth on that trade alone, and never the others, falls to $100. Everybody could effectively find yourself following their particular person incentives and sticking to one another to the protocol’s collective doom. Tips on how to cope with these conditions and whether or not or not they’re even vital is a completely empirical difficulty; it’s arduous to say what the true world will do beforehand.

Formalizing the protocol, now we have the next:

- Each set of N blocks (right here, we set N = 100) constitutes a separate “epoch”. We outline the epoch quantity as ground(block.quantity / 100), and we outline the block quantity modulo 100 to be the “residual”.

- If the residual is lower than 50, then anybody can submit a transaction with any worth V and hash H = sha3([msg.sender, R, P]), the place P is their estimate of the worth of 1 US cent in wei (bear in mind, 1 wei = 10-18 ether, and 1 cent = 10-2 USD) and R is a random quantity.

- If the residual is larger than 50, then anybody who submitted a hash can submit P, and the contract will examine if sha3([msg.sender, P]) matches the hash.

- On the finish of the epoch (or, extra exactly, on the level of the primary “ping” in the course of the subsequent epoch), everybody who submitted a worth for P between the twenty fifth and seventy fifth percentile, weighted by deposit, will get their deposit again plus a small reward, everybody else will get their deposit minus a small penalty, and the median worth is taken to be the true UScent/wei value. Everybody who didn’t submit a sound worth for P will get their deposit again minus a small penalty.

Observe that there are doable optimizations to the protocol; for instance, one would possibly introduce a characteristic that enables anybody with a specific

Pworth to steal the deposit from whoever submitted the hash, making it impractical to share one’s

Pto attempt to affect individuals’s votes earlier than residual 50 hits and the second part begins. Nonetheless, to maintain this instance from getting too difficult we won’t do that; moreover, I personally am skeptical of “pressured non-public knowledge revelation” methods typically as a result of I predict that a lot of them will change into ineffective with the eventual introduction of generalized zero-knowledge proofs, fully homomorphic encryption and obfuscation. For instance, one may think an attacker beating such a scheme by supplying a zero-knowledge proof that their

Pworth is inside a specific 1015 wei-wide vary, giving sufficient info to provide customers a goal however not sufficient to virtually find the precise worth of

P. Given these considerations, and given the will for simplicity, for now the easy two-round protocol with no bells-and-whistles is greatest.

Earlier than we begin coding SchellingCoin itself, there’s one different contract that we might want to create: a sorting perform. The one strategy to calculate the median of a listing of numbers and decide who’s in a specific percentile vary is to type the listing, so we’ll need a generalized perform to do this. For added utility, we’ll make our sorting perform generic: we’ll type pairs as a substitute of integers. Thus, for examples, [30, 1, 90, 2, 70, 3, 50, 4] would change into [ 30, 1, 50, 4, 70, 3, 90, 2 ]. Utilizing this perform, one can type a listing containing any form of object just by making an array of pairs the place the primary quantity is the important thing to type by and the second quantity is a pointer to the item in mum or dad reminiscence or storage. This is the code:

if msg.datasize == 0: return([], 0) else: low = array(msg.datasize) lsz = 0 excessive = array(msg.datasize) hsz = 0 i = 2 whereas i < msg.datasize: if msg.knowledge[i] < msg.knowledge[0]: low[lsz] = msg.knowledge[i] low[lsz + 1] = msg.knowledge[i + 1] lsz += 2 else: excessive[hsz] = msg.knowledge[i] excessive[hsz + 1] = msg.knowledge[i + 1] hsz += 2 i = i + 2 low = name(contract.tackle, low, lsz, lsz) excessive = name(contract.tackle, excessive, hsz, hsz) o = array(msg.datasize) i = 0 whereas i < lsz: o[i] = low[i] i += 1 o[lsz] = msg.knowledge[0] o[lsz + 1] = msg.knowledge[1] j = 0 whereas j < hsz: o[lsz + 2 + j] = excessive[j] j += 1 return(o, msg.datasize)

Laptop college students could acknowledge this as a quicksort implementation; the concept is that we first cut up the listing into two, with one half containing every thing lower than the primary merchandise and the opposite half containing every thing larger, then we recursively type the primary and second lists (the recursion terminates ultimately, since ultimately the sub-lists may have zero or one objects, by which case we simply return these values immediately), and at last we concatenate output = sorted_less_than_list + first merchandise + sorted_greater_than_list and return that array. Now, placing that into “quicksort_pairs.se”, let’s construct the code for the actual SchellingCoin. Be happy to go to the github to see the code multi function piece; right here, we’ll undergo it just a few traces at a time.

First, some initialization code:

init: contract.storage[0] = block.quantity contract.storage[3] = create('quicksort_pairs.se') code: HASHES = 2^160 VALUES = 2^170

The primary code block units contract storage index 0 to the present block quantity at initialization time, after which creates a quicksort contract and saves that in storage index 3. Observe that theoretically you’d wish to simply create the quicksort contract as soon as and check with it by tackle; we’re simply doing an inline create for simplicity and to point out the characteristic. Within the code we begin off by declaring two variables to function pseudo-constants; HASHES = 2160 because the pointer for the place we retailer hashes, and VALUES = 2170 because the pointer for the place we retailer values from the second part.

Now, from right here let’s skip to the underside half of the code, as a result of that seems to be extra handy and it is the code that really will get run “first” over the course of the contract’s lifetime.

# Hash submission if msg.knowledge[0] == 1: if block.quantity % 100 < 50: cur = contract.storage[1] pos = HASHES + cur * 3 contract.storage[pos] = msg.knowledge[1] contract.storage[pos + 1] = msg.worth contract.storage[pos + 2] = msg.sender contract.storage[1] = cur + 1 return(cur) # Worth submission elif msg.knowledge[0] == 2: if sha3([msg.sender, msg.data[3], msg.knowledge[2]], 2) == contract.storage[HASHES + msg.data[1] * 3]: contract.storage[VALUES + msg.data[1]] = msg.knowledge[2] return(1) # Steadiness request elif msg.knowledge[0] == 3: return(contract.steadiness) # Worth request else: return(contract.storage[2])

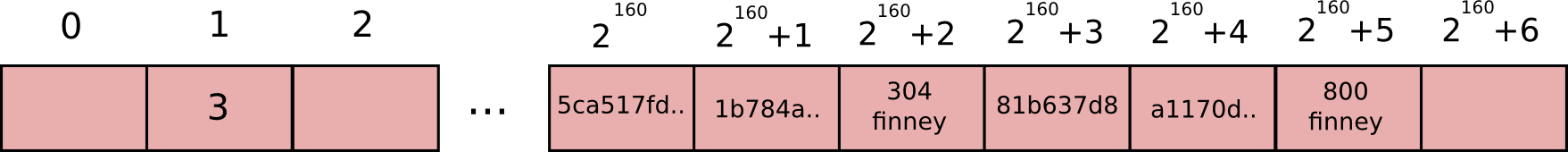

The primary essential paradigm that we see right here is utilizing msg.knowledge[0] to check with a “message kind”; messages with zeroth knowledge merchandise 1 are hash submissions, 2 are worth submissions, 3 are steadiness requests and 4 are requests for the present UScent/wei value. This can be a customary interface that you’ll probably see throughout very many contracts. The primary clause, the one for submitting hashes, is considerably concerned, so allow us to break it down step-by-step. The first function right here is to permit individuals to submit hashes, and document submissions in storage. To that finish, the contract is storing the info sequentially in storage beginning at index 2160. We have to retailer three items of knowledge – the precise hash, the dimensions of the accompanying deposit, and the sender tackle, for every hash, so we do this. We additionally use storage index 1 to retailer what number of hashes have already been submitted. Thus, if two hashes have been submitted, storage will look one thing like this:

The exact directions within the clause are:

- Proceed provided that the residual is lower than 50.

- Set the variable cur to storage index 1, the place we’re going to be storing the variety of hashes which have already been submitted

- Set the variable pos to the index in storage by which we can be placing the brand new hash

- Save the hash (provided as the primary knowledge merchandise), the sender tackle and the worth in storage

- Set the brand new variety of hashes to cur + 1

- Return the index of the hash provided

Technically, if the one customers of SchellingCoin are individuals, step 5 is pointless; though the index can be obligatory in a later step, a wise consumer may doubtlessly merely scan the

cur variable instantly after the transaction, eradicating the necessity for the opcodes wanted to deal with the return. Nonetheless, since we count on that in Ethereum we may have loads of situations of contracts utilizing different contracts, we’ll present the return worth as a behavior of excellent machine interface.

The following clause is for submitting values. Right here, we ask for 2 knowledge objects as enter: the index the place the hash was saved throughout step one of the protocol (that is the return worth of the earlier clause), and the precise worth. We then hash the sender and worth collectively, and if the hash matches then we save the end in one other place in contract storage; another method is to make use of one single beginning storage location and easily have 4 slots per hash as a substitute of three. We return 1 is profitable, and nothing for a failure. The third and fourth clauses are merely trivial knowledge requests; the third is a steadiness examine, and the fourth returns the contract’s present view of the worth.

That is all for the interface aspect of the contract; nonetheless, the one half that we nonetheless have to do is the half that really aggregates the votes. We’ll break that up into components. First, now we have:

HASHES = 2^160 VALUES = 2^170 if block.quantity / 100 > contract.storage[0] / 100: # Kind all hashes N = contract.storage[1] o = array(N) i = 0 j = 0 whereas i < N: if contract.storage[VALUES + i]: o[j] = contract.storage[VALUES + i] o[j + 1] = i j += 2 i += 1 values = name(contract.storage[3], o, j, j)

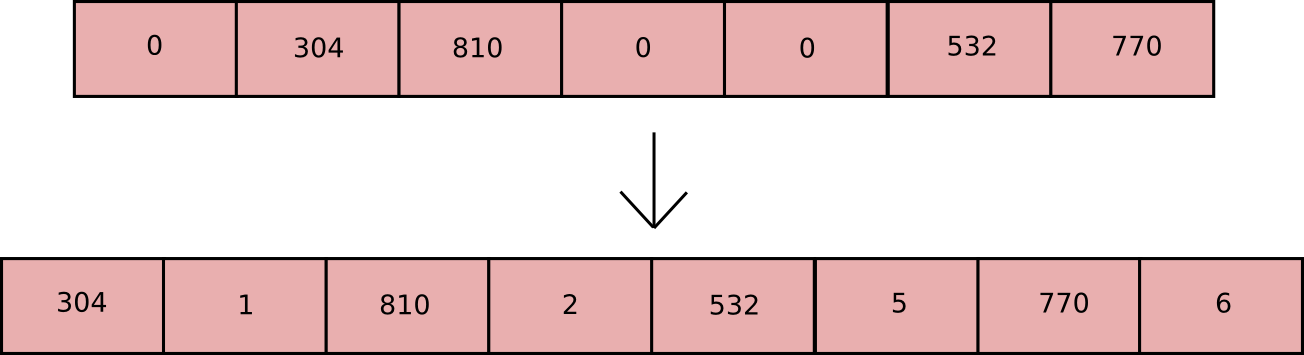

First, we use storage index 0 to retailer the final accessed epoch, and we examine if the present epoch is greater than the final accessed epoch. Whether it is, then that indicators the beginning of a brand new epoch, so we have to course of all of the votes and clear the contract for the following epoch. We begin off by copying the values which have been submitted to an array (values that haven’t been submitted, ie. zeroes, should not put into this array). We maintain two working counters, i and j; the counter i runs by all worth slots, however the counter j counts solely the worth slots which have one thing inside them. Observe that the array that we produce is of the shape [ val1, index1, val2, index2 … ], the place index1 and many others are the indices of the related values within the unique values array in contract storage, thus for instance, the next values would result in the next array:

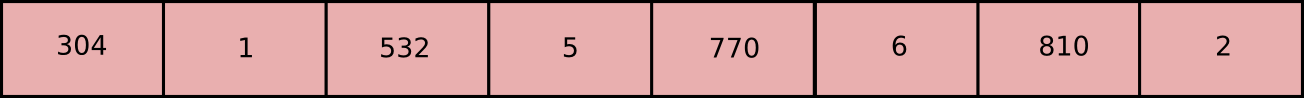

Then, we ship that array by the quicksort contract, which kinds knowledge pairs within the array. After the kind, we find yourself with:

Now, what now we have is a sorted listing of all of the values that individuals have submitted, alongside tips that could the place the related metadata is saved in chilly storage. The following a part of the code will deal with three issues concurrently. First, it’s going to compute the overall quantity that has been deposited; that is helpful in determining the median. Second, we’ll make two arrays to symbolize deposits and their related addresses, and we’ll take away that knowledge from the contract. Lastly, we’ll 99.9% refund anybody who didn’t submit a worth. Theoretically, we may make it a 70% refund or a 0% refund, however which may make the contract too dangerous for individuals to throw their life financial savings in (which is definitely what we wish in a proof-of-stake-weighted system; the extra ether is thrown in by legit customers the tougher it’s for an attacker to muster sufficient funds to launch an assault). here is the code; be happy to know every line your self:

# Calculate whole deposit, refund non-submitters and # cleanup deposits = array(j / 2) addresses = array(j / 2) i = 0 total_deposit = 0 whereas i < j / 2: base_index = HASHES + values[i * 2 + 1] * 3 contract.storage[base_index] = 0 deposits[i] = contract.storage[base_index + 1] contract.storage[base_index + 1] = 0 addresses[i] = contract.storage[base_index + 2] contract.storage[base_index + 2] = 0 if contract.storage[VALUES + values[i * 2 + 1]]: total_deposit += deposits[i] else: ship(addresses[i], deposits[i] * 999 / 1000) i += 1

Now, we come to the final a part of the code, the half the computes the median and rewards individuals. Based on the specification, we have to reward everybody between the twenty fifth and seventy fifth percentile, and take the median (ie. fiftieth percentile) as the reality. To truly do that, we wanted to first type the info; now that the info is sorted, nonetheless, it is so simple as sustaining a working counter of “whole deposited worth of every thing within the listing up so far”. If that worth is between 25% and 75% of the overall deposit, then we ship a reward barely larger than what they despatched in, in any other case we ship a barely smaller reward. Right here is the code:

inverse_profit_ratio = total_deposit / (contract.steadiness / 1000) + 1 # Reward everybody i = 0 running_deposit_sum = 0 halfway_passed = 0 whereas i < j / 2: new_deposit_sum = running_deposit_sum + deposits[i] if new_deposit_sum > total_deposit / 4 and running_deposit_sum < total_deposit * 3 / 4: ship(addresses[i], deposits[i] + deposits[i] / inverse_profit_ratio * 3) else: ship(addresses[i], deposits[i] - deposits[i] / inverse_profit_ratio) if not halfway_passed and new_deposit_sum > total_deposit / 2: contract.storage[2] = contract.storage[VALUES + i] halfway_passed = 1 contract.storage[VALUES + i] = 0 running_deposit_sum = new_deposit_sum i += 1 contract.storage[0] = block.quantity contract.storage[1] = 0

On the similar time, you’ll be able to see we additionally zero out the values in contract storage, and we replace the epoch and reset the variety of hashes to zero. The primary worth that we calculate, the “inverse revenue ratio”, is mainly the inverse of the “rate of interest” you get in your deposit; if inverse_profit_ratio = 33333, and also you submitted 1000000 wei, then you definately get 1000090 wei again in case you are near the median and 999970 in case you are not (ie. your anticipated return is 1000030 wei). Observe that though this quantity is tiny, it occurs per hundred blocks, so actually it’s fairly giant. And that is all there’s to it. If you wish to check, then strive working the next Python script:

import pyethereum t = pyethereum.tester s = t.state() s.mine(123) c = s.contract('schellingcoin.se') c2 = s.contract('schellinghelper.se') vals = [[125, 200], [126, 900], [127, 500], [128, 300], [133, 300], [135, 150], [135, 150]] s.ship(t.k9, c, 10**15) print "Submitting hashes" for i, v in enumerate(vals): print s.ship(t.keys[i], c, v[1], [1] + s.ship(t.keys[i], c2, 0, [v[0], 12378971241241])) s.mine(50) print "Submitting vals" for i, v in enumerate(vals): if i != 5: print s.ship(t.keys[i], c, 0, [2, i, v[0], 12378971241241]) else: print s.ship(t.keys[i], c, 0, [2, i, 4]) print "Ultimate examine" s.mine(50) print s.ship(t.k9, c, 0, [4])

Earlier than working the script, you’ll want to fill the ‘schellinghelper.se’ file with return(sha3([msg.sender, msg.data[0], msg.knowledge[1]], 3)); right here, we’re simply being lazy and utilizing Serpent itself to assist us put the hash collectively; in actuality, this could positively be performed off-chain. In the event you do this, and run the script, the final worth printed by the contract ought to return 127.

Observe that this contract because it stands is just not actually scalable by itself; at 1000+ customers, whoever provides the primary transaction at the beginning of every epoch would want to pay a really great amount of fuel. The best way to repair this economically is after all to reward the submitter of the transaction, and take a flat price off each participant to pay for the reward. Additionally, nonetheless, the rate of interest per epoch is tiny, so it could already not be value it for customers to take part except they’ve a signigicant amount of money, and the flat price could make this drawback even worse.

To permit individuals to take part with small quantities of ether, the only answer is to create a “stake pool” the place individuals put their ether right into a contract for the long run, after which the pool votes collectively, randomly deciding on a participant weighted by stake to produce the worth to vote for in every epoch. This would cut back the load from two transactions per consumer per epoch to a few transactions per pool per epoch (eg. 1 pool = 1000 customers) plus one transaction per consumer to deposit/withdraw. Observe that, not like Bitcoin mining swimming pools, this stake pool is totally decentralized and blockchain-based, so it introduces at most very small centralization dangers. Nonetheless, that is an instructive instance to point out how a single contract or DAO could find yourself resulting in a complete ecosystem of infrastructure engaged on the blockchain with contracts speaking to one another; a specialised SchellingCoin blockchain wouldn’t be capable to invent pooling mechanisms after the very fact and combine them so effectively.

So far as purposes go, essentially the most speedy one is contracts for distinction, and ultimately a decentralized cryptographic US greenback; if you wish to see an try at such a contract see here, though that code is nearly definitely susceptible to market manipulation assaults (purchase a really great amount of USD contained in the system, then purchase USD in the marketplace to maneuver the worth 0.5%, then promote the USD contained in the system for a fast 0.3% revenue). The core thought behind the decentralized crypto-dollar is straightforward: have a financial institution with two currencies, USD and ether (or slightly, UScent and wei), with the power to have a optimistic or detrimental amount of {dollars}, and manipulate the rate of interest on greenback deposits with a view to maintain the contract’s internet greenback publicity all the time near zero in order that the contract doesn’t have any internet obligations in currencies that it doesn’t have the power to carry. An easier method would merely be to have an expanding-supply forex that adjusts its provide perform to focus on the USD, however that’s problematic as a result of there is no such thing as a safety if the worth falls an excessive amount of. These sorts of purposes, nonetheless, will probably take fairly a very long time (in crypto phrases; fairly quick in conventional finance phrases after all) to get constructed.

[ad_2]

Source link