[ad_1]

UK authorities have not too long ago permitted secondary laws geared toward enhancing their potential to confiscate cryptocurrency property, together with Bitcoin, concerned in felony actions legally.

This growth stems from the passage of the Financial Crime and Company Transparency Invoice final 12 months, which empowered authorities to freeze and seize crypto property suspected of facilitating crimes like cash laundering and drug trafficking.

UK Authorities Can Legally Confiscate Bitcoin

Efficient April 26, a brand new law will grant UK regulation enforcement the authority to freeze digital property for as much as 90 days with out requiring a courtroom order if there’s suspicion of felony involvement. This measure goals to disrupt illicit financing, stopping the motion or concealment of property.

Certainly, the forthcoming rule builds upon the inspiration of the Financial Crime and Company Transparency Act of 2023. It amplifies regulation enforcement’s functionality to confiscate and immobilize particular crypto property related to felony offenses. These embrace cash laundering, drug trafficking, and terrorism.

Though UK authorities have beforehand seized crypto property often, the brand new laws is poised to expedite these procedures. Lately, the UK Metropolitan Police confiscated over £1.4 billion price of Bitcoin, following an funding rip-off in China.

Learn extra: The State of Crypto Regulation in the United Kingdom

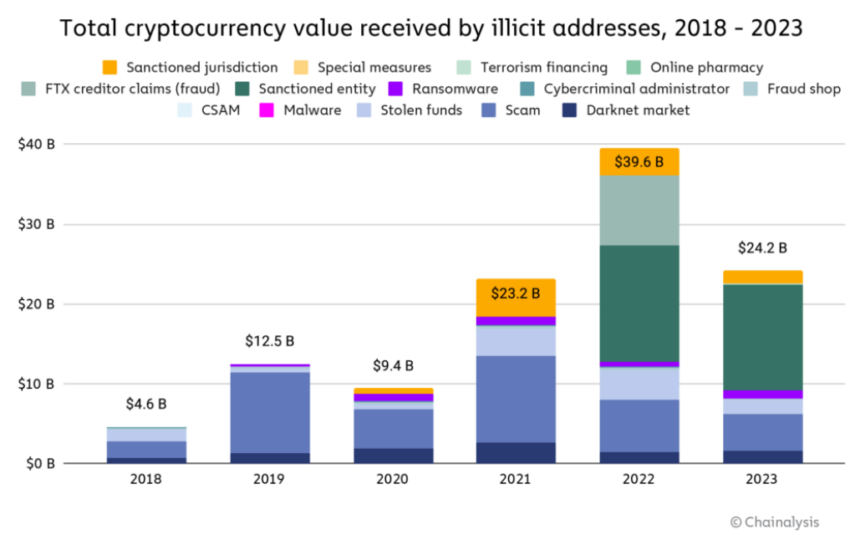

This proactive stance by UK authorities displays a broader international pattern in the direction of heightened interest in crypto asset seizure. Notably, the US Authorities has seized billions in digital assets allegedly linked to numerous felony actions, together with terrorism and different illicit actions.

The activation of those provisions marks a pivotal second in UK crypto regulation. Stakeholders foresee these adjustments as pivotal in curbing felony actions and defending lawful asset holders.

Apart from that, the laws will bolster regulation enforcement’s capability to fight crimes, with far-reaching implications for the crypto sector. In the meantime, the heightened regulatory oversight and asset seizure potential spotlight the essential need for compliance and due diligence amongst people and companies within the crypto house.

Disclaimer

All the data contained on our web site is revealed in good religion and for common info functions solely. Any motion the reader takes upon the data discovered on our web site is strictly at their very own danger.

[ad_2]

Source link