[ad_1]

On February 23, widespread Bitcoin miner Riot Platforms issued a cautionary assertion relating to potential profitability challenges in its enterprise operations. The corporate cited varied components, together with international provide chain disruptions, chip shortages, and growing regulatory scrutiny round local weather change, as key threats to its operations.

Larger Bitcoin Mining Issue Requires Larger Hash Charge

The highest Bitcoin miner resident in Texas shared this less-than-optimistic outlook on its means to revenue in 2024. In its annual investor K-10 report, Riot outlined 13 threat components that might affect its enterprise and monetary operations.

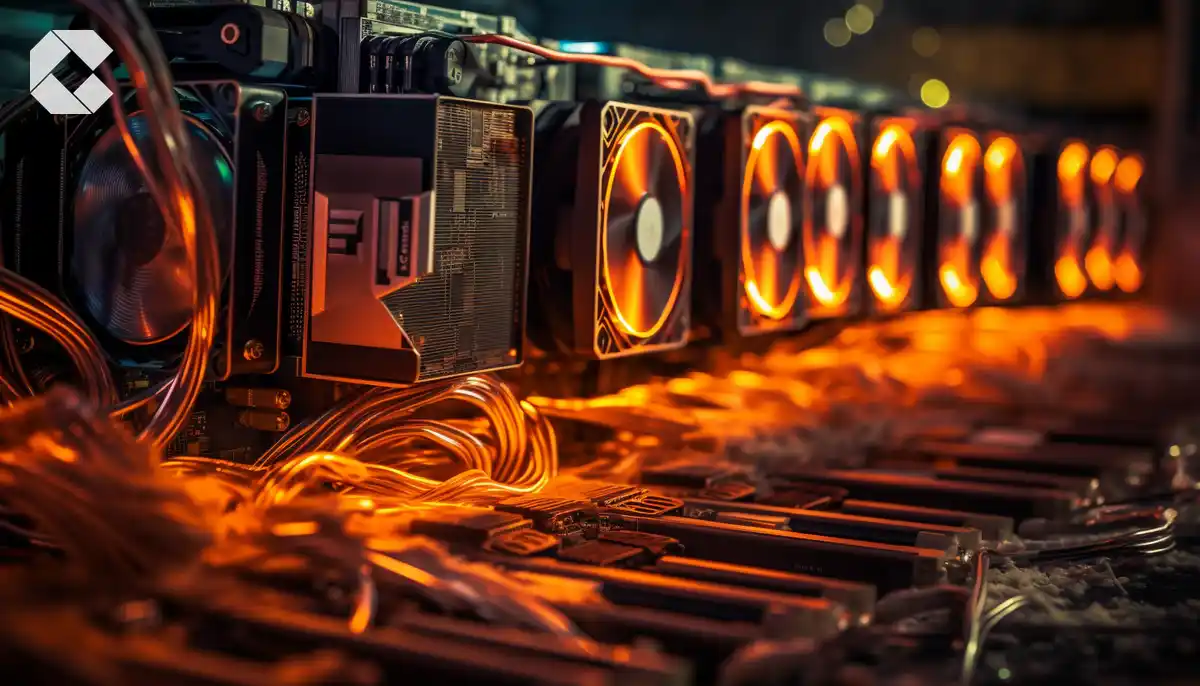

Certainly one of these components is the escalating hash rate required to mine a Bitcoin reward. The hash fee is the computing energy crucial to resolve the cryptographic puzzles that underlie each Bitcoin transaction. To deal with this, Bitcoin miners usually deploy extremely subtle Utility Particular Built-in Chips (ASICs) to resolve the puzzle and earn block rewards.

Riot Platforms famous that hash charges usually develop exponentially as the worth of Bitcoin will increase. The community’s hash fee has surged as a result of renewed curiosity within the foremost digital asset.

Riot Platforms has said that if it fails to develop its present 12.4 exahash (EH) per second, its operations might be adversely impacted. The sport plan to fight that is buying new and extra environment friendly ASIC miners to spice up their capability to mine Bitcoins efficiently.

One other issue the annual report considers is the worldwide provide chain difficulty prompted by the Covid-19 pandemic. With a number of nations recovering from the lockdown, the worldwide provide chain has modified.

This has resulted in a constrained provide of semiconductors wanted to provide extremely specialised ASIC machines. With constrained semiconductor provide, Riot Platforms claimed that a number of mining corporations have been pressured to pay premium costs to entry the few ASICs out there available in the market.

In addition to restricted ASIC miner entry, the corporate’s progress has been influenced by restricted entry to important infrastructures like electricity distribution and development supplies.

Riot Platforms is one among many Bitcoin mining corporations working within the US. The corporate boasts an enormous lineup of 112,944 Bitcoin miners. In 2023, Riot earned 6,626 in Bitcoin as profit (price $341 million at present charges) from its mining operations. This determine represents a 19.3% enhance from the 5,554 Bitcoins mined in 2022.

Riot Platforms Experiences Full 12 months 2023 Monetary Outcomes, Present Operational and Monetary Highlights.

$280.7 Million in Complete Income, 6,626 Bitcoin Produced, and Document Hash Charge Capability of 12.4 EH/s.

Learn the total press launch right here: https://t.co/SeUytqm5ek. pic.twitter.com/Gr35dX8GmW

— Riot Platforms, Inc. (@RiotPlatforms) February 22, 2024

The Bitcoin miner additionally famous that its common value to mine 1 BTC has dropped to $7,539 as of 2023.

Crypto Regulatory Scrutiny And Local weather Change Issues

Regardless of its elevated output, Riot Platforms has highlighted the escalating scrutiny from authorities stakeholders relating to the environmental impact of its operations as a big impediment.

Based on the Texas-based miner, altering expectations on its environmental, societal, and governance (ESG) practices and local weather impacts may incur big prices.

The Bitcoin miner elaborated that new laws and elevated regulation regarding local weather change may impose vital prices on them and their suppliers. This consists of prices associated to elevated vitality necessities, capital gear, environmental monitoring and reporting, and different prices related to compliance with such rules.

For context, stringent regulatory oversights on crypto mining practices are being mentioned within the US. The US Energy Information Administration (EIA) has created a survey focused at crypto mining corporations.

The survey, meant to gauge crypto mining corporations’ vitality wants, doesn’t explicitly state whether or not the gathered information could be deployed in future regulatory actions. Nonetheless, it brings to thoughts that crypto mining is now a focus for US authorities businesses.

Riot Platforms said that strict regulatory oversight of its enterprise ecosystem may see it lose any type of aggressive benefit it has over its friends in different areas.

Concerning the doable implications of the EIA survey, Riot Platforms’ Head of Public Coverage, Brian Morgenstern, said that it’s greater than a cursory look into the trade.

“They’re attempting handy you the rope that they wish to use to hold you later.”

The EIA survey isn’t just a survey. It’s a political weapon designed to strangle US Bitcoin miners.

I break down the motivations behind the EIA audit in a brand new podcast with @stephanlivera pic.twitter.com/u16lvsAMpX

— Brian Morgenstern (@MorgensternNJ) February 22, 2024

Morgenstern stated in a podcast that the EIA survey is a weapon by regulators designed to strangle US Bitcoin miners.

[ad_2]

Source link