[ad_1]

Kraken, a number one cryptocurrency alternate, has joined forces with business giants Coinbase and Binance in a authorized standoff towards the US Securities and Trade Fee (SEC). These lawsuits might have a significant influence on the continuing discourse over crypto regulation.

Kraken, throughout an affidavit earlier than each the Home Monetary Providers Committee and the Home Agriculture Committee on Could 10, 2023, argued that present legal guidelines fall brief in overlaying the digital asset business.

Kraken Ups the Ante Towards SEC

The alternate harassed the necessity for Congress to develop a extra complete algorithm to safeguard shoppers and traders. A day after this testimony, the SEC introduced its intention to sue Kraken.

This was met with a agency response from Kraken, which filed a movement to dismiss the lawsuit. The alternate’s argument hinges on the declare that the digital property in query don’t represent funding contracts, thus falling outside the SEC’s purview.

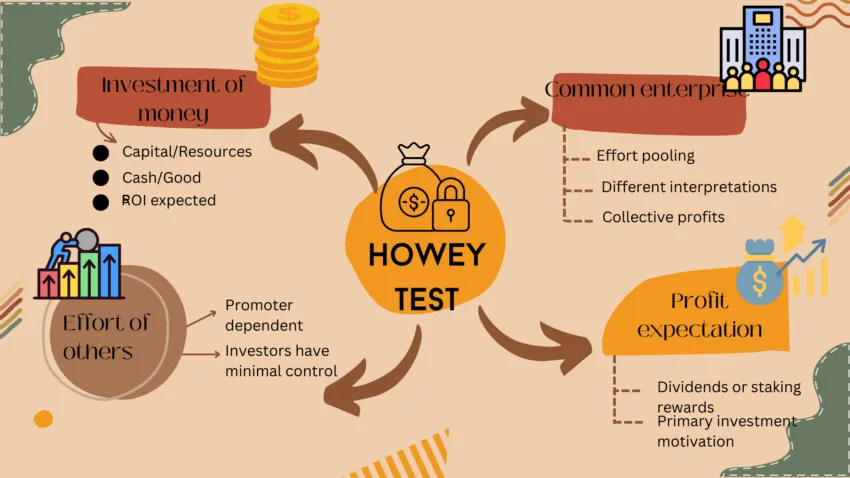

The SEC determines this classification by utilizing the Howey Take a look at. An asset could be categorized as a security if it meets any of the 4 traits of the check. Kraken argues that none of its listed property fall below these attributes.

Learn extra: What Is the Howey Test and How Does It Impact Crypto?

A current Kraken weblog submit explained its viewpoint:

“Even taking all the SEC’s allegations within the Criticism as true – and lots of will not be – its argument is flawed as a matter of legislation.”

Coinbase and Binance Fits Ongoing

Coinbase, one other distinguished participant within the crypto area, is escalating its personal battle with the SEC. The alternate has launched an enchantment towards the SEC, pushing it to make a clear-cut resolution on classifying cryptocurrencies. Paul Grewal, Coinbase’s Chief Authorized Officer, described the SEC’s stance as:

“Arbitrary and capricious, an abuse of discretion, and opposite to legislation.”

In the meantime, Binance is preparing to confront the SEC in a Washington courtroom. The SEC’s lawsuit towards Binance consists of allegations of artificially inflating buying and selling volumes and enabling the buying and selling of crypto tokens deemed securities.

Learn extra: Who Is Changpeng Zhao? A Deep Dive Into the Ex-CEO of Binance

Binance’s response underscores its place that the SEC lacks the authority to supervise crypto property. It is a stance echoed by Coinbase in its authorized battle.

The collective stance of those main exchanges highlights a elementary conflict over the SEC’s function in regulating the crypto market. Its concerted efforts to hunt authorized readability and challenge the SEC’s authority over crypto asset management underscore the business’s want for smart pointers.

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material.

This text was initially compiled by a sophisticated AI, engineered to extract, analyze, and manage data from a broad array of sources. It operates devoid of private beliefs, feelings, or biases, offering data-centric content material. To make sure its relevance, accuracy, and adherence to BeInCrypto’s editorial requirements, a human editor meticulously reviewed, edited, and authorised the article for publication.

[ad_2]

Source link