[ad_1]

The cryptocurrency market ended the week flat after the newest jobs report additional deflated hopes of an rate of interest minimize by the Federal Reserve within the first quarter of 2024, main some to restrict their quantity of danger till a clearer financial image emerges.

Inventory merchants brushed the report apart, nevertheless, as robust earnings stories from tech giants Amazon (AMZN) and Meta (META) on Thursday helped bolster the most important indices and diminished Wednesday’s Powell-inspired pullback to nothing however a footnote in an total constructive week.

On the closing bell, the S&P, Dow, and Nasdaq all completed within the inexperienced after reaching new all-time highs on Friday, up 1.07%, 0.35%, and 1.74%, respectively.

Knowledge supplied by TradingView exhibits that the roles report led to a spike in volatility for Bitcoin (BTC), with its worth whipsawing to a low of $42,530 after which spiking to $43,700, earlier than in the end returning to help close to $43,000. On the time of writing, BTC trades at $43,005, a lower of 0.14% on the 24-hour chart.

BTC/USD Chart by TradingView

Analysts at Coinbase see a possible finish to the sideways buying and selling for Bitcoin on the horizon as “Many technical components pressuring Bitcoin particularly (and crypto extra broadly) are beginning to be exhausted,” they stated in a report launched Thursday.

“That is evidenced by the liquidations at FTX (disposing of their Grayscale Bitcoin Belief or GBTC shares, for instance) in addition to the emergence of some giant defunct entities from chapter,” they stated. “Certainly, web inflows into US spot bitcoin ETFs have averaged greater than US$200M day by day during the last week (taking the overall web inflows to $1.46B since January 11) with a wholesome day by day quantity of ~$1.35B. Consequently, we count on macro components to turn into extra related for the digital asset class within the weeks forward, which may very well be supportive for efficiency.”

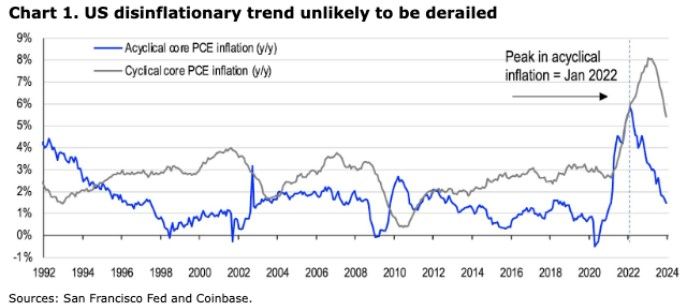

Citing feedback from the Federal Reserve that “the dangers to attaining [the board’s] employment and inflation objectives are transferring into higher steadiness,” Coinbase stated this “suggests the easing cycle will more than likely begin on Could 1, whereas an finish to the Fed’s steadiness sheet discount plans might begin in June (although there’s an opportunity it might start across the similar time as charge cuts).”

“We don’t consider the disinflationary pattern might be derailed and count on the Fed to chop charges by 100bps this 12 months, in comparison with the 75bps implied within the dot plot or the just about 150bps priced into Fed funds futures,” they stated. “That might even be in line with the usually anodyne stances pursued by policymakers throughout election years.”

“Finally, this could coincide with idiosyncratic drivers just like the Bitcoin halving in late April and will doubtlessly prop up each Bitcoin and different tokens in 2Q24,” they stated. “Furthermore, we count on the consequences of extra promoting from ETF issuers and the inclusion of spot Bitcoin ETFs in asset managers’ mannequin portfolios to unlock elevated liquidity on this area.”

MN Buying and selling founder Michaël van de Poppe stated he continues to carry the view that Bitcoin will commerce sideways till the halving in April – to the advantage of altcoins – earlier than heading larger within the second half of the 12 months.

My imaginative and prescient of #Bitcoin stays the identical.

I believe we’ll consolidate, and in that interval, we’ll see altcoins choosing up momentum.

At this level, #Chainlink is displaying some spectacular upward momentum already. pic.twitter.com/5Z5A9EQbtl

— Michaël van de Poppe (@CryptoMichNL) February 2, 2024

Combined finish to the week for the altcoin market

Altcoins completed the week combined, with a majority of tokens within the high 200 recording positive aspects on Friday.

Day by day cryptocurrency market efficiency. Supply: Coin360

API3 led the sphere with a rise of 27.8%, whereas Flare (FLR) climbed 12.7%, and Pendle (PENDLE) gained 12.3%. Sui (SUI) noticed the most important decline, falling 5.9%, adopted by a 5.6% loss for ApeCoin (APE), and a lower of 4.9% for Gate Token (GT).

The general cryptocurrency market cap now stands at $1.65 trillion, and Bitcoin’s dominance charge is 51.2%.

Disclaimer: The views expressed on this article are these of the writer and should not mirror these of Kitco Metals Inc. The writer has made each effort to make sure accuracy of data supplied; nevertheless, neither Kitco Metals Inc. nor the writer can assure such accuracy. This text is strictly for informational functions solely. It isn’t a solicitation to make any alternate in commodities, securities or different monetary devices. Kitco Metals Inc. and the writer of this text don’t settle for culpability for losses and/ or damages arising from the usage of this publication.

[ad_2]

Source link