[ad_1]

It was one other day of declines within the crypto market as Bitcoin (BTC) continues to bleed within the midst of huge gross sales by Grayscale, which is promoting on behalf of traders who need to money of their GBTC to take earnings or rotate into ETFs with decrease charges.

“We expect the catalyst in Bitcoin ETFs that has pushed the ecosystem out of its winter will disappoint market individuals,” said JPMorgan analysts led by Kenneth Worthington in a be aware on Monday that defined why they downgraded Coinbase International (COIN) to underweight from impartial.

“We see higher potential for cryptocurrency ETF enthusiasm to additional deflate, driving with it decrease token costs, decrease buying and selling quantity, and decrease ancillary income alternatives for corporations like Coinbase,” Worthington added, giving COIN a value goal of $80, which represents a 38% drop from Monday’s shut.

Shares traded combined on Tuesday as a slew of earnings stories confirmed some sectors of the economic system firing on all cylinders whereas others are struggling. The S&P bounced again from early strain to achieve 0.29% and closed slightly below the all-time excessive set on Monday, whereas a late afternoon rally pushed the Nasdaq to a brand new document excessive and a achieve of 0.43% on the day. The Dow traded underwater from the market open and closed down 0.25%.

Knowledge supplied by TradingView exhibits that Bitcoin bulls have been rejected of their early try and reclaim help at $40,000, which led to a pullback to a day by day low of $38,500. On the time of writing, BTC trades at $39,160, a lower of two.45% on the 24-hour chart.

BTC/USD Chart by TradingView

In line with cycles dealer Bob Lukas, the weekly cycle has topped, and crypto merchants can count on sideways or declining value motion for the foreseeable future.

BTC/USD 1-week chart. Supply: X

“Mid-February greatest case for lows IMO if it’s a value rout,” he mentioned. “March is greatest cycle timing for low. Good to see some concern construct up over time.”

Whereas some are bemoaning the worth decline for Bitcoin, others acknowledge that the worth motion had gotten frothy with the launch of the spot BTC ETFs, and a pullback was due.

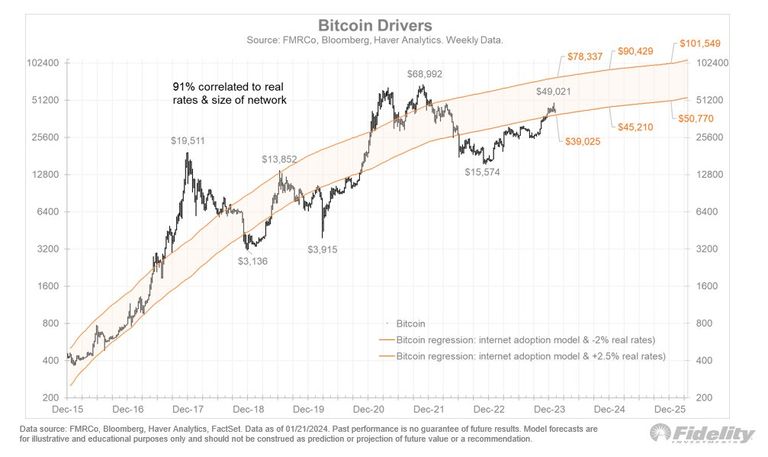

“Bitcoin’s value has traveled again into what I think about its truthful worth band,” tweeted Jurrien Timmer, director of International Macro at Constancy Investments.

Bitcoin drivers. Supply: X

“The slope of the curve is predicated on the web adoption curve just a few many years in the past, and the width is predicated on an actual price band of -2% (prime) and +2.5% (backside),” he mentioned.

An extended-term outlook was supplied by market analyst Rekt Capital, who mentioned that Bitcoin will finally surpass $46,000 with ease, however it’s unlikely to take action till after the halving in late April.

Every Candle 4 breaks its 4 12 months Cycle resistance (black)

Thus, Bitcoin will comfortably break $46000 resistance this yr however probably solely after the Halving$BTC #Crypto #Bitcoin pic.twitter.com/QWEgqoIZTM

— Rekt Capital (@rektcapital) January 23, 2024

And crypto dealer Bloodgood said he “will begin deploying money again to Bitcoin with [the] largest bid at 36500,” whereas the “Remainder of the money will go to altcoins when [the] market bounces with pressure.”

Altcoins deep within the pink

Altcoins continued to get hammered decrease as solely 9 tokens within the prime 200 recorded positive aspects on Tuesday.

Every day cryptocurrency market efficiency. Supply: Coin360

Huobi Token (HT) had the perfect efficiency, gaining 11.45% to commerce at $2.05, whereas Chiliz (CHZ) climbed 3.38%, and Aptos (APT) gained 3.1%. ORDI (ORDI) led the losers, declining 17.65%, whereas SATS (1000SATS) fell 16.1%, and Decentralized Social (DESO) misplaced 15.4%.

The general cryptocurrency market cap now stands at $1.52 trillion, and Bitcoin’s dominance price is 50.4%.

Disclaimer: The views expressed on this article are these of the creator and will not replicate these of Kitco Metals Inc. The creator has made each effort to make sure accuracy of knowledge supplied; nonetheless, neither Kitco Metals Inc. nor the creator can assure such accuracy. This text is strictly for informational functions solely. It’s not a solicitation to make any change in commodities, securities or different monetary devices. Kitco Metals Inc. and the creator of this text don’t settle for culpability for losses and/ or damages arising from the usage of this publication.

[ad_2]

Source link