[ad_1]

Ripple CEO Brad Garlinghouse is about to take part within the prestigious World Financial Discussion board (WEF) in Davos, scheduled from January fifteenth to nineteenth, 2024 this week. Notably, this yr marks a major shift in Ripple’s engagement on the WEF, transitioning from peripheral occasions to a direct involvement within the discussion board’s central discussions.

Garlinghouse will probably be a key participant within the “Clear-Eyed about Crypto” panel on January 18, from 17:30 to 18:15 CET. The WEF web site outlines the panel’s agenda as exploring the divergent world attitudes in direction of digital currencies, starting from their embrace as a cornerstone of innovation and inclusive finance to outright bans.

The panel aligns with the WEF’s Centre for Monetary and Financial Programs, which focuses on enhancing the monetary system by know-how, selling particular person monetary well-being, and supporting local weather motion by monetary transformation.

Becoming a member of Garlinghouse on the panel are esteemed figures corresponding to Paul Mo-po Chan, Monetary Secretary of the Hong Kong Particular Administrative Area, Michael Sonnenshein, CEO of Grayscale Investments, Daniela Stoffel, State Secretary for Worldwide Finance of Switzerland, and Brendan Vaughan, Editor-in-Chief of Quick Firm.

Ripple Seeks To Interact With World Leaders

In an interview with Monetary Information, Ripple President Monica Lengthy elaborated on the importance of Ripple’s presence on the WEF. “It’s important for our business to be represented at Davos by mature gamers who may also help dispel the hype that usually distracts from the actual work being completed. Ripple’s attendance is a testomony to our dedication to participating with world leaders and shaping the dialog round the way forward for finance,” Lengthy acknowledged.

Ripple joins different outstanding crypto organizations corresponding to Circle, Coinbase, Stellar, and Hedera at this yr’s discussion board. Lengthy underscored the business’s evolution regardless of current challenges, noting, “Regardless of a bear market, institutional curiosity in blockchain and Web3 has accelerated previously yr — significantly amongst giant monetary establishments, banks, and asset managers, that are more and more recognizing the tangible use instances of the know-how, be it funds, tokenization, or custody.”

The WEF’s agenda displays the rising prominence of blockchain and digital property in world monetary discussions. A key subject this yr is ‘The Tokenisation Economic system’, which can discover blockchain’s position in enhancing monetary inclusion. The panel contains Circle CEO Jeremy Allaire and Stellar CEO Denelle Dixon, amongst others.

Crypto Trade Thrives Regardless of Powerful Challenges

Lengthy additionally addressed the business’s efforts to rebound from the setbacks of 2023, marked by the collapse of main entities like FTX, BlockFi, Celsius, and Three Arrows Capital. “This yr’s Davos gathering is going down amid a backdrop of a 150% annual surge in bitcoin and rising institutional curiosity from heavyweights corresponding to BlackRock and Constancy,” she famous, highlighting the sector’s resilience and evolving panorama.

Moreover, Lengthy emphasised the necessity for business engagement with regulatory our bodies to foster mainstream adoption. “For continued mainstream adoption, decentralized finance and conventional finance have to work collectively. The business should interact with governments to make sure that sound coverage and regulatory frameworks are established,” she suggested.

This name to motion is especially related given the regulatory progress within the US, together with the approval of 11 spot Bitcoin ETFs and developments in world crypto regulatory frameworks. Because the WEF convenes, the crypto business, represented by leaders like Garlinghouse and Lengthy, is about to make one other step into mainstream adoption.

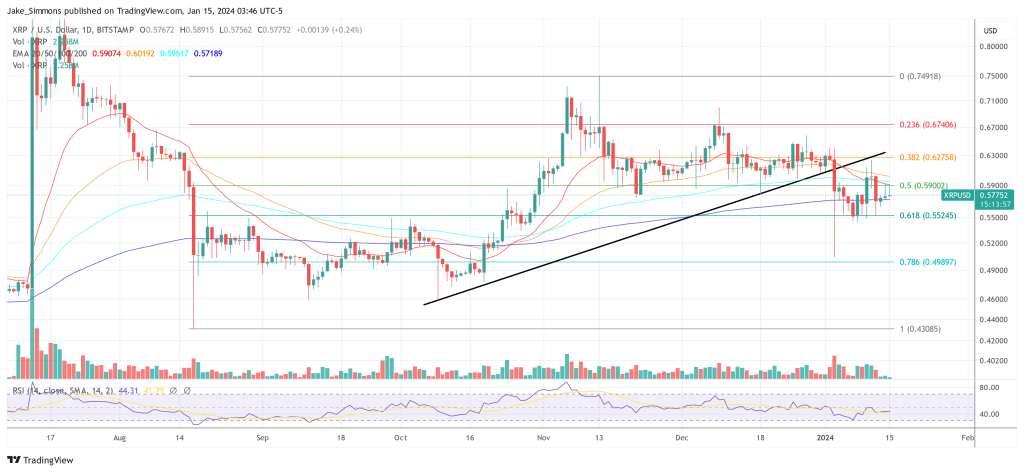

At press time, XRP traded at $0.57752.

Featured picture from Axios, chart from TradingView.com

[ad_2]

Source link