[ad_1]

With at this time’s launch of the Private Consumption Expenditure (PCE) worth index by the Bureau of Financial Evaluation, the Bitcoin market simply skilled a very powerful macro occasion of the week. Forward of the Federal Open Market Committee (FOMC) of the US Federal Reserve (Fed) on Might 2-3, all eyes had been on the PCE at this time.

The latter is named the Fed’s favourite inflation gauge. (versus CPI). It measures costs paid by shoppers for home purchases of products and companies and excludes meals and power.

The baseline was as follows: February’s core PCE index was +0.3% on a month-to-month foundation, under the forecast of +0.4%. For March, analysts anticipated a rise of +0.3%. On an annualized (YoY) foundation, a rise of 4.5% was anticipated, a slight drop from the earlier month’s 4.6%.

Hitting expectations or any “optimistic” surprises had been anticipated to be bullish for the Bitcoin market. Famend analyst Ted (@tedtalksmacro) stated up entrance: “Bulls need to proceed seeing it pattern south!” and added the probabilities for a bullish shock had been good: “CPI + PPI prints earlier within the month, not less than for now, means that the trail of least resistance is for decrease inflation numbers.”

PCE Barely Impacts Bitcoin Value

These expectations weren’t met. As reported by the Bureau of Financial Evaluation, core PCE got here in at 0.3% on a month-to-month foundation, as anticipated. On an annual foundation, core PCE fell to 4.6%, additionally delivering the anticipated quantity.

BREAKING: US PCE information is out!

Headline y/y 4.2% vs 4.1% expectation

Headline m/m 0.1% vs 0.1% expectation

Core y/y 4.6% vs 4.58% expectation

Core m/m 0.3% vs 0.3% expectation

— Markets & Mayhem (@Mayhem4Markets) April 28, 2023

Bitcoin worth reacted consistent with expectations. On the time of writing, BTC was sticking to the worth stage round $29,300.

The large query, nonetheless, might be whether or not progress in preventing inflation is sufficient for Fed Chairman Jerome Powell. In a telephone prank with a pretend Ukraine President Volodymyr Zelenskyy yesterday, Powell acknowledged that there are not less than two extra price hikes coming, adopted by an extended interval of excessive rates of interest with vital destructive results on the US financial system and the US labor market.

Powell additionally said {that a} recession in the US is probably going. “That is what it takes to get inflation down. By cooling off the financial system and cooling off the labor market inflation comes down. We don’t know of any painless method for inflation to come back down.”

In a prank name with a pretend Zelenskyy Jerome Powell, Chairman of the Federal Reserve, admits not less than 2 extra upcoming rate of interest hikes adopted by an extended interval of excessive charges with vital destructive results on the US financial system and the US labor market. https://t.co/vDb19Ed5ux

— Kim Dotcom (@KimDotcom) April 27, 2023

What Will The Fed Make Of The Knowledge?

After the newest macro information, Fed Funds Futures merchants count on a chance of greater than 80% for a 25 foundation factors (bps) price hike subsequent Wednesday. The chance in accordance with the CME FedWatch Device was at 88% earlier than the discharge of the PCE and remained at this stage afterwards.

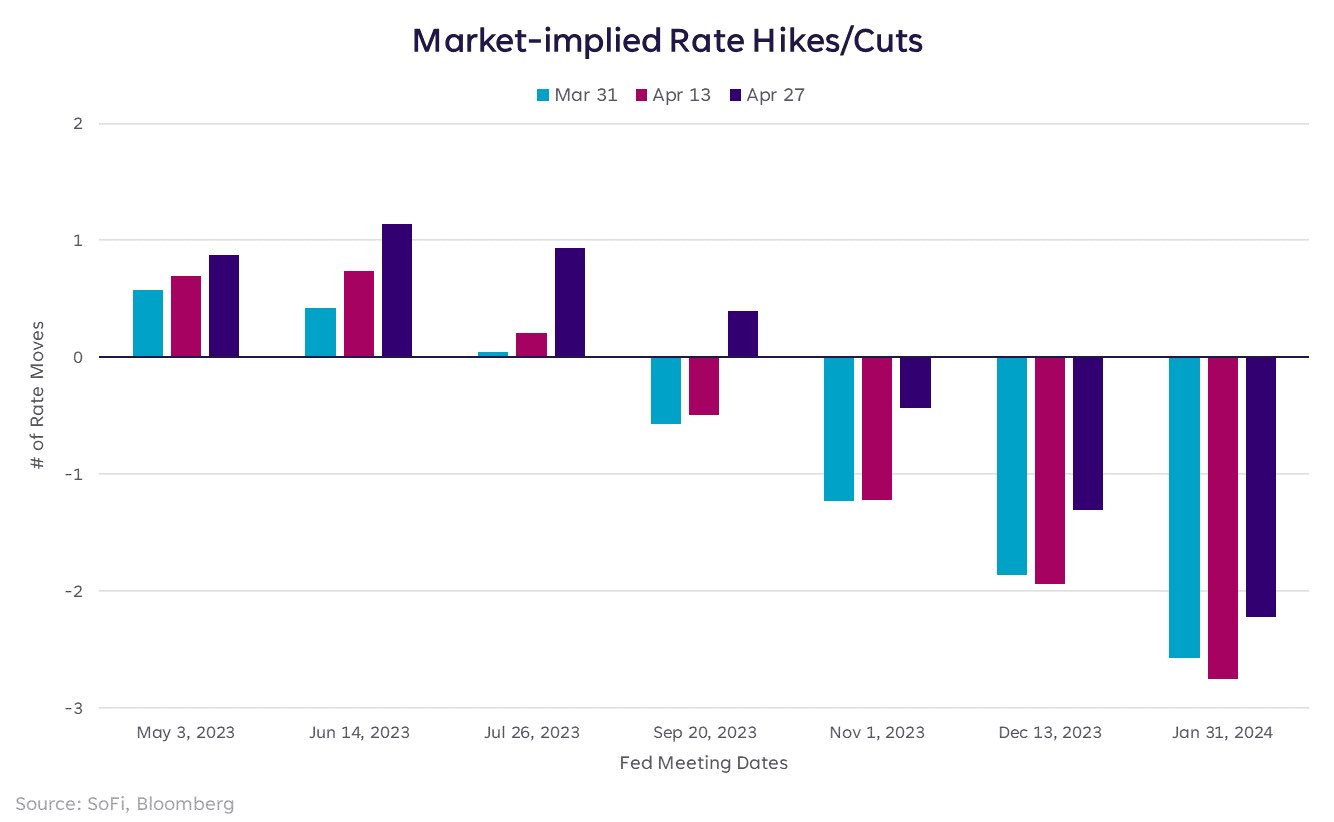

Nonetheless, the market is looking Powell’s bluff. Liz Younger, head of funding technique at SoFi shared the chart under and stated previous to the PCE launch:

Market pricing implies 88% odds of a price hike subsequent week, up from earlier within the month. Some merchants are beginning to wager on a hike in June as nicely, however that’s much less sure. Both method, markets nonetheless suppose we’re going to get a number of cuts later in 2023 & early 2024.

Right now’s launch is just not anticipated to vary this. Alternatively, a second wave of financial institution failures is presently brewing within the US. Greater rates of interest are more likely to push extra regional banks to their restrict. Bitcoin might as soon as once more be the beneficiary, because the Fed can’t hike as excessive as they’d need to.

At press time, the Bitcoin worth stood at $29,314.

Featured picture from iStock, chart from TradingView.com

[ad_2]

Source link