[ad_1]

Cryptocurrency agency Ripple Labs, famend for the XRP token, is about to repurchase $285 million price of firm shares from early buyers and workers, in response to two undisclosed sources acquainted with the matter, as reported by Reuters.

The tender provide, which values Ripple at $11.3 billion, permits buyers to promote as much as 6% of their stake within the privately-held firm. Moreover, Ripple has confirmed the tender provide and said its intention to allocate $500 million for the buyback, masking the bills associated to changing restricted inventory models into shares and addressing tax obligations.

Brad Garlinghouse, Ripple’s CEO, expressed the corporate’s plan to conduct common share buybacks to boost liquidity for buyers. He additionally clarified that Ripple at present has no quick intentions of going public in the US, citing regulatory uncertainties.

Garlinghouse revealed that Ripple holds over $1 billion in money and possesses a crypto portfolio exceeding $25 billion, predominantly consisting of XRP tokens.

This transfer follows Ripple’s current authorized victory in opposition to the US Securities and Trade Fee (SEC), the place a US District Choose additionally decided that XRP gross sales on public exchanges didn’t represent unregistered securities choices.

Established in 2012, Ripple focuses on creating a fee system that facilitates cross-border transactions and advocates for using XRP. In Could of the final yr, Ripple acquired Swiss crypto custody agency Metaco for $250 million.

Regardless of navigating challenges through the SEC lawsuit, Garlinghouse emphasised the corporate’s development, with 95% of its prospects being non-US monetary establishments. The precise measurement of Ripple’s fee enterprise stays undisclosed.

XRP Value Motion

Ripple’s native cryptocurrency, XRP, has skilled a current downward pattern, at present buying and selling at $0.57 with a market cap of $31.06 billion, reflecting a 3% enhance at press time.

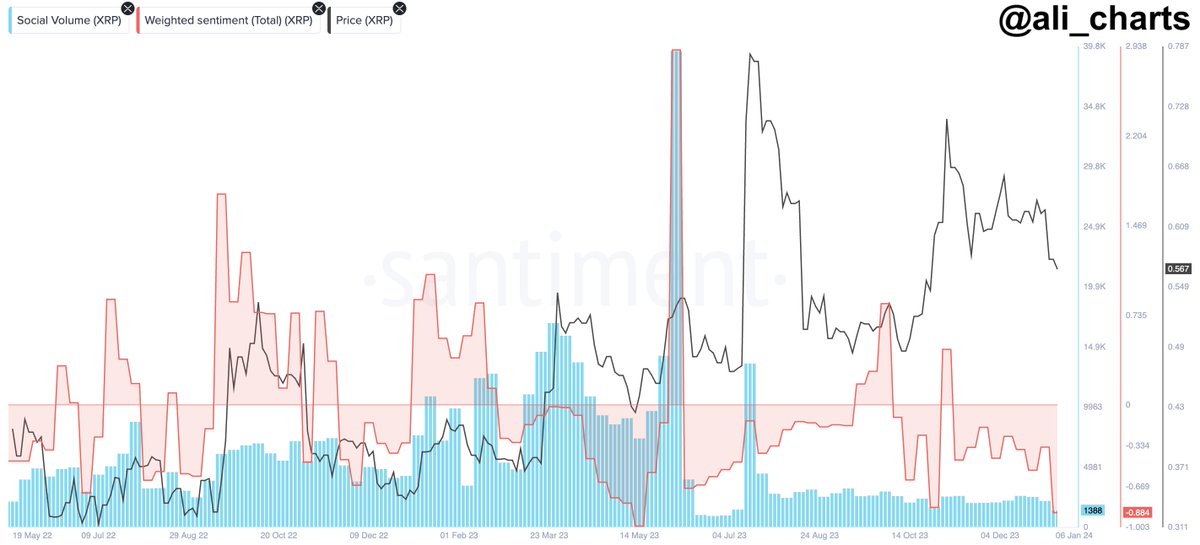

In a current replace, crypto analyst Ali Martinez drew consideration to the weighted market sentiment of XRP, noting that it has reached its lowest destructive level since mid-Could 2023.

For contrarian XRP buyers who observe a technique of going in opposition to prevailing sentiment, Martinez means that this improvement may current an intriguing alternative. Nonetheless, buyers are suggested to contemplate a number of elements and conduct thorough analyses earlier than making any monetary choices primarily based on sentiment indicators.

In line with Ali Martinez, the prevailing sample influencing XRP’s worth actions since June 2022 seems to be an ascending parallel channel.

If this pattern continues, there’s a potential for XRP to maneuver in direction of the center or higher boundaries of the channel, at present positioned at $0.80 and $1.10, respectively.

[ad_2]

Source link