[ad_1]

Newest information on ETFs

Go to our ETF Hub to search out out extra and to discover our in-depth knowledge and comparability instruments

Suppliers of crypto alternate traded funds are struggling to ascertain their merchandise as viable investments, in keeping with regulatory consultants, as a crackdown on digital belongings continues.

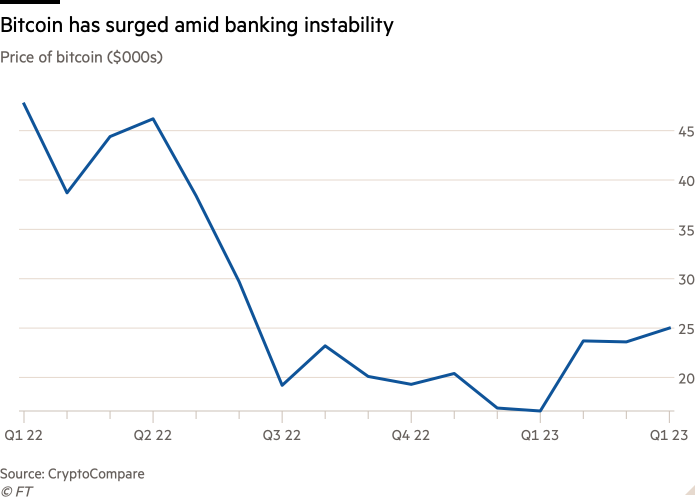

Crypto markets endured a yr of acute turbulence in 2022 when the worth of standard digital belongings, equivalent to bitcoin and ethereum, plummeted from file highs. These sudden falls plunged a number of once-prominent corporations — together with lending platform Celsius Community and crypto hedge fund Three Arrows Capital — out of business.

An industry-wide disaster of confidence culminated in November, when crypto alternate FTX — which, at its top, represented a pillar of the {industry} — collapsed in a matter of days after a surge in buyer withdrawals. The alternate’s failure sparked a renewed sense of urgency amongst monetary regulators to crack down on crypto markets — a development that, in flip, poses a problem to the world of crypto ETFs.

Crypto ETFs intention to provide retail traders publicity to adjustments in digital asset values, with out the necessity to purchase or maintain them immediately. Nonetheless, regulators more and more fear that these traders want safety from risky costs and safety scares.

“We’re within the midst of a regulatory onslaught in opposition to crypto,” says John Reed Stark, former chief of the Securities and Trade Fee’s Workplace of Web Enforcement. “Day by day, it looks as if there’s a brand new lawsuit focusing on the {industry}. The SEC just isn’t going to face idly by, particularly when traders are in danger. Buyers might not like the principles however, identical to seatbelt legal guidelines, generally traders want safety from themselves.”

Because the chief monetary markets watchdog within the US, the SEC has issued a blitz of enforcement actions in opposition to distinguished crypto firms, together with lender Genesis and exchanges Gemini and Kraken. The fee can also be at loggerheads with asset supervisor Grayscale, which is looking for approval from the regulator to show its bitcoin belief right into a spot ETF holding the cryptocurrency immediately.

The SEC has been prepared to approve crypto futures ETFs — funds that monitor futures contracts, that are based mostly on crypto costs however traded on regulated futures exchanges. Nevertheless, it has repeatedly stopped in need of granting approval to ETFs proposing to carry cryptocurrencies themselves, arguing that they commerce on largely unregulated platforms the place market manipulation presents a persistent danger.

“I doubt the fee goes to vary its pondering, provided that they’re suing a brand new crypto firm each week,” argues Stephen Diehl, software program engineer and critic of the crypto {industry}. “The problem is on the {industry} to show that crypto is a secure funding for People’ retirement accounts — and that’s a really excessive bar.”

However Grayscale has lengthy argued there must be no distinction between spot and futures crypto ETFs, as a result of futures ETFs in impact expose traders to the identical crypto market {that a} spot crypto ETF would. The asset administration agency sued the SEC after having its request to transform its bitcoin belief into an ETF rejected. Grayscale claimed that the regulator’s choice was “arbitrary, capricious, and discriminatory”.

“The place this lawsuit lands will seemingly outline the panorama of cryptocurrency ETFs for years to come back,” suggests Bryan Armour, director of passive methods analysis at funding insights firm Morningstar.

Regardless of the tumultuous yr for crypto belongings, ETFs giving publicity to them thrived for many of 2022. Buyers poured more than $240mn into six US bitcoin futures ETFs throughout the first 11 months of 2022, with greater than 80 per cent of these inflows from June onwards — exactly when crypto was thrust into an unprecedented disaster of confidence.

That development has continued into this yr. By the top of January, a number of crypto ETFs posted eye-popping performances, together with the Valkyrie Bitcoin Miners ETF, which registered a 101 per cent return for the month.

Later, in March, a number of crypto ETFs posted one-week returns of roughly 30 per cent, together with the ProShares Bitcoin Technique ETF, which delivered 36 per cent, according to data firm VettaFi.

Asset supervisor ProShares launched the Bitcoin Technique ETF to nice fanfare in late 2021 — when it amassed greater than $1bn in its first week of buying and selling. Its efficiency has, nevertheless, nosedived amid crypto’s market crunch.

In 2023, although, crypto ETFs have been buoyed by a restoration in costs. Bitcoin — the world’s flagship cryptocurrency — has risen above $28,000, a roughly 70 per cent enhance from its $16,500 mark firstly of the yr.

However, despite this rebound, direct crypto buying and selling has been affected by fears surrounding the safety of buyer funds — lending credence to the notion that new crypto traders postpone by the dangers are pivoting to ETFs as a safer entry level to digital belongings.

These fears have been heightened by the collapse of FTX and have been perpetuated by a number of safety points within the decentralised finance area, together with final month’s $197mn hack of decentralised finance protocol Euler Finance.

In response to Ilan Solot, co-head of digital belongings at Marex, a London-based monetary companies agency, ETFs retain their attract for these traders curious about cryptocurrencies however new to the asset class. “In the event you’re new to crypto, managing your individual non-public key [to hold currencies directly] could also be riskier than having an ETF in your buying and selling account.”

“If somebody needs publicity to bitcoin, utilizing an ETF provides them a much less environment friendly product however they’re paying for the comfort of not having to carry their very own crypto,” notes Solot.

[ad_2]

Source link