[ad_1]

Uncover the top-rated defi tokens with excessive liquidity and promising communities.

Disclosure: This text doesn’t characterize funding recommendation. The content material and supplies featured on this web page are for instructional functions solely.

The decentralized finance (defi) ecosystem is without doubt one of the fastest-growing markets with the promise of permitting traders extra management over their property without having third-party actors.

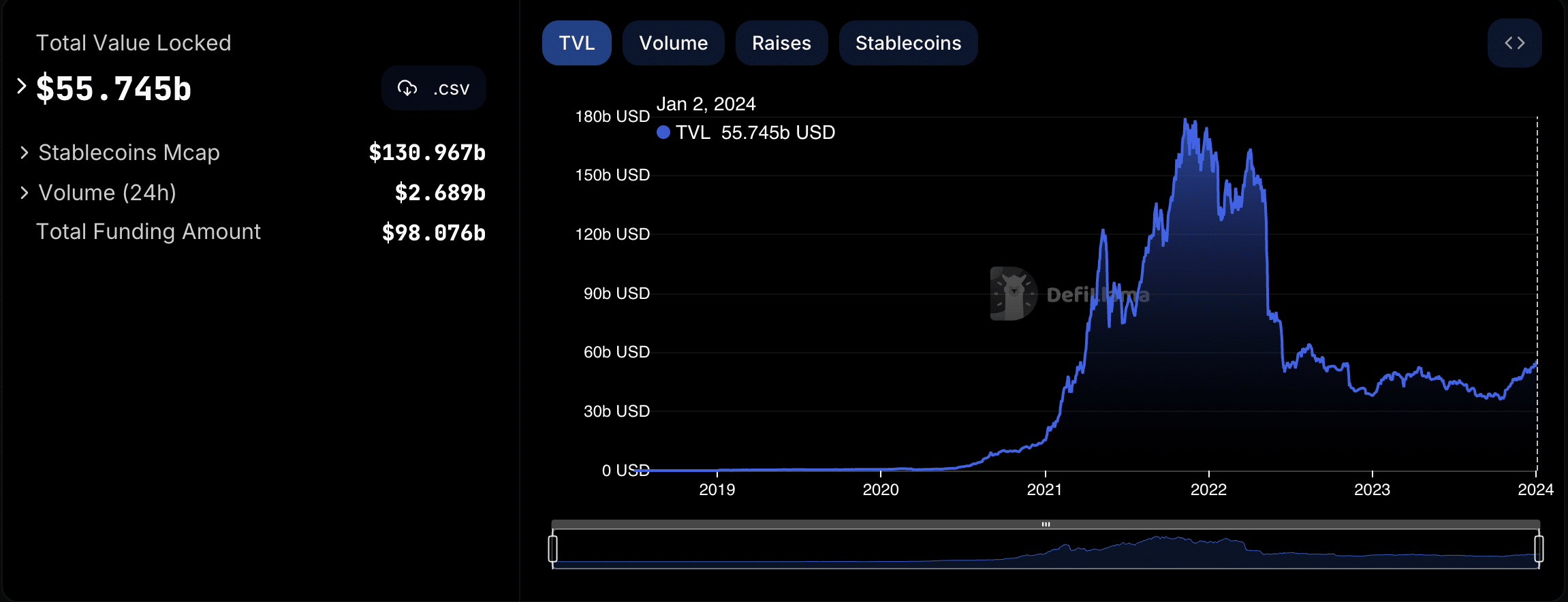

The defi complete worth locked (TVL) rallied to a whopping $179 billion in November 2021. Nonetheless, in accordance with DefiLlama, with the collapse of high-profile crypto corporations in 2022, it dropped to a neighborhood low of $35 billion in October 2023.

The latest market-wide rally has helped defi tasks achieve momentum once more. Per DefiLlama, the entire defi TVL has been continually rising since mid-October 2023, reaching $52 billion.

This information explores the perfect performing defi crypto assets with excessive liquidity and nice communities. Earlier than deciding which cash are the perfect defi tokens to purchase, conduct your personal analysis and contemplate the dangers.

Ethereum: the godfather

Whereas many imagine that the defi ecosystem was born with the creation of Bitcoin (BTC) in 2009, the Ethereum (ETH) blockchain offered a stable infrastructure for defi to be constructed on.

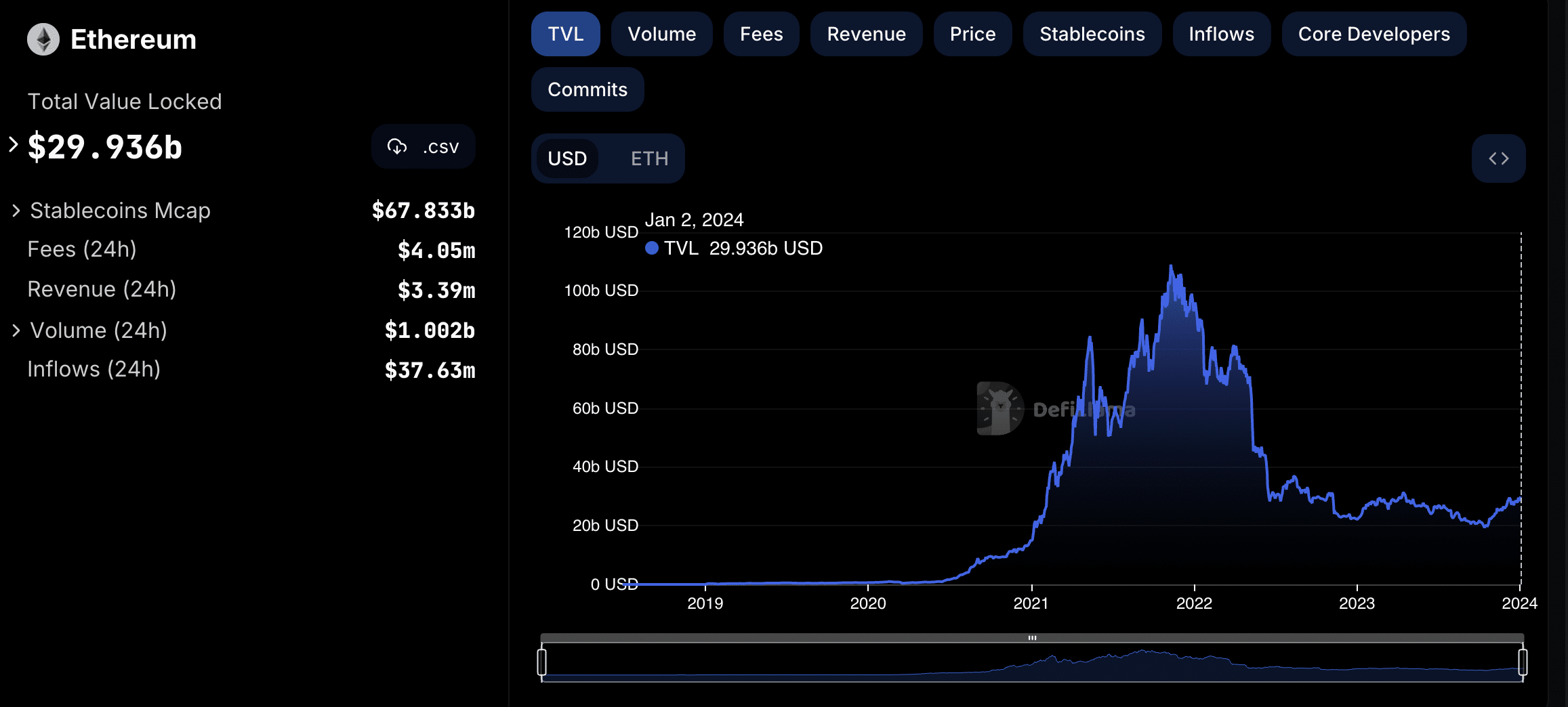

In line with knowledge offered by DefiLlama, Ethereum at present has a greater than 50% share of the defi TVL, now standing at greater than $29 billion. It’s vital to notice that layer-2 networks constructed on the Ethereum blockchain have been excluded from the TVL.

Whereas Ethereum will not be a defi protocol itself, it nonetheless will get the highest spot on this record as a result of its base infrastructure has helped many defi platforms and decentralized functions (dapps) run easily and attain hundreds of thousands of customers.

Furthermore, the event of Ethereum made it potential for builders to execute defi apps through its good contracts.

Liquid staking protocols

Lido Finance: revolutionizing liquid staking

Lido Finance is a trailblazer within the staking class, rising as the primary mainstream liquid staking protocol in December 2020. Lido permits customers to stake Ethereum and supported property whereas sustaining liquidity.

In line with the venture, this flexibility permits customers to earn staking rewards with out locking up their property – a function that may be helpful in periods of market volatility. Lido’s spectacular TVL of over $22.5 billion makes it the biggest defi protocol within the web3 scene.

Holders of Lido’s native token, LDO, can take part in governance decisions and profit from the platform’s general progress. With the rising prominence of liquid staking and Lido’s method, LDO has the potential to change into a useful asset.

Rocket Pool: decentralized staking

Rocket Pool goals to simplify the staking course of for Ethereum, adopting a decentralized method. By means of useful resource pooling, Rocket Pool permits people to stake with as little as 0.01 ETH, making staking accessible to a broader viewers.

The protocol’s dedication to decentralization and group possession, aligned with Ethereum’s rules, is clear in its TVL milestones. The defi protocol at present boasts a TVL of $2.9 billion, a notable enhance from the $604 million determine in December 2022.

Rocket Pool’s native token, RPL, lately garnered consideration following Coinbase’s investment within the token in August 2023. RPL holders have a stake within the protocol’s governance selections. Because the protocol good points reputation and belief, the RPL token might probably witness elevated demand.

Decentralized exchanges (DEX)

Uniswap: reworking token swaps

Uniswap is an automatic market maker (AMM) that goals to democratize liquidity provision, enabling anybody to change into a liquidity supplier and earn buying and selling charges.

With a TVL of over $3.8 billion, Uniswap is a essential infrastructure piece within the defi ecosystem, facilitating seamless token swaps with minimal slippage and charges. Ruled by the UNI token holders, the protocol ensures “lively stewardship” for token holders.

Attributable to its position as a governance token, holders of UNI actively participate in making selections and shaping the way forward for the fast-growing DEX.

Balancer: empowering customizable liquidity swimming pools

Balancer, a multi-token automated market maker, empowers customers to create or add liquidity to customizable swimming pools, incomes buying and selling charges. Identified for its flexibility, Balancer permits liquidity suppliers to create swimming pools with as much as eight tokens, setting customized weights.

Balancer’s TVL has surged to over $993 million, inserting it among the many high 20 defi protocols by complete worth locked. Consequently, the decentralized protocol now performs a major position within the defi ecosystem.

Balancer’s native token, BAL, is central to the protocol’s governance and liquidity incentives, facilitating essential decision-making like different protocols. The pliability of liquidity provision and governance participation positions BAL as a token to observe in 2024.

GMX: spot and perpetual DEX

GMX has swiftly gained recognition as a decentralized spot and perpetual alternate on the Arbitrum community. Providing low swap charges and nil value impression trades, GMX’s TVL of greater than $600 million reveals its speedy progress and rising curiosity from the defi group.

The GMX token has already demonstrated its potential for large value surges this yr amid a rally to an all-time excessive (ATH) of $97 in April. Regardless of being 45% down from this worth, the token reveals promise, owing to the growth of the GMX protocol.

Curve Finance: effectivity in stablecoin buying and selling

Curve Finance facilitates stablecoin buying and selling within the defi house. As a DEX centered on stablecoins, Curve makes use of an AMM to reduce slippage and facilitate seamless buying and selling between secure property. The platform guarantees supplementary payment earnings for liquidity provision.

Curve Finance cuts throughout a number of chains — together with Ethereum, Arbitrum, Polygon, and Avalanche. The protocol has maintained its affect within the defi market regardless of the $47 million reentrancy exploit in July 2023.

Lending protocols

AAVE: pioneering defi lending

AAVE operates as a decentralized cash market protocol, permitting customers to lend, borrow, and earn curiosity on cryptocurrencies.

Integrating options like flash loans and collateral swaps has attracted traders to AAVE. It has solidified its place as one of many largest defi lending platforms.

The protocol’s growth to a number of chains, together with Polygon and Avalanche, displays its dedication to offering sooner and more cost effective options. The AAVE token emerges as a catalyst for developments, with a formidable 55% over the previous yr.

Compound Finance: accessible lending and borrowing

Compound Finance differentiates itself with choices comparable to cToken for a number of asset assist, absence of credit score checks, and dynamic rates of interest. Customers can provide property to the protocol’s liquidity pool and earn curiosity or borrow towards their equipped collateral.

Compound has recorded one of many largest surges in TVL, because the protocol breaks into the highest 10 within the defi sector. The COMP token, representing a stake in governance, aligns the pursuits of all contributors, contributing to a really decentralized monetary system.

Governance protocols

MakerDAO: the spine of DAI stablecoin

MakerDAO, one of many largest protocols within the defi scene, operates because the spine of the DAI stablecoin. Pegged to the US greenback and backed by surplus collateral, DAI goals to supply a secure and dependable type of cryptocurrency.

MakerDAO’s system permits customers to open Collateralized Debt Positions (CDPs), lock in collateral, and generate DAI.

The governance mannequin involving MKR token holders goals to make sure decentralization. In 2024, MKR stands out as one of many high defi tokens to observe, given its position within the MakerDAO ecosystem by performing as a mechanism to take care of DAI’s stability, as it’s obligatory for charges accrued Collateralized Debt Positions after DAI minting.

What’s a defi coin?

A coin is often related to cryptocurrency. Defi cash or tokens permit you to make the most of decentralized apps and platforms. These embrace decentralized exchanges, lending platforms, staking protocols, real-world property, yield platforms, and dapps.

Is defi funding?

Each funding has its personal set of dangers. The defi cash talked about above have excessive potential, nice liquidity, and promising utilities. Nonetheless, doing intensive analysis and taking warning earlier than investing in defi cash is at all times obligatory.

The place to purchase defi cryptocurrencies?

You should purchase defi cryptos on totally different centralized and decentralized exchanges. A number of the main centralized crypto exchanges that permit you to spend money on defi cash are Binance, Coinbase, KuCoin, Kraken, OKX, and Bybit.

How does defi’s future look?

Consultants believe that the longer term for defi is shiny as totally different nations try to make the most of its potential. The worldwide defi market measurement is predicted to reach $232 billion by 2030. Nonetheless, it’s essential to do not forget that the crypto market is extremely unstable. Contemplate studying the right way to spend money on defi correctly, because it includes dangers regardless of its potential progress.

[ad_2]

Source link