[ad_1]

Yoo Bok-hyun, the pinnacle of South Korea’s Monetary Supervisory Companies (FSS) is ready to go to the US Securities and Trade Fee (SEC) to interact in discussions about cryptocurrency with SEC Chair Gary Gensler.

The first motive for this go to is reportedly to share insights into the crypto market and deliberate on the strategic route of regulatory insurance policies.

South Korea Continues Analysis into Crypto Rules

In accordance with a current report, the overarching theme of the journey is discussions on the administration and supervision of the digital asset market.

As South Korea continues with its efforts to control cryptocurrency, Yoo acknowledges the necessity to bolster the nation’s regulatory framework.

In the meantime, this comes amid BeInCrypto not too long ago reporting that South Korea FSS is preparing to implement robust regulations for crypto in July 2024.

Nevertheless, the specifics of regulatory plans for the dynamic digital asset market stay a piece in progress.

Learn extra: How Does Regulation Impact Crypto Marketing? A Complete Guide

The go to to the SEC, will help You with growing effective methods of managing and supervising the crypto sector.

Earlier this yr, BeInCrypto highlighted South Korea’s strengthened regulations concerning crypto exchanges and their required reserve holdings.

Nevertheless, in accordance with native reviews, the brand new guidelines define at the very least 3 billion gained fund (roughly $2.26 million).

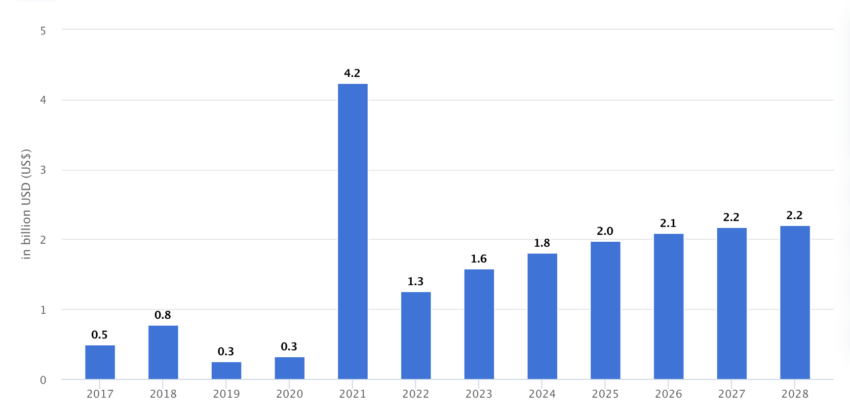

In the meantime, Statista information signifies that the crypto market’s income in South Korea is projected to achieve $2.2 billion by 2028.

Gensler Firmly Believes that every one Cryptocurrencies are Securities

This transfer comes on the heels of a current organizational overhaul by the Monetary Companies Fee, geared toward bolstering supervision, inspection, market monitoring, and institutional enhancements for digital asset operators.

Moreover, this situation has gained paramount significance in South Korea with the enforcement of the Digital Asset Act.

Nevertheless, it evaluates the securities nature of digital property primarily based on whether or not traders anticipate income from the efforts of others.

In the meantime, the report notes the SEC Chairman Gensler’s stance. It states his perception contemplating practically all digital property besides Bitcoin as securities, provides a layer of complexity to the regulatory discourse.

Learn extra: Crypto Regulation: What Are the Benefit and Drawbacks?

Disclaimer

In adherence to the Trust Project pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.

[ad_2]

Source link