[ad_1]

Blockchain-based non-public credit score is gaining traction in 2023 as corporations search financing in a high-interest-rate atmosphere.

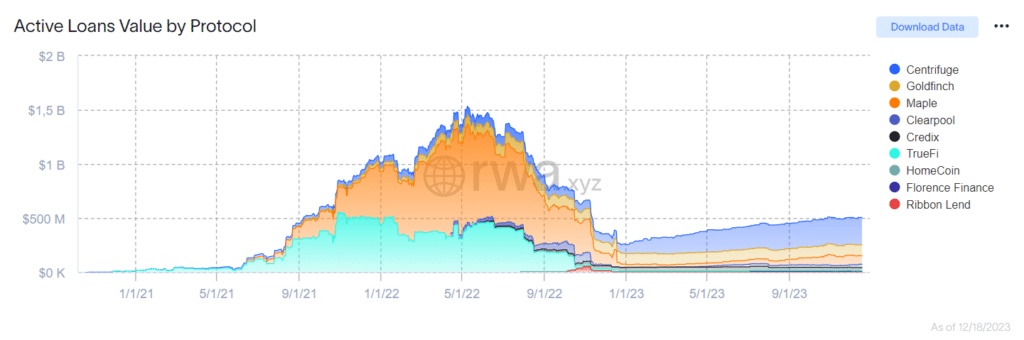

In accordance with data from RWA.xyz, blockchain-powered non-public loans have surged by 55%, reaching roughly $581.6 million as of Dec. 18. Whereas this determine is beneath the height of almost $1.5 billion in June 2022, it represents a noteworthy shift as the full loans worth surpassed the $4.5 billion mark.

As reported by Bloomberg, the standard private credit market stays dominant with a worth of $1.6 trillion, dwarfing the rising blockchain-based non-public credit score sector.

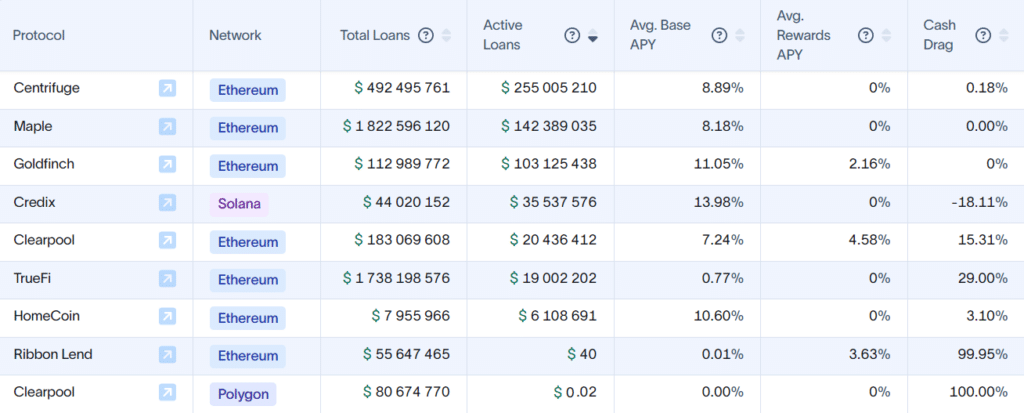

Amongst 9 RWA protocols, just one extends its companies past Ethereum to Solana, whereas one other operates on Ethereum’s sidechain, Polygon. At the moment, Centrifuge leads in energetic worth, boasting over $255 million in energetic loans and a complete mortgage worth exceeding $492 million, based on RWA.xyz information.

Blockchain lending, leveraging elevated transparency and good contracts, is acknowledged for lowering dangers and decreasing borrowing charges in comparison with the slower and extra opaque conventional non-public credit score market. This evolving panorama is engaging for traders, with blockchain protocols charging debtors lower than 10% APR, a big distinction to the 15% to twenty% charges prevalent in conventional finance.

Crypto giants are additionally getting into the blockchain-based non-public credit score area with new developments, reminiscent of Undertaking Diamond by Coinbase Asset Administration. As crypto.information earlier reported, the brand new product leverages Ethereum’s layer-2 scaling community, Base, and integrates Coinbase’s parts, together with the change’s Prime’s companies in addition to web3 crypto pockets, and Circle’s USDC stablecoin.

At the moment, Undertaking Diamond is accessible to registered institutional customers exterior the U.S. The launch happens amid intense competitors to combine conventional monetary property like bonds and credit score into blockchain methods. This course of, referred to as the tokenization of real-world property, is believed to reinforce settlement speeds, scale back operational prices, and improve transparency.

[ad_2]

Source link