[ad_1]

The Bitcoin (BTC) worth has been buying and selling in a variety between $27,000 and $28,000 since Friday final week, with $27,800 presently being crucial resistance degree to kick off a transfer to the upside. As lately as final Tuesday, BTC was buying and selling above $30,000 earlier than plunging greater than 10%.

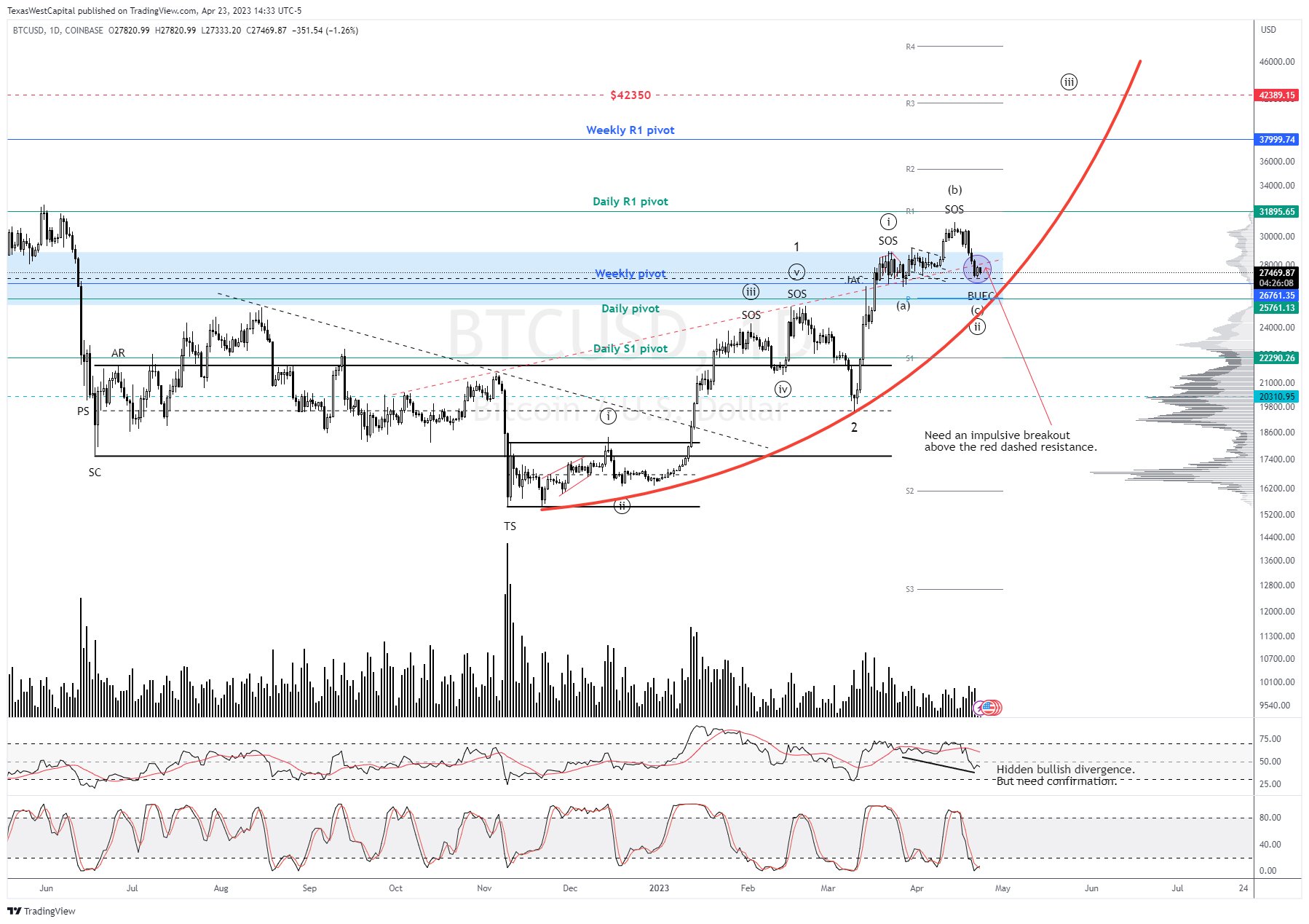

Nevertheless, Wyckoff and Elliott Wave analysts agree that the transfer just isn’t a trigger for concern. In keeping with dealer and market psychology coach Christopher Inks, a minimal goal of $42,350 is expected for Bitcoin as a part of its subsequent bounce.

Right here’s What Wyckoff Evaluation Says About The State Of Bitcoin

The Wyckoff technique was invented by Richard Wyckoff within the early Thirties and proposes to learn the market utilizing causal fundamentals that truly predict market actions. The buildup and distribution schemes are in all probability the most well-liked a part of Wyckoff’s work within the crypto and Bitcoin group.

The fashions break down the buildup and distribution phases into 5 phases (A via E), together with a number of Wyckoff occasions. Inks writes in his evaluation that Bitcoin is almost certainly in an accumulation in keeping with the Wyckoff technique.

“The Elliott Wave depend might or might not be right domestically. We wish to see an impulsive breakout above that ascending pink dashed resistance to sign that the wave ((ii)) flat construction could also be full, however a breakout above wave (b) is required so as to add confidence to that depend,” writes Inks, who shared the chart under.

If Inks’ depend is right, then one other breakout has the every day pivot as its goal. Because of this the wave ((iii)) of three from right here has a minimal goal of $42,350 per Bitcoin. In keeping with the analyst, this idea can also be supported by the truth that the RSI on the every day chart is presently displaying a hidden bullish divergence, with affirmation that it’s full nonetheless pending.

As well as, the Stoch RSI on the every day chart has moved again into the oversold space, so a breakout from the oversold space would additional help the belief that the wave ((ii)) is full, the analyst says and concludes:

We will additionally notice the pink parabola. Whereas worth stays above that curved line we must always proceed to anticipate larger, total, somewhat than a bigger pullback. Let’s see if we are able to get that rally from someplace round this space.

Todd Butterfield of the Wyckoff Inventory Market Institute agrees with Inks. In his newest evaluation, Butterfield writes that Bitcoin skilled a pointy sell-off on low quantity final week – as anticipated.

That is “one other low-risk shopping for alternative,” in keeping with the famend analyst. The technometer is at 38.5 for BTC/USD and 40.4 for BTC/USDT. By way of Twitter, he commented:

Bitcoin has not reached oversold and the value motion had me staying on the sidelines for a second. An oversold Technometer just isn’t a detailed your eyes and purchase, however a sign that we might be forming a backside, or due for some sideways/larger.

At press time, the BTC worth stood at $27,236, transferring as soon as once more nearer to the decrease finish of the vary, in all probability for another sweep of the low.

Featured picture from iStock, chart from TradingView.com

[ad_2]

Source link