[ad_1]

Cryptocurrency costs reacted positively to the Federal Reserve’s newest determination on rates of interest on Nov. 1.

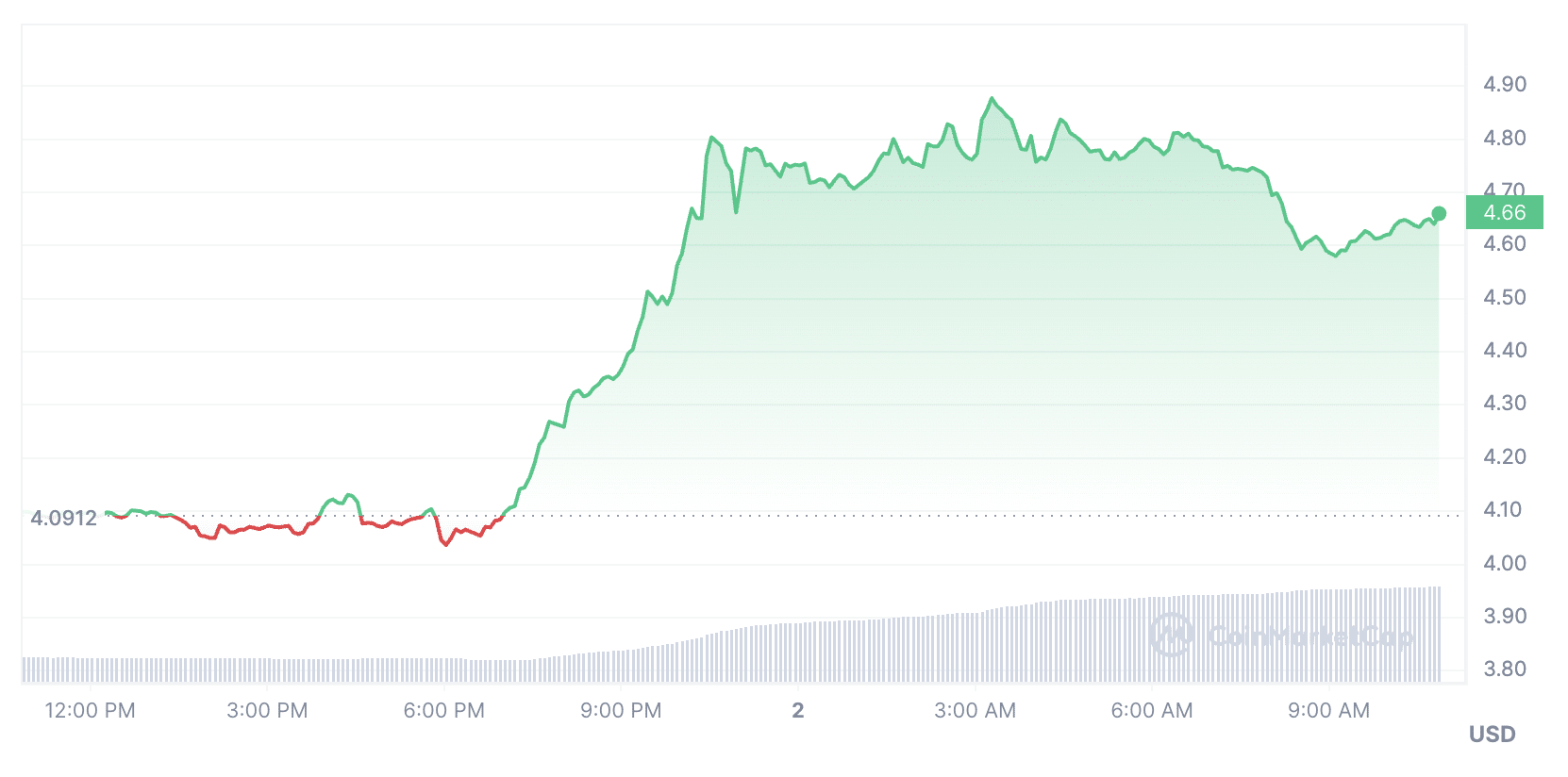

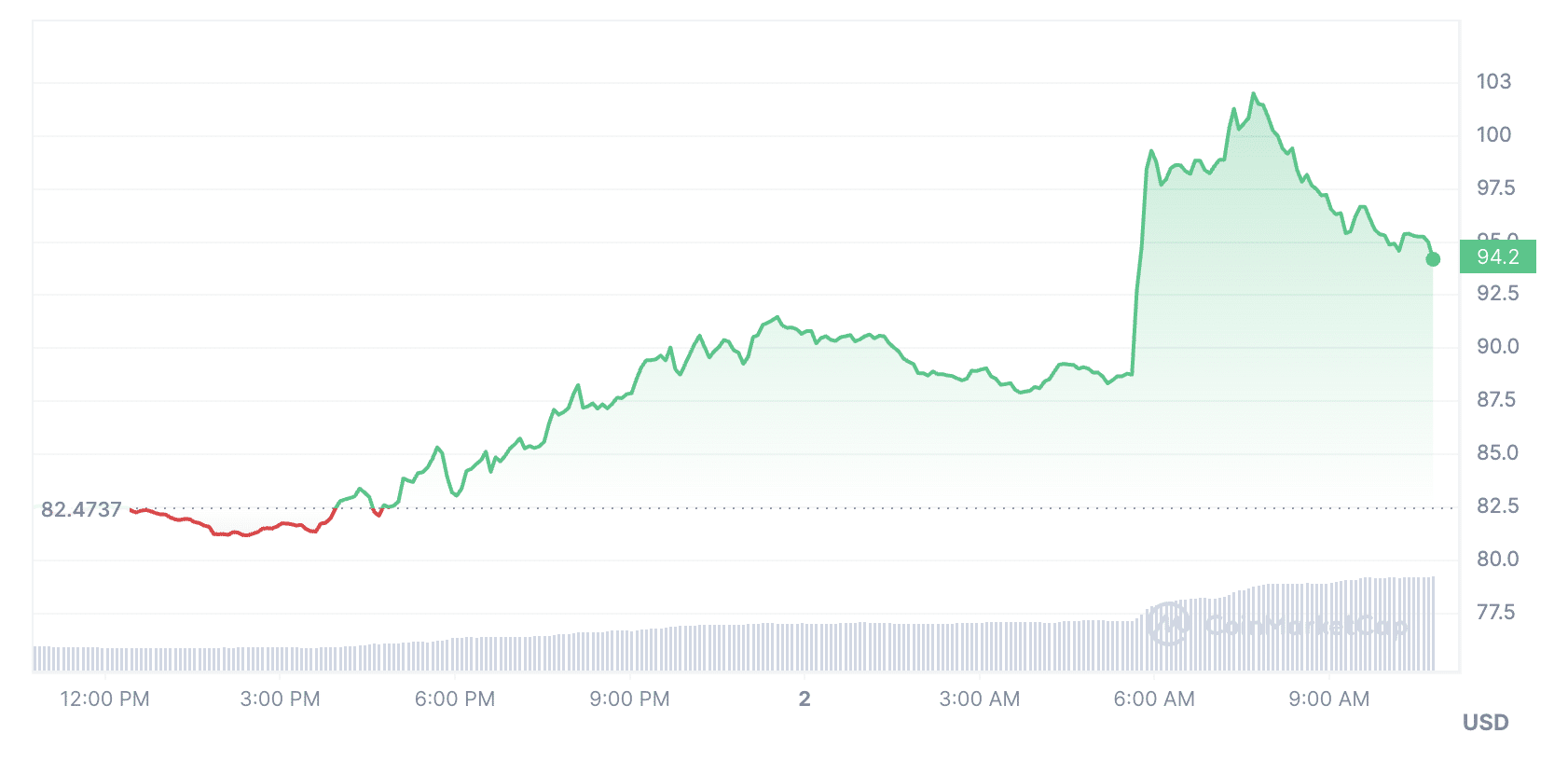

Defi tokens like AAVE and Uniswap (UNI) led the best way, rising over 20% in a second. AAVE rose to $98.13 and Uniswap’s UNI rose to $4.80. These tokens are thriving as a result of general significance of the cryptocurrency rally.

Within the case of Uniswap, the rally means demand for cryptocurrencies will enhance as traders attempt to comply with the gang. Within the inventory market, it was already seen Coinbase’s share worth skyrocketed this week. When writing, UNI trades at $4.65, up 13.6% in 24 hours.

Likewise with AAVE: as cryptocurrency costs rise, there’s a chance that demand for its lending initiatives will proceed. Certainly, the whole worth locked in lots of DeFi protocols has jumped, in response to DeFi Llama. Now AAVE is buying and selling at $94.21, up 14.11% in 24 hours.

The rise in altcoins comes after Bitcoin went increased on November 1st. At that second, BTC approached the $36k stage, close to which the coin was final in Could 2022. Afterward, Bitcoin entered a correction.

Bitcoin rose amid the US Federal Reserve’s determination to go away its key rate of interest unchanged for the second time. Refusal to additional enhance it’s a constructive sign for the market. Such actions might point out {that a} rate-cut interval is approaching.

[ad_2]

Source link