[ad_1]

David Lawant, the pinnacle of analysis for FalconX, an institutional crypto buying and selling platform tailor-made for monetary establishments, not too long ago offered an insightful forecast concerning the way forward for Bitcoin (BTC) costs in mild of the anticipated launch of a spot Bitcoin ETF in the US. Sharing his predictions through X (beforehand often called Twitter), he articulated the monetary variables which may play a decisive position.

Lawant remarked, “The subsequent important variable to look at within the spot BTC ETF launch saga will probably be how a lot AUM these devices will collect as soon as they launch. I believe the market is at the moment anticipating this influx to be between $500 million and $1.5 billion.”

The Magic Quantity To Push Bitcoin Value Previous $40,000

The crypto group is keenly anticipating a optimistic nod for a Spot Bitcoin ETF both on the finish of 2023 or the start of 2024. An important date on the calendar is January 10, 2024, which is about as the ultimate deadline for the ARK/21 Shares utility, main the present sequence of functions.

Undoubtedly, a inexperienced sign from regulatory authorities for the spot ETF will probably be a game-changer for all the crypto asset class. Lawant highlighted the significance of this growth, stating, “It’s going to open room for big pockets of capital that as we speak can’t correctly entry crypto, corresponding to monetary advisors, and convey a stamp of approval from the world’s most outstanding capital markets regulator.”

The urgent query, although, is the speedy impression on capital influx. “The primary couple of weeks after launch will probably be crucial to check how a lot urge for food there’s for crypto for the time being in these nonetheless comparatively untapped swimming pools of capital,” Lawant emphasised.

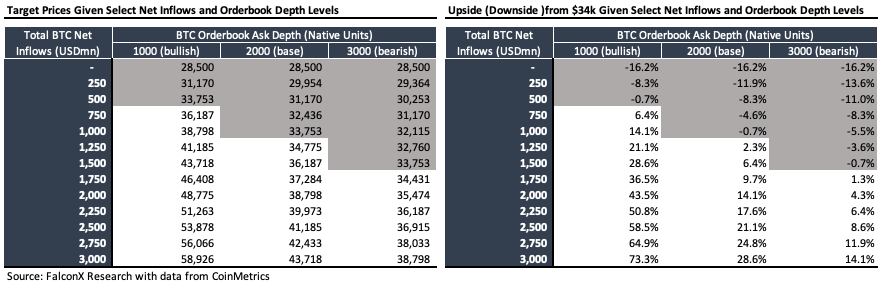

Counting on historic information, Lawant identified the steadiness of the ask aspect of BTC’s order ebook, particularly for costs located above the $30,000 mark. This information permits for an approximation of how the influx of capital may affect the value trajectory of BTC.

By way of numerous influx eventualities squared towards a spectrum of the depth of market eventualities, Lawant deduces that the market is presumably forecasting web inflows ranging between $500 million and $1.5 billion throughout the preliminary weeks post-launch.

Drawing conclusions from his evaluation, Lawant surmised:

For BTC to ascertain a brand new vary between the present degree and greater than $40k, the overall web inflows would want to quantity to $1.5 billion+. Then again, if complete web inflows are available in under $500 million, we might transfer again to the $30k degree and even under.

Nonetheless, it’s paramount to notice the inherent assumptions in Lawant’s evaluation. He admits, “One is that the transfer from $28.5k to $34.0k was completely attributed to the market anticipating price-insensitive web inflows from the ETF launch.” This implies, amongst different issues, that the present value improve was triggered neither by the correlation with gold nor by the worldwide crises or turmoil within the bond market.

Lawant additionally highlighted the potential variability in BTC value motion throughout the order ebook. Nonetheless, given the stature of issuers like BlackRock, Constancy, Invesco, and Ark Spend money on the SEC queue, the present favorable macroeconomic local weather for different financial belongings, and potential improved liquidity circumstances, Lawant stays bullish in regards to the potential BTC value rally following the ETF debut. He concluded with, “ceteris paribus I’m nonetheless enthusiastic about how the BTC value might react to the ETF launch.”

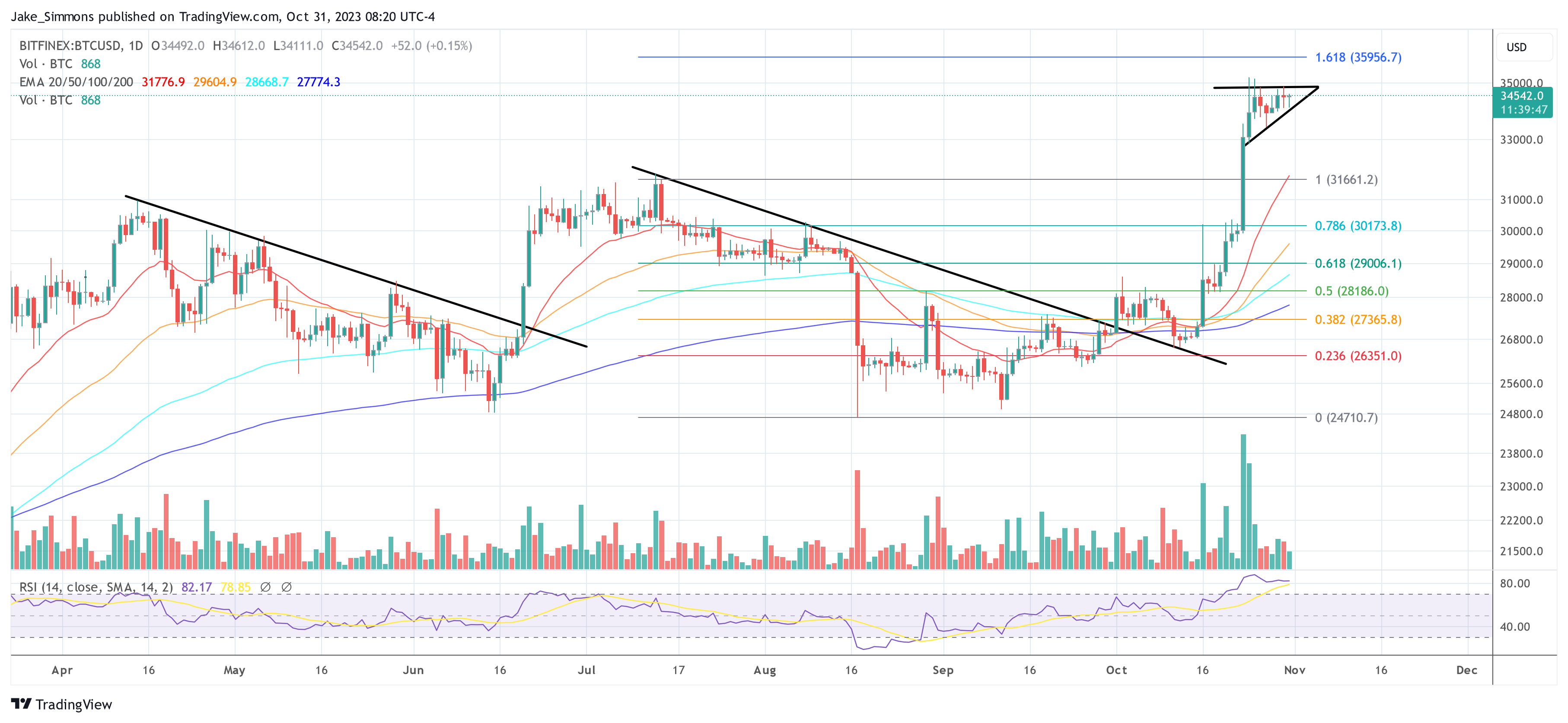

At press time, BTC traded at $34,542.

Featured picture from Shutterstock, chart from TradingView.com

[ad_2]

Source link