[ad_1]

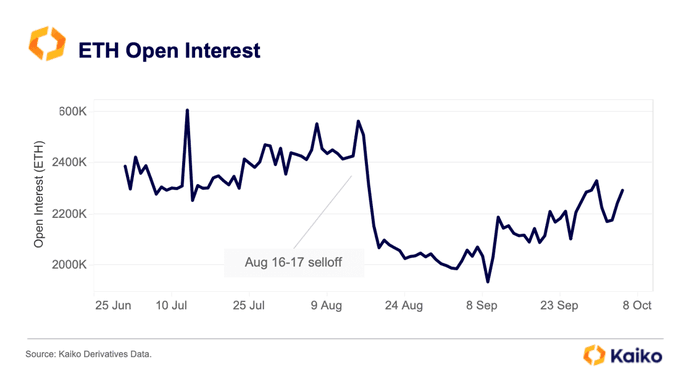

Ethereum costs is likely to be stagnant at spot charges, weaving across the $1,540 and $1,560 zone, taking a look at technical charts. Nevertheless, amid this era of consolidation and holders worrying about Ethereum’s prospects, Kaiko notes that the coin’s open curiosity has been step by step rising since September 2023.

Ethereum Open Curiosity Rising: What Does It Imply?

As of October 10, Kaiko observes that there are greater than 2.2 million contracts, and the quantity has been rising steadily over the previous few buying and selling weeks. With rising open curiosity, it could trace that bulls are within the equation, which can assist costs now that costs are beneath immense strain.

In crypto buying and selling, open curiosity is the whole variety of excellent spinoff contracts of a given coin. In the meantime, derivatives are contracts that derive worth from the underlying asset, on this case, Ethereum. Herein, the whole open curiosity information is accrued from ETH choices, futures, and perpetual futures from platforms the place merchants can use leverage.

There will be completely different interpretations of open curiosity relying available on the market state. Since open curiosity consists of lengthy and quick positions at any time, gauging the instructions of how market members are posting trades will be difficult.

Even so, rising open curiosity signifies that extra merchants are opening positions, which will be seen as bullish, particularly if costs are increasing. Conversely, falling open curiosity means that merchants are exiting, which suggests waning momentum and bearish sentiment.

ETH Consolidates Even After Ethereum Futures ETF Approval

Primarily based on this, Ethereum stays in a crucial place and assist. Notably, the coin is shifting sideways with low buying and selling volumes.

From the day by day chart, ETH is across the $1,500 and $1,550 major assist. Although patrons look like in management, since costs are boxed contained in the June to July 2023 commerce vary, any break beneath the assist zone might set off extra losses.

The overall optimism explaining rising open curiosity could possibly be because of the current approval of Ethereum Futures exchange-traded funds (ETFs). The US Securities and Alternate Fee (SEC) approved a number of Ethereum Futures ETFs for the primary time.

This resolution noticed Ethereum costs edge increased in early October. Although costs have since contracted, institutional buyers can now discover publicity in Ethereum by way of structured and controlled merchandise accredited by the stringent regulator.

It’s unclear whether or not the rising ETH open curiosity indicators power and if the coin will get better going ahead. From the day by day chart, ETH has robust liquidation at across the $1,750 degree and stays consolidated.

Characteristic picture from Canva, chart from TradingView

[ad_2]

Source link