[ad_1]

What’s Centralized Finance (CeFi)?

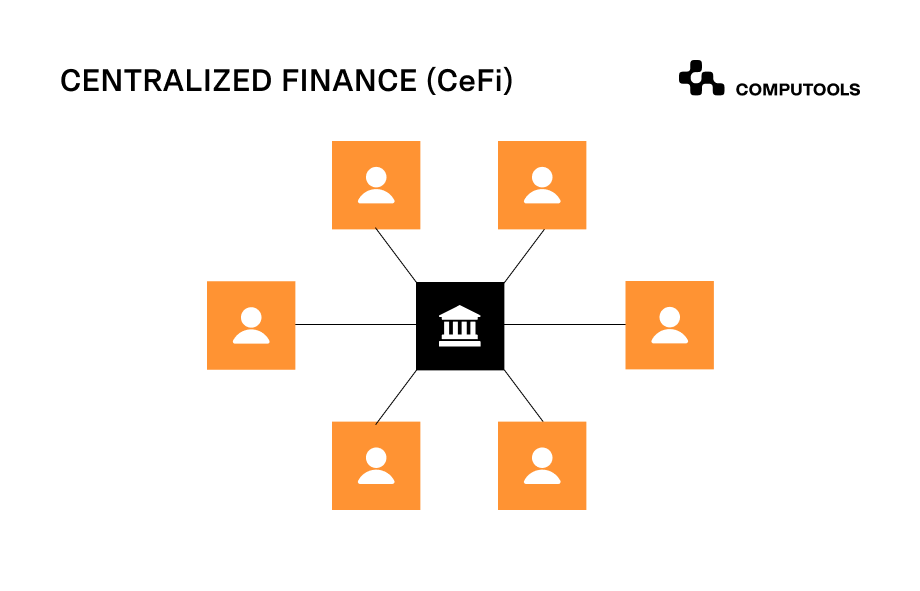

Centralized finance (CeFi) is outlined as a monetary ecosystem the place centralized authorities management monetary belongings and the circulation of cash. They set the foundations and requirements for the way belongings are managed and transacted.

Traditional financial (TradFi) companies are supplied by mainstream monetary establishments, together with banks, brokerages, and insurance coverage suppliers.

Nonetheless, the emergence of blockchain technology has launched the ideas of CeFi and decentralized finance (DeFi) to facilitate funds, lending, borrowing, and different companies.

Techopedia Explains

TradFi is, by its nature, centralized. Governments, banks, and different monetary establishments are answerable for all transactions, and there may be restricted transparency in how the system operates.

However within the cryptocurrency world, CeFi refers to actions which can be managed by a centralized third get together, versus the peer-to-peer (P2P) transactions which can be characterised by DeFi.

CeFi is the crypto market equal of conventional funding corporations and inventory brokerages, which facilitate the buying and selling of equities and fiat currencies in public inventory markets.

Most CeFi companies are operated by privately owned corporations that facilitate the buying and selling of digital assets, primarily cryptocurrencies and non-fungible tokens (NFTs).

Foremost Options of CeFi

- Centralized management: CeFi depends on intermediaries to handle belongings and facilitate transactions. These centralized authorities supply companies, act as custodians of funds, and are answerable for guaranteeing the steadiness and security of the financial system.

- Regulation: Centralized monetary establishments are closely regulated by authorities authorities and regulatory our bodies to guard the buyer. Establishments should adhere to strict guidelines, corresponding to anti-money laundering (AML) and know your customer (KYC) necessities, to assist stop tax evasion, switch of illegitimate funds, and terrorist financing.

- Accountability: Centralized entities are typically obligated to offer particulars relating to their monetary efficiency and operations to the general public in addition to regulators.

- Restricted accessibility: Entry to CeFi companies could also be restricted or restricted for sure populations, such because the unbanked or underbanked and people with low earnings or credit score scores.

Centralized Finance Examples

Examples of centralized cryptocurrency companies embody exchanges corresponding to Binance, Coinbase, and Kraken.

In CeFi, exchanges preserve asset custody and retain management over the private keys related to cryptocurrency wallets, which allow entry to blockchain-based coins and tokens.

The central alternate bears a part of the accountability for guaranteeing the security, safety, and execution of transactions, together with clear reporting to customers. The alternate additionally has the authority to impose dealing with and transaction charges for purchases, gross sales, trades, and token conversions.

Whereas CeFi presents safety as customers should confirm their identification to have the ability to open an account, the chance is that they don’t management their keys and, in the end, their very own funds.

Execs and Cons of CeFi

| Execs of CeFi | Description |

| Safety | Established exchanges sometimes have sturdy safety measures in place. |

| Person-friendliness | CeFi platforms are sometimes extra user-friendly and accessible for newcomers than self-custody crypto wallets. |

| Liquidity | CeFi exchanges can supply excessive liquidity for buying and selling varied cryptocurrencies and cross-chain bridging. |

| Buyer assist | CeFi platforms normally present buyer assist for customers. |

| Fiat integration | CeFi permits for straightforward conversion between fiat currencies and cryptocurrencies. |

| Security nets | Some CeFi platforms supply insurance coverage or reimbursement in case of security breaches. |

| Regulatory compliance | Compliance with laws corresponding to KYC can improve legitimacy and belief. |

| Cons of CeFi | Description |

| Centralization | CeFi depends on intermediaries, rising the chance of a single level of failure and vulnerability to fraud or cyberattacks. |

| Management of belongings | Customers should belief the alternate with their belongings and personal keys. |

| Rules | CeFi exchanges are topic to authorities laws, which can restrict sure actions. |

| Prices | Buying and selling on CeFi exchanges could contain charges, which may add up over time. |

| Privateness considerations | Person information could also be collected and shared with third events, elevating privacy considerations. |

| Restricted transparency | The extent of CeFi transparency might be decrease than DeFi. For example, an funding agency could not disclose the small print of its methods or efficiency. |

| Downtime | CeFi exchanges can expertise downtime or upkeep, affecting entry. |

CeFi vs. DeFi, TradFi

Whereas CeFi entails a centralized middleman, DeFi depends on sensible contracts operating on blockchain networks to execute transactions. This permits people anyplace on the planet to alternate belongings straight with out the involvement of intermediaries.

Decentralized applications (dApps) present entry to monetary companies to anybody with an Internet connection, together with the underserved and unbanked. Additionally they give all customers extra management over their belongings by way of private wallets and buying and selling accounts, for which they maintain sole entry to their personal keys.

DeFi goals to offer nameless open-source methods that improve financial transparency and don’t require customers to offer private information. DeFi companies present lending, crypto yield farming, borrowing, asset holding, and extra with out restrictions on customers, which CeFi suppliers can implement.

Nonetheless, DeFi is a brand new technology-based method and requires a comparatively excessive diploma of technical experience. There are additionally dangers associated to flawed protocol or sensible contract coding, human errors, or malicious attackers.

Centralized finance goals to mix some great benefits of DeFi with the reliability and ease of use of TradFi companies. CeFi permits prospects to curiosity on financial savings, lend and borrow funds, spend crypto utilizing a debit or bank card, commerce cryptocurrencies and tokenized assets, and so forth, all whereas taking accountability for safeguarding prospects’ funds.

Exchanging fiat forex into cryptocurrency requires a centralized establishment. CeFi suppliers have the potential to carry out this conversion, in contrast to DeFi options. Moreover, CeFi suppliers can execute transactions on margin and supply loans straight.

| CeFi | TradFi | DeFi | |

| Custody of funds | Centralized establishment controls custody | Centralized establishment controls custody | Person retains custody |

| Private info | Requires identification verification and permission | Requires identification verification and permission | Permissionless and nameless |

| Companies | Funds, fiat-to-crypto switch, buying and selling, borrowing, lending | Funds, borrowing, lending, buying and selling | Crypto and tokenized asset buying and selling, funds, borrowing, lending, yield farming |

| Transaction charges | Excessive charges | Excessive charges | Low charges |

| Person expertise | Simple person interfaces | Easy person expertise | Advanced interfaces, sensible contracts, and algorithms |

| Safety | Liable for person funds | Liable for person funds | Not accountable for person funds |

| Threat | Probably susceptible to assaults/breaches | Low threat | Greater threat |

| Customer support | Main exchanges present customer support | All establishments present customer support | No buyer assist |

The Backside Line

Centralized finance goals to occupy the center floor between the normal monetary system and blockchain-based decentralized purposes.

CeFi gives methods for newcomers to enter the cryptocurrency markets with out having to navigate the customarily complicated purposes that present DeFi companies.

Nonetheless, centralized finance lacks the anonymity and permissionless nature of DeFi, requiring customers to offer private information and quit management of their personal pockets keys.

As blockchain-based monetary companies evolve, it stays to be seen how CeFi and DeFi will coexist and form the way forward for finance.

[ad_2]

Source link