[ad_1]

Digital belongings supervisor CoinShares says institutional crypto funding merchandise loved their fourth consecutive week of inflows final week.

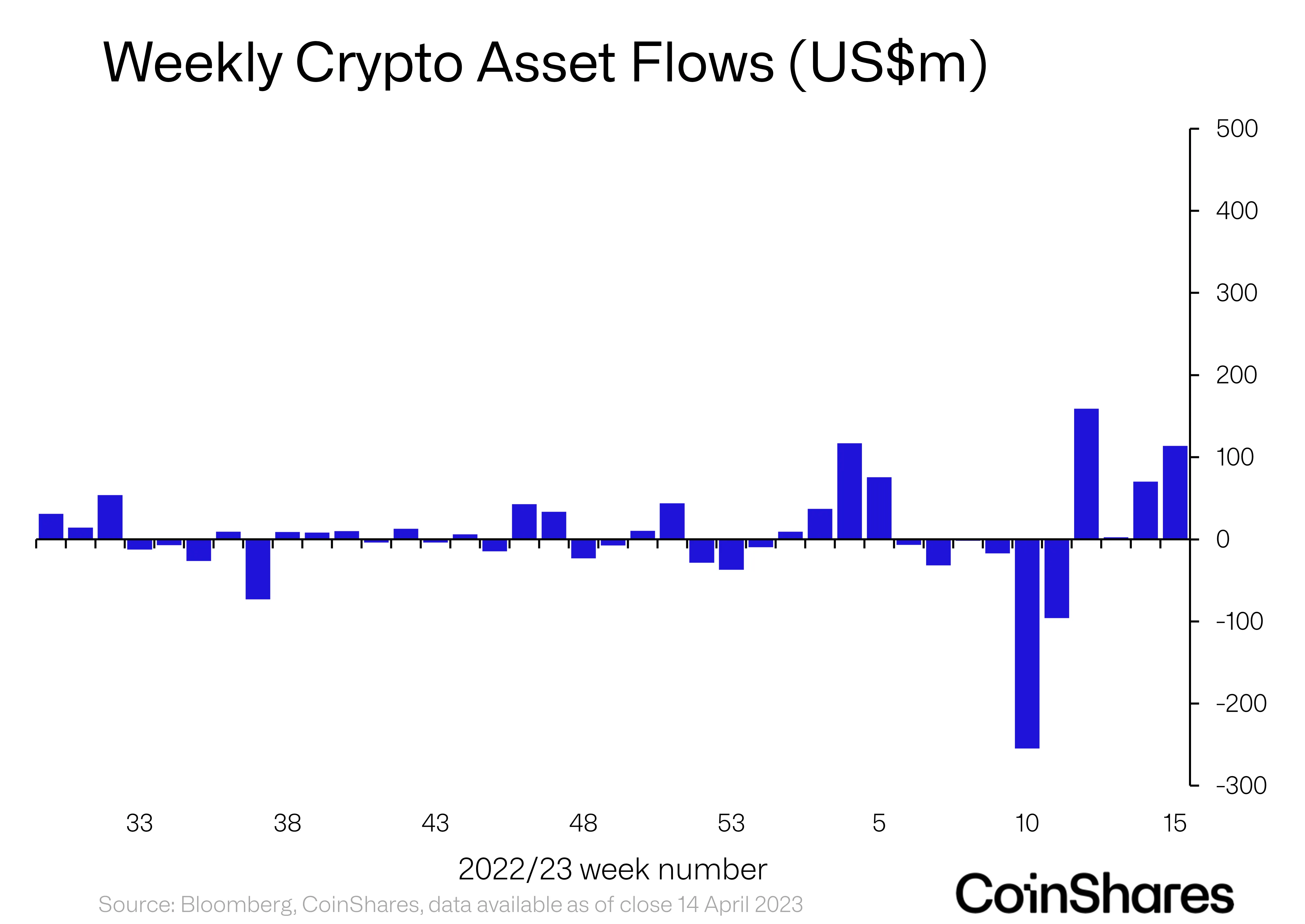

In its newest Digital Asset Fund Flows Weekly Report, CoinShares finds that institutional crypto funding merchandise noticed inflows of practically $114 million final week, a continued signal of bullishness from institutional buyers.

“Digital asset funding merchandise noticed inflows totaling $114m final week, which is seeing continued enhancing sentiment for the asset class. This 4-week run of inflows now complete $345m, virtually absolutely correcting the prior 6-week run of outflows that totaled $408m.”

CoinShares additionally notes that the improved investor sentiment comes at a time of low Bitcoin (BTC) market quantity.

The king crypto has been virtually the complete focus of the buyers, based on Coinshares.

“Bitcoin has once more been virtually the only focus for buyers, with inflows of $104m final week, bringing its complete 4-week run to $310m. We consider it is a flight to security by buyers scared of the continued conventional finance challenges. Opinion stays divided although, with quick bitcoin seeing inflows totaling $14.6m final week.”

Regardless of Ethereum’s (ETH) profitable Shapella improve, the main sensible contract platform solely took in $0.3 in inflows.

All altcoins took a backseat to BTC final week, with Solana (SOL) merchandise struggling outflows of $2.1 million. Cardano (ADA) and XRP merchandise took in $100,000 a chunk whereas Litecoin (LTC) merchandise raked in $200,000.

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Examine Price Action

Observe us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Day by day Hodl usually are not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal threat, and any loses chances are you’ll incur are your accountability. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please observe that The Day by day Hodl participates in affiliate internet marketing.

Featured Picture: Shutterstock/andreync/Chuenmanuse

[ad_2]

Source link