[ad_1]

Are you interested by Ripple’s native foreign money, XRP, and its function in world transfers? XRP is a singular digital foreign money owned by Ripple, designed to facilitate seamless and safe cross-border transactions for banks and monetary establishments. Whereas Ripple confronted challenges in 2020, the brand new 12 months holds promise for its progress and growth. The worth of XRP is influenced by components corresponding to financial institution adoption and cryptocurrency rules. If you happen to’re an fanatic on the earth of cryptocurrencies or a thematic investor within the monetary sector, XRP could possibly be an intriguing funding alternative. Nevertheless, it’s vital to notice that XRP is extremely unstable, providing short-term buying and selling prospects. Market tendencies, mainstream adoption, and technological developments additionally play a major function in figuring out the worth of XRP. Moreover, the continued SEC vs. Ripple lawsuit has the potential to influence the regulatory panorama of your complete cryptocurrency trade. Whether or not you select to purchase and maintain XRP, commerce it, or discover different funding avenues, the alternatives surrounding XRP are price contemplating.

Overview of Ripple and XRP

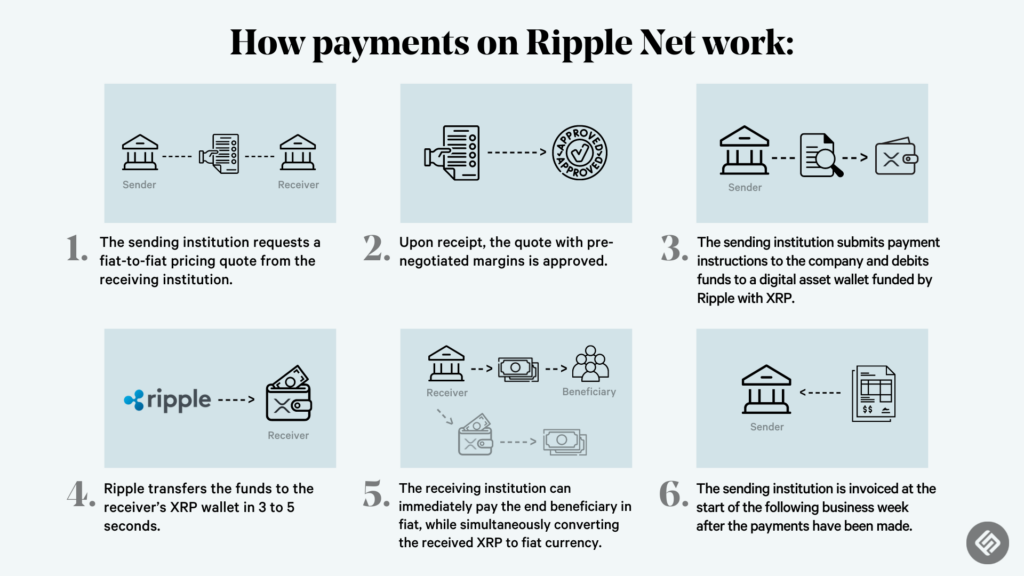

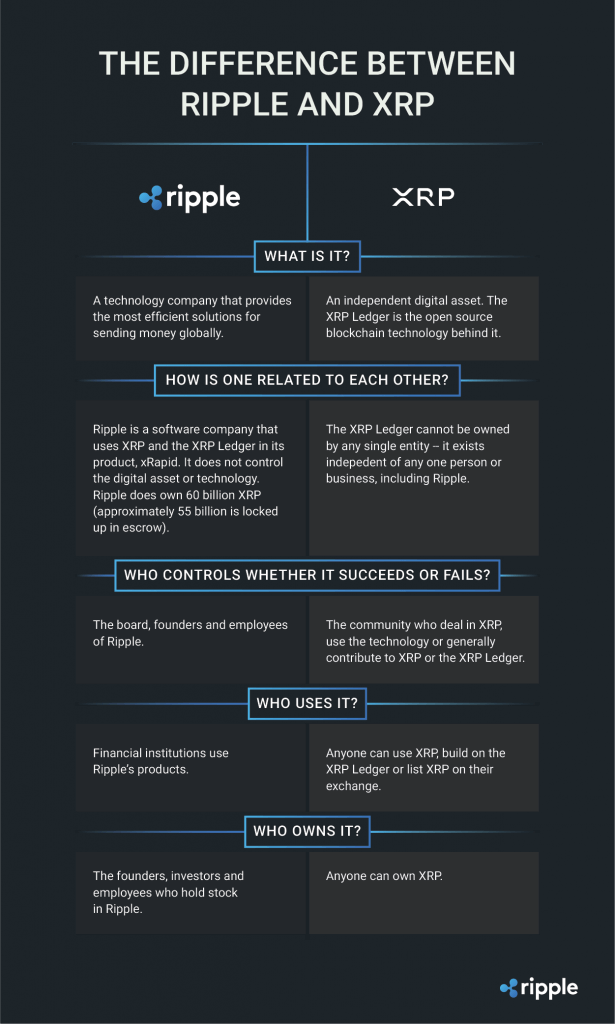

Ripple is a blockchain-driven fee system designed for world transfers. It operates utilizing its native digital currency, XRP. What units XRP aside from different cryptocurrencies is that it’s wholly owned by Ripple and primarily goals to serve banks as a switch of worth. Ripple’s fee protocol is constructed on a distributed open supply web protocol consensus ledger, which permits for quick and safe cash transfers. This makes it a beautiful answer for monetary establishments seeking to enhance the effectivity of cross-border funds.

Components Influencing the Worth of XRP

The worth of XRP is influenced by numerous components. One of many key components is the adoption of Ripple by banks and monetary establishments. As extra establishments combine Ripple’s fee system into their operations, the demand for XRP is more likely to improve, thereby impacting its value. Moreover, the regulatory environment surrounding cryptocurrencies additionally performs a major function in figuring out the worth of XRP. Any new rules or restrictions imposed on cryptocurrencies can have an effect on the general market sentiment and, in flip, the worth of XRP.

Development Potential of Ripple in 2021 and Past

Ripple confronted its justifiable share of challenges in 2020, together with the continued authorized battle with the U.S. Securities and Alternate Fee (SEC). Nevertheless, regardless of these obstacles, Ripple nonetheless has important room for progress in 2021 and past. The corporate continues to determine partnerships with main monetary establishments and develop its presence in numerous areas. Moreover, as the worldwide adoption of blockchain know-how and cryptocurrencies will increase, Ripple is well-positioned to capitalize on this rising development.

Funding Alternatives and Issues

For cryptocurrency fanatics and buyers, XRP presents a beautiful funding alternative. Its shut affiliation with Ripple and its potential to disrupt the normal banking system make it an intriguing choice. Moreover, thematic buyers who’re within the monetary sector can think about investing in XRP as a option to acquire publicity to this trade. Nevertheless, it is very important be aware that investing in XRP comes with dangers, significantly as a consequence of its excessive volatility. Due to this fact, buyers ought to rigorously think about their danger tolerance and conduct thorough analysis earlier than making any funding selections.

Along with long-term funding alternatives, XRP additionally presents short-term buying and selling alternatives. Its volatility can create favorable situations for merchants seeking to capitalize on value fluctuations. Nevertheless, buying and selling XRP requires cautious evaluation and understanding of market tendencies, in addition to the flexibility to react shortly to altering situations. Merchants ought to have a stable buying and selling technique in place and be ready for the potential dangers related to short-term buying and selling.

Components Affecting the Worth of XRP

A number of components can have an effect on the worth of XRP. At first, market tendencies play a vital function in shaping the worth of XRP. Investor sentiment, general market situations, and the efficiency of different cryptocurrencies can affect the demand for XRP and in the end influence its worth. Moreover, mainstream adoption of Ripple’s fee system and XRP by monetary establishments and companies can considerably have an effect on its worth. The extra customers and entities undertake Ripple, the stronger the community impact turns into, doubtlessly driving up the worth of XRP. Technological developments inside the Ripple ecosystem and developments in blockchain know-how as a complete may also contribute to the worth of XRP.

The SEC vs. Ripple Lawsuit and Its Implications

the ongoing legal battle between the SEC and Ripple has garnered important consideration inside the cryptocurrency trade. The SEC alleges that Ripple performed an unregistered securities providing when it initially offered XRP. The end result of this lawsuit has the potential to influence the regulatory panorama not just for Ripple however for your complete cryptocurrency trade. If the SEC’s allegations are confirmed, it might result in stricter rules and pointers for cryptocurrencies. However, if Ripple efficiently defends itself, it might present readability and regulatory certainty for the trade, in the end benefiting Ripple and XRP.

A number of Funding Methods for XRP

There are numerous ways in which buyers can method investing in XRP. One widespread technique is shopping for and holding XRP, which entails buying the digital foreign money with the intent of holding it for an prolonged interval. This technique permits buyers to learn from any potential value appreciation over time. Nevertheless, it is very important consider the excessive volatility of XRP and the related dangers.

One other funding technique is buying and selling XRP. Merchants can benefit from the short-term value fluctuations of XRP to generate income. This technique requires energetic monitoring of the market and the usage of technical evaluation to establish potential entry and exit factors. Merchants also needs to implement danger administration methods to guard their capital.

It is very important be aware that mining will not be relevant to XRP. In contrast to different cryptocurrencies corresponding to Bitcoin, XRP is not mined. It is because all XRP tokens have been pre-mined and distributed on the time of creation. Due to this fact, mining will not be a viable funding avenue for XRP.

In conclusion, Ripple and its native digital foreign money XRP current distinctive alternatives and issues for buyers. Whereas Ripple’s fee system has the potential to revolutionize the worldwide monetary trade, it additionally faces challenges and uncertainties, corresponding to the continued authorized battle with the SEC. Traders ought to rigorously consider their danger tolerance and conduct thorough analysis earlier than making any funding selections associated to XRP. By understanding the components influencing its value, the expansion potential within the coming years, and the varied funding methods out there, buyers could make knowledgeable decisions relating to their involvement with Ripple and XRP.

Investing in Ripple in 2023: A Viable Enterprise?

Armed with insights into Ripple’s latest historical past, assessing its viability as an funding in 2023 necessitates a complete understanding of some key issues.

One should decide whether or not they align with the profile of an XRP holder and dealer and if the coin meets their necessities. Equally essential is greedy the drivers behind XRP’s value and whether or not its function as a disruptor within the transaction trade stays related.

XRP caters to varied types of merchants and buyers. It appeals to normal cryptocurrency fanatics, because it stands as an altcoin distinct from Bitcoin. But, its outstanding place inside the high 5 cash and its established market lend it a way of credibility and stability.

Concurrently, XRP appeals to thematic buyers who acknowledge its potential to cater to the banking trade’s distinctive wants. This aligns with Ripple’s aspiration to facilitate swift and easy cross-border worth transfers for monetary establishments.

Because the panorama of cryptocurrency and finance continues to evolve, Ripple’s function stays distinct and doubtlessly promising. Nevertheless, given the volatility inherent to the cryptocurrency market, potential buyers ought to train prudence and keep knowledgeable in regards to the ever-changing dynamics that affect XRP’s trajectory.

[ad_2]

Source link