[ad_1]

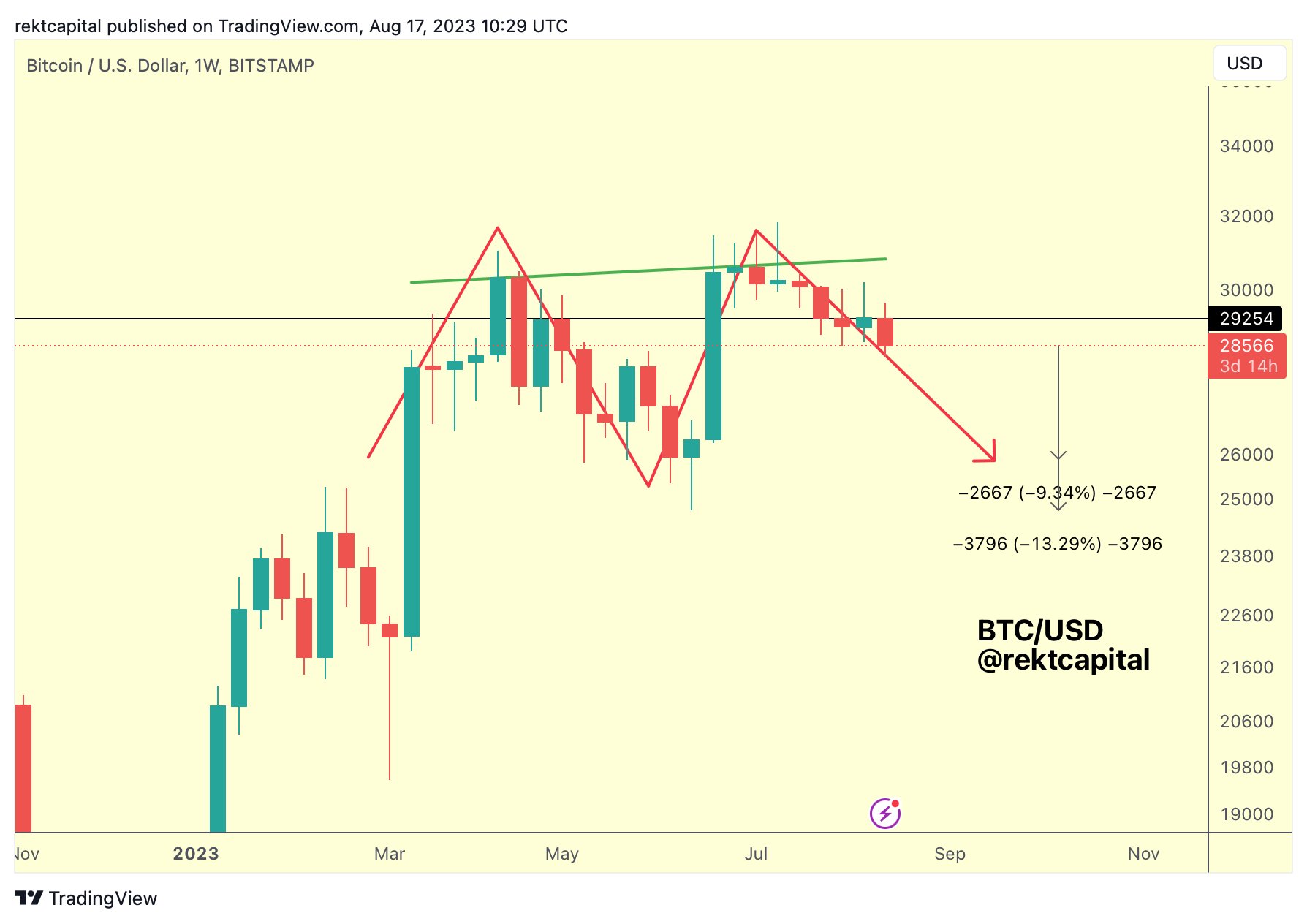

In a current evaluation of the Bitcoin value, seasoned crypto analyst Rekt Capital mentioned the looming presence of a possible double prime formation on the weekly chart. The scenario paints an image of impending volatility, with each bullish and bearish narratives rising from this usually foreboding sample.

“The BTC Double High nonetheless stays intact,” tweeted Rekt Capital, emphasizing the technical construction’s significance. He continues, “Weekly Bearish Divergence lends extra bearish confluence to this construction as properly. Extra, the bear div is creating a brand new decrease excessive (dotted inexperienced) relative to its main downtrend (strong inexperienced).” Nonetheless, BTC would want to drop a further -9% to -13% from present costs to finish its potential double prime.

However what makes this evaluation notably intriguing is the present state of Bitcoin’s quantity. Rekt Capital additional observes, “What’s attention-grabbing in regards to the quantity behind BTC’s value motion is that the 2 current peaks shaped on inclining quantity whereas the RSI shaped decrease highs.” For a lot of, this simultaneous enhance in quantity with descending RSI hints at underlying market weak point, an perception additional supported by the following declining quantity after the native prime at roughly $31,000.

Diving deeper in his video evaluation, Rekt Capital highlighted the necessity for a definite “M”-shaped formation, a trademark of the double prime sample. “For Bitcoin to type a double prime right here, we’ve to see an ‘M’-shaped formation happen. Once we see a M type, that’s basically a double prime. One prime right here [at $30,800] and one prime right here [at $31,300].”

Dropping pivotal assist ranges may invite substantial downward motion. “Dropping this [neckline] stage at $26,000 as assist would allow additional draw back,” warns the analyst. Nonetheless, for merchants and buyers hoping for symmetrical habits, Rekt Capital speculates, “And if we see symmetry right here, a 3 month second a part of this M may type in order that’s going to immediate additional draw back and simply gradual bleeding into that 90 day-mark which might be round subsequent month.”

However not all is bleak. Ought to Bitcoin hint again to $24,000, a retracement would “see us retest the neckline of this inverse head & shoulders that we noticed escape.” Rekt Capital provides, “So a retest of this stage as a brand new assist ought to really allow additional upside.”

Additionally, a take a look at the 1-week chart additionally reveals that there’s one other state of affairs for the invalidation of the double prime. Bitcoin has shaped an ascending trendline from its low in early January. Supplied BTC can maintain this trendline on a weekly foundation and bounce up from there (at round $28,200), an invalidation would happen. The symmetry of the M could be damaged, the uptrend on the upper time frames may proceed.

Featured picture from iStock, chart from TradingView.com

[ad_2]

Source link