[ad_1]

Litecoin’s newest halving has grow to be a central matter of debate within the cryptocurrency market. With the upcoming halving occasion, miners will obtain half the reward they used to for producing blocks.

This phenomenon will not be new, as Bitcoin undergoes comparable halvings each 4 years. Nonetheless, the implications of the halving on Litecoin’s future bear significance because it may take miners out of enterprise.

A Nearer Have a look at Litecoin Halving

Understanding the Litecoin halving course of is important to know the core of the problem.

Litecoin miners obtain a sure variety of LTC after they produce a block. This reward, initiated at 50 LTC per block, undergoes a 50% discount after each 840,000 blocks mined, roughly each 4 years.

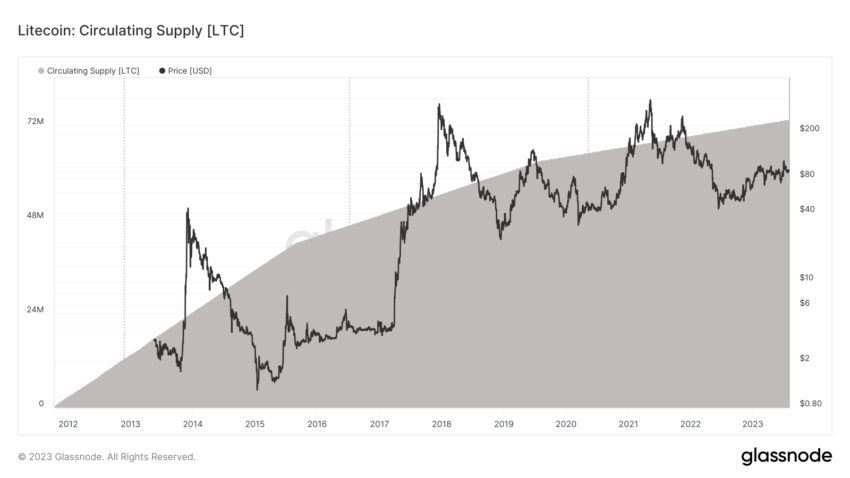

The mining reward is poised to drop from 12.5 LTC to six.25 LTC quickly. This mechanism is designed to maintain the availability of LTC in examine, with a tough cap of 84 million LTC. At the moment, almost 87% of this complete provide is already in circulation.

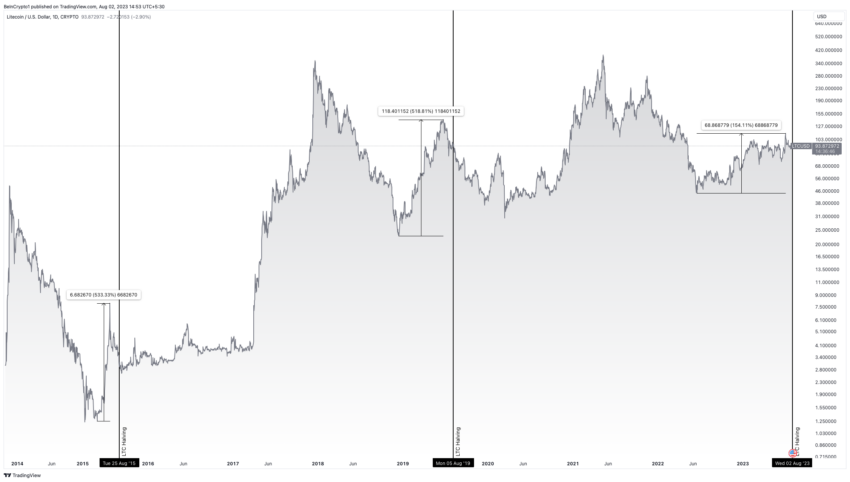

Litecoin’s price dynamics appear to sway with its halving occasions. BeInCrypto’s senior analyst Valdrin Tahiri observed that the value of LTC skyrocketed by 533% earlier than the 2015 Litecoin halving and jumped 519% in 2019.

These percentages level to an underlying development the place Litecoin’s price tends to peak simply earlier than the halvings.

Learn extra: Litecoin (LTC) Price Prediction

This sample is termed by BeInCrypto’s International Head of Information, Ali Martinez, as a “purchase the rumor, promote the information” occasion, hinting that the market anticipates the availability shock earlier than it occurs, which Litecoin creator Charlie Lee acknowledged.

“Numerous the value motion is a self-fulfilling prophecy… For Bitcoin and Litecoin, generally the value went up earlier than [the halving], generally it runs up afterwards. Generally it doesn’t actually have an excessive amount of of an impact. All of it is determined by how the market reacts to the halving,” stated Lee.

The Significance of Litecoin Halving

Tone Vays, the founding father of Monetary Summit, weighed in on this occasion, drawing parallels between Bitcoin and Litecoin halvings. He highlighted that this occasion, similar to the Bitcoin halving, successfully cuts by half the reward Litecoin miners obtain for producing blocks.

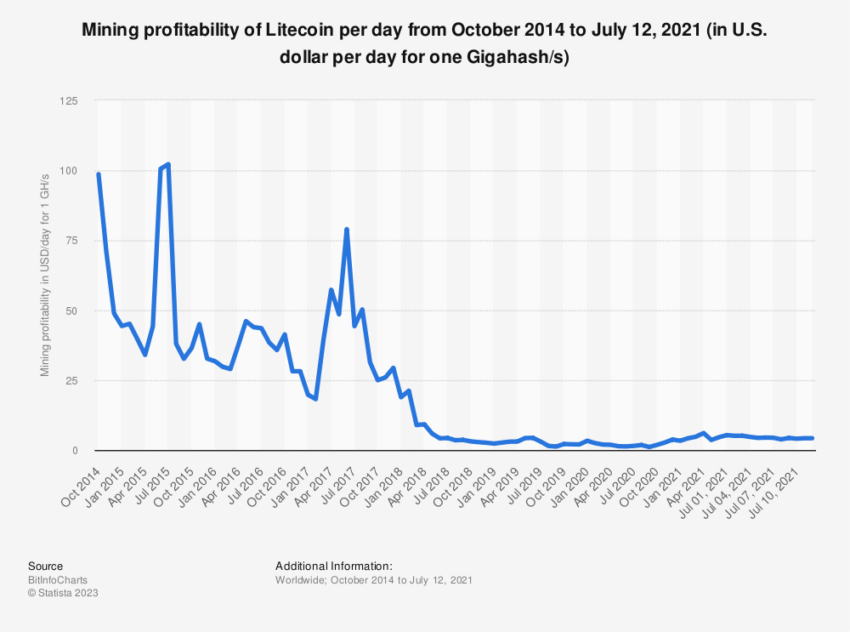

Nonetheless, for miners to stay , the worth of the cryptocurrency ought to ideally double each 4 years.

“Litecoin must double in worth at a minimal each 4 years. In any other case, nobody would need to mine it any additional, making the Litecoin community much less safe, which it may result in a loss of life spiral,” Vays advised BeInCrypto.

Learn extra: Best Cloud Mining Sites 2023: A Beginners Guide

The underlying concern is {that a} drop in mining exercise may render the Litecoin community weak, particularly relating to security. Fewer miners may make the community extra inclined to 51% attacks, whereby a single entity may management many of the community’s mining energy, compromising its integrity.

Vays expressed skepticism concerning the long-term profitability of Litecoin mining. Particularly with the present halving, suggesting that LTC may face challenges sooner or later.

“I don’t see any method for Litecoin to be helpful until Bitcoin’s Lightning Network fails. So long as Bitcoin’s Lightning Community succeeds, there is no such thing as a want for LTC as a result of BTC scales to small transactions. This is similar method there is no such thing as a extra want for silver as cash as a result of nobody will ever be exchanging items of gold with one another,” added Vays.

This sentiment stems from Vays’ perception that Bitcoin has a far higher adoption charge and real-world utility than Litecoin. As such, the ripple impact of a Bitcoin halving is felt extra acutely throughout the cryptocurrency market than a Litecoin halving.

Dogecoin and Litecoin Twin-Mining

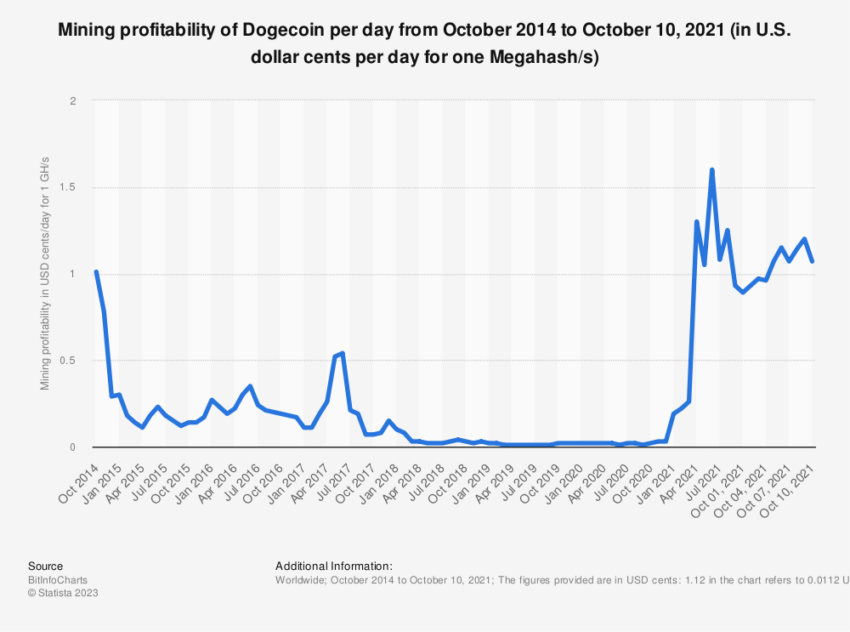

Nonetheless, the scenario will not be fully bleak for Litecoin miners. As block rewards for Litecoin lower, it may naturally imply decreased profitability for miners. But, a crucial issue may present some aid. Litecoin has a dual-mining mechanism with Dogecoin.

Youwei Yang, chief economist at BIT Mining, highlighted this distinctive facet. He famous that whereas Litecoin’s block reward would halve, Dogecoin’s stays unchanged. This dual-mining mechanism may considerably offset the lowered profitability from Litecoin’s halving.

“Litecoin machines have the aptitude of additionally mining Dogecoin…. We imagine that Litecoin could be very secure, and Dogecoin has the potential to draw younger generations. Dogecoin has sufficient sound and strong expertise that can assist the community and, on the similar time, entice billions of curiosity and hundreds of thousands of customers. So the mix of expertise may also help [Litecoin and Dogecoin] survive and get adopted,” stated Yang.

Learn extra: Crypto Telegram Groups To Join in 2023

As a result of twin mining expertise, Litecoin halving’s impression on miner profitability could be cushioned. Nonetheless, Yang added that present market dynamics, together with the low volatility within the crypto market, may imply that the halving does not significantly impact the Litecoin value as earlier ones did.

Regardless, Vays stays bearish on Litecoin’s prospects, particularly in gentle of the halving. He foresees that Litecoin builders must resolve between shifting to a proof-of-stake (PoS) mannequin or adopting the SHA 256 algorithm and merging mining with Bitcoin.

Disclaimer

Following the Belief Challenge tips, this function article presents opinions and views from business consultants or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially mirror these of BeInCrypto or its employees. Readers ought to confirm data independently and seek the advice of with an expert earlier than making choices primarily based on this content material.

[ad_2]

Source link