[ad_1]

The Nationwide Financial institution of Ukraine (NBU) has requested native cryptocurrency corporations to file particulars of their financials, elevating considerations over new regulatory measures.

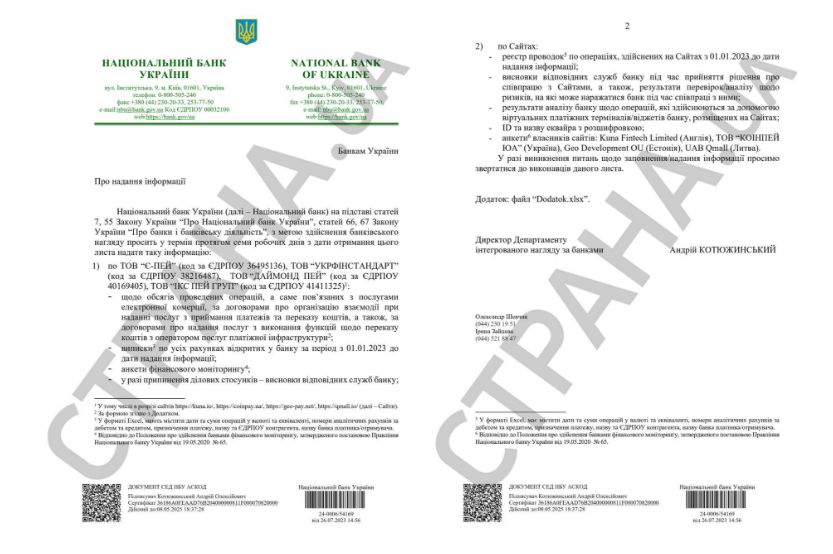

The financial institution demanded at the least 4 digital asset corporations together with Kuna, CoinPay, Geo Pay, and Qmall to offer monetary paperwork alongside different necessities inside seven days.

The information made rounds after it was circulated on social media by a number of Ukrainian telegram information channels. Per the discharge, the NBU additionally desires corporations to offer buying and selling info akin to operational volumes and the motion of all crypto belongings.

Michael Chobanyan, the CEO of Kuna, a digital asset change in Ukraine that falls underneath the brand new regulation confirmed the doc being circulated including that the reason being fairly unclear.

The transfer by the Ukrainian authorities has left many bothered over the nation’s recent clampdown on crypto actions, a choice many digital asset executives describe as “crippling.”

Along with monetary necessities, corporations are to file statements on all accounts in 2023. Chobanyan additional lamented the “predatory actions” of the NBU which led to the change leaving its business-to-customer mannequin within the nation.

Chonayan acknowledged that the federal government has carried out earlier searches triggered by the actions of the NBU and different regulators.

“Over the previous two weeks, the primary wave of searches in exchanges came about in Kyiv and throughout Ukraine, which have been triggered by the actions of the NBU, Ministry of Inside Affairs, and the Safety Service of Ukraine. There can be extra searches and exchanges.”

How far can corporations be stretched?

The latest regulatory insurance policies by Ukrainian authorities have slowed the expansion of web3 corporations within the nation.

Kuna’s change volumes hit rock after the corporate left the business-customers mannequin. In line with Chobanyan, buying and selling volumes have plunged 90% on the change in a number of months.

Recall that Kuna’s quantity initially took a steep dive final 12 months by 60% after the agency left Russia. Regardless of bottleneck laws, Ukrainian markets nonetheless present a lot of potential.

Since Russia’s invasion, Ukraine has acquired donations of as much as $225 million in cryptocurrency alone in response to blockchain agency Crystal Blockchain.

Chobanyan famous that he takes positives from the latest developments within the nation including that he has now pushed the corporate to turn into a profitable European model relatively than “a distinct segment Ukrainian participant.”

“Now we give attention to Europe and particularly the b2b market. I have no idea whether or not it’s associated to the concern that we are going to launch this service in Ukraine or not.”

[ad_2]

Source link