[ad_1]

The cross-chain protocol Multichain skilled a serious setback that has considerably disrupted decentralized finance (DeFi) actions on Fantom. For the reason that onset of Multichain’s difficulty in Could, Fantom Basis has been striving to reassure customers about its affiliation with the protocol.

Nonetheless, early indicators counsel that the issues with Multichain have severely affected Fantom’s DeFi operations, resulting in asset depegging and initiatives shuttering their operations.

DeFi Protocol Closes Operations, Belongings Depeg

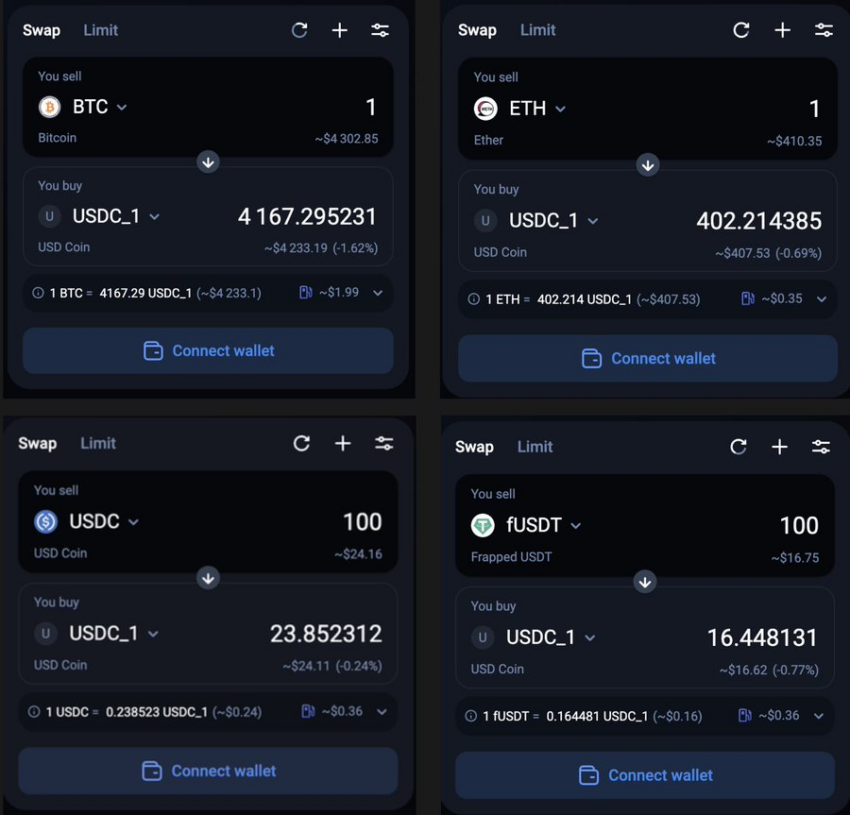

Belongings, reminiscent of Bitcoin, USDC, Ethereum, and numerous stablecoins bridged through Multichain on Fantom, have drastically depegged from their true values.

Web3 Data Graph Protocol 0xScope famous this discrepancy in early June, following the illicit switch of $126 million in Multichain customers’ funds to unidentified addresses. A lot of the pilfered belongings originated from the Fantom Bridge.

0xScope highlighted how merchants had been disposing of their Fantom-based stablecoins at a loss. One explicit dealer allegedly endured a lack of roughly $200,000.

“As a result of Multichain freeze, persons are promoting stables (fUSDT, and so forth.) for FTM and depositing FTM to CEX to flee from the Fantom protocol! Fantom [stablecoins are] now buying and selling at ~$0.7.”

Learn extra: Top 10 Must Have Cryptocurrency Security Tips

The depegging of belongings has particularly impacted Geist Finance, a fork of Aave on Fantom.

The decentralized liquidity market protocol has stated that the Multichain exploit has resulted in irreversible losses. This outcomes from Multichain bridged belongings now buying and selling at solely 22% of their precise worth.

“After affirmation from Multichain that the funds won’t be recovered, we’re asserting that Geist won’t reopen. As a result of Chainlink oracles are monitoring the worth of actual USDC, USDT, WBTC or ETH, they don’t seem to be conscious of the true worth of Multichain belongings,” defined Geist Finance.

Andre Cronje, co-founder of Fantom Community, acknowledged the influence of the Multichain incident. He lamented that assurances of decentralization, geolocation distribution, and entry given by the Multichain group proved false.

“Multichain was an enormous blow… Don’t belief, confirm (saying this to myself)… [We are] wanting into different backstops or serving to restoration, even utilizing basis treasury. Till now we have extra information we simply can’t give any arduous confirmations. We received’t go away this as is although,” stated Cronje.

Cronje additionally identified that Fantom Basis is coordinating with related events to retrieve the misplaced belongings. It confirmed contacting stablecoin issuers reminiscent of Circle, Tether, and TUSD.

The Basis requested these corporations to freeze assets in Multichain wallets.

“We now have verified that roughly $60 million USDC and $2 million USDT have been frozen,” stated the Fantom Basis.

Fantom’s Whole Worth Locked (TVL) Crashes

On account of these occasions and DeFi protocols shutting down operations, the full worth of belongings locked (TVL) on Fantom has plummeted.

On-chain data from DeFiLlama reveals that Fantom’s TVL has decreased by greater than 80%, falling to $69.03 million from its Could excessive of $364 million.

Learn extra: Top 6 DeFi Lending Platforms

Fantom’s decentralized exchanges have additionally skilled a pointy decline in buying and selling quantity. Information from DeFiLlama signifies that the community’s common weekly quantity all through June was lower than $100 million.

Though there was a slight improve within the first half of this month to over $200 million, this determine falls considerably wanting its February 2022 peak of $5.2 billion.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices based mostly on this content material.

[ad_2]

Source link