[ad_1]

KanawatTH

Thesis

Bitcoin (BTC-USD) stays in a bear market in my view. Endurance is a advantage – we should watch for apathy to turn into the narrative earlier than a real market backside is reached. For now, I see a number of negatives together with weak seasonality, continued regulatory enforcement actions, competitors from governmental CBDCs, rising Bitcoin Dominance, distribution by bigger holders, grasping sentiment, adverse Technicals (i.e., chart), tightening Fed liquidity, lackluster fund flows and adverse On-Chain Metrics. Whereas Bitcoin is in a hazard zone, the long-term case for Bitcoin stays stronger than ever! The U.S. (and different governments) continues to print extra {dollars} and debase the foreign money and Bitcoin addresses (i.e., adoption) continues to rise. Additional, the approaching Halving Cycle and associated robust Tokenomics favor greater costs.

Introduction

I first heard of Bitcoin again in 2017 when my youthful colleagues grew to become obsessive about its value (however nothing else). I used to be working at a financial institution on the time, so I didn’t have a lot time to dedicate to this “rabbit gap.” I took an mental short-cut figuring, after little thought, that Bitcoin was a digital coin with little intrinsic worth. Six years deep into that rabbit gap, I can see that it’s greater than that, although I respect a few of the brightest minds similar to Nassim Nicholas Taleb that may’t get previous Bitcoin’s “culty-ness.”

The place are we now?

Bitcoin and the crypto market total rebounded wildly from the underside submit the FTX (FTT-USD) fraud in November 2022. At the moment, Bitcoin plunged from over $21k to roughly $15.5k. Whereas I consider it’s too early for Bitcoin to turn into uncorrelated to equities, it confirmed outstanding resilience through the Silvergate/Silicon Valley financial institution runs and continued to rise to the present-day low $30s.

Was November 2022 the Bear Market Backside?

I used to be very torn throughout Bitcoin’s November backside. I comply with a mess of indicators and practically ALL of them have been saying this was it – “We’re at all-time low.” Nonetheless, I informed my YouTube channel subscribers that this will NOT be the underside as a result of I used to be nonetheless anticipating the Federal Reserve to stay hawkish. Bear in mind, in the interim Bitcoin is Macro and Macro is Bitcoin, which means that it’s very delicate to liquidity.

Brief-term Indicators are Bearish

I’m licensed as a Monetary Threat Supervisor and consider managing threat is an important success issue if one desires to dwell by means of bear markets. As such, I might quite err on the aspect of warning. I nonetheless assume Bitcoin may fall, even when it will be like a dancer that’s crouching down earlier than a big soar, as famed dealer and dancer Nicolas Darvas as soon as mentioned. Beneath is an inventory of pink flags for Bitcoin:

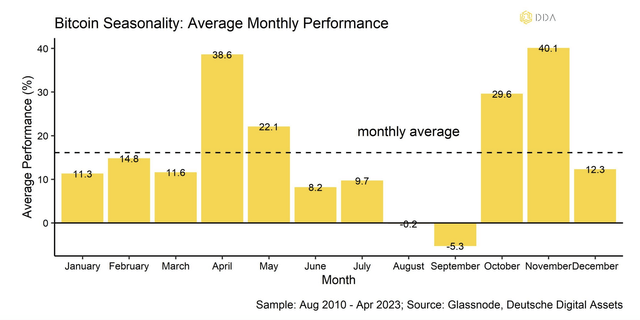

Promote in Might and Go Away

Because the saying goes, threat belongings have a tendency to say no through the summer season months, so why take undo threat?

Deutsche Digital Belongings

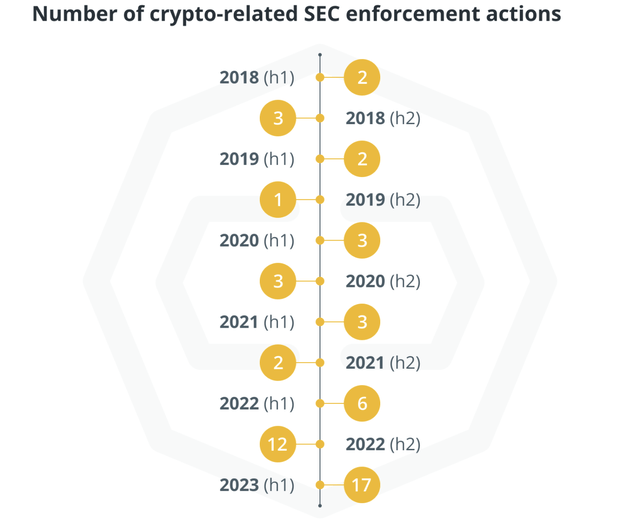

Regulatory Enforcement

Regulators, notably Gary Gensler’s SEC, have regulated through enforcement. The SEC has sued crypto associated corporations over 17 times this 12 months, below what’s known as Operation Chokepoint 2.0, (which has been described as a well-coordinated effort to marginalize the blockchain business and cut-off connections to the banking business). Operation Chokepoint 2.0 grew to become popularized following a post from enterprise capitalist Nic Carter. Bitcoin is seen as a menace to the U.S. authorities’s management of cash (and sanctioning energy) and a menace to the US Greenback’s reserve foreign money standing. As most readers know, the SEC has just lately sued Coinbase (COIN) and Binance (BNB-USD) and has mentioned that every one crypto belongings are securities. The one exceptions could also be Bitcoin and stablecoins. Nonetheless, on February 2023, the SEC informed Paxos Trust that it was meaning to sue them because it thought-about the Binance USD stablecoin an “unregistered safety.” (see the subsequent bullet for more information on stablecoins). These lawsuits cut back cash flows into all digital belongings together with Bitcoin. Whereas some flows are going into Bitcoin as a “protected haven” this isn’t sustainable.

Cointelegraph

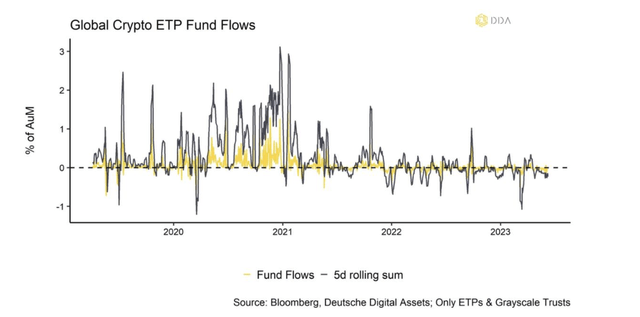

Destructive Fund Flows

Talking of flows, the fixed regulatory restrictions and lack of crypto regulation (“guidelines of the street”) from Congress, has resulted in decrease flows going into all digital belongings. Observe that fund flows are likely to differ broadly on a week-to-week foundation, so it’s higher to look at them throughout a multi-month interval (CoinShares supplies glorious weekly move information for people who want to comply with this). I don’t anticipate institutional flows till at the very least 2025 when/if there’s regulatory readability. Decrease flows cut back buying and selling liquidity, and because the saying goes, “escalator up – elevator down.”

Deutsche Digital Belongings

Stablecoins & Central Financial institution Digital Currencies (CBDCs)

There are additionally some headline and regulatory dangers relating to imminent rules on stablecoins. I just lately spoke to Senator Kirsten Gillibrand (Democrat-NY) who expects her upcoming digital asset invoice to particularly spotlight stablecoins. Stablecoins have been described because the “backbone” that enables Defi and non-custodial (i.e., DEX) buying and selling, in response to Coin Bureau. With out them, Bitcoin’s liquidity would dry up. Additional, stablecoins and Bitcoin are a menace to the US greenback, therefore central banks predict to introduce their very own variations (i.e., CBDCs). The above is each a short-term and long-term threat.

CryptoQuant

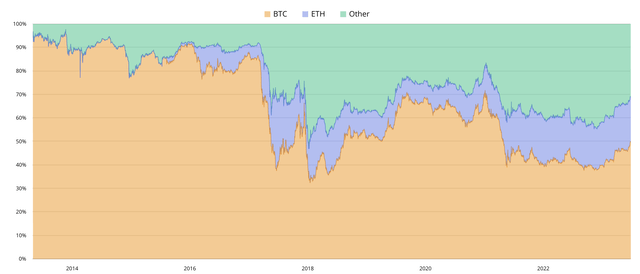

Bitcoin Dominance is rising

Bitcoin’s market cap, or Bitcoin + Ethereum (ETH-USD), as a share of complete digital asset market cap, usually grows throughout bear markets. Observe that some blockchain analysts are actually grouping Ether with Bitcoin because it’s thought-about a safe-haven provided that the SEC’s Hinman and the CFTC acknowledged it’s not a security. Traditionally, Altcoins bleed towards Bitcoin in bear markets – we’re witnessing this now. In simply the final three-months, Bitcoin + Eth dominance rose from 65% to 69%.

BTC Instruments

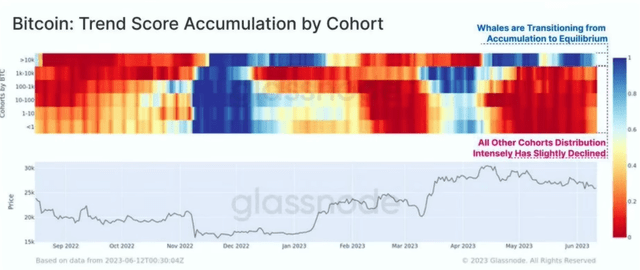

Massive Holders of Bitcoin have stopped accumulating

There are totally different cohorts of Bitcoin holders relying on how giant their baggage are. The most important, after all, are generally known as whales. Glassnode tranches them in response to six cohorts. Throughout the April-Might rally, solely the smallest of holders accrued, the remainder (sharks, dolphins, whales…) have been promoting aggressively. Sometimes, small (i.e., retail “weak arms”) traders purchase on the high and promote on the backside. The pink squares signify promoting, which is going on amongst most cohorts now, except for the most important holders (> 10k bitcoin) that are impartial. One of the best time to DCA into Bitcoin is when the squares are blue (accumulation) as occurred post-FTX.

Glassnode

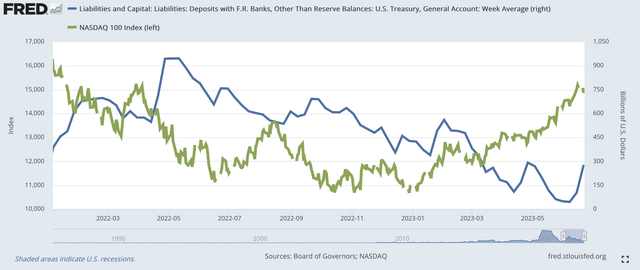

Tightening Liquidity through the Fed TGA

I consider that liquidity has been the main issue affecting ALL threat belongings since 2008. It’s no marvel that Bitcoin and NASDAQ’s synthetic intelligence tech shares have risen just lately, as liquidity rose when the Federal Reserve tried to avert the March 2023 bank runs. Nonetheless, now that the Fed’s slapped a bandage on the Regional Banking Crises and Congress has averted a debt ceiling, the Fed must refill its Treasury Basic Account (TGA). This refilling may drain practically $0.7 trillion in liquidity. Consequently, I believe Bitcoin and Tech are in danger. The rising blue line within the chart under represents the “refilling of the TGA pockets”. The extra it rises, the tighter is liquidity. The inexperienced line represents the NASDAQ 100 Index (Left hand aspect axis).

St. Louis Fed

I consider what we’re seeing in each equities and cryptocurrencies is a LIMITED provide of cash chasing a couple of belongings – on this case tech shares and Bitcoin. Whereas Bitcoin has reached a brand new yearly excessive, the full Altcoin market has not. Once more, this rally is doubtful.

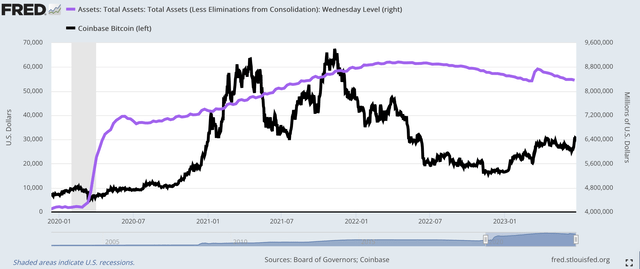

Declining Fed Steadiness Sheet

The Federal Reserve’s resumed its program of Quantitative Tightening. That is already being mirrored within the chart under the place you possibly can see the decline in Complete Belongings (i.e., Steadiness Sheet) as proven within the purple line (Proper hand axis). One can see how vigorously (albeit delayed) that Bitcoin costs (black line) reacted to the preliminary rising steadiness sheet after which declined because the Fed rolled-off its portfolio.

St. Louis Fed

Sentiment has gotten too frothy

I exploit sentiment as a opposite indicator each for equities and Bitcoin. The thrill over Blackrock’s (WisdomTree, Constancy) ETF software has began to make individuals giddy. The BTC Instruments Worry & Greed Index has turned Grasping. That is typically one of the best time to promote, not purchase.

BTC Instruments

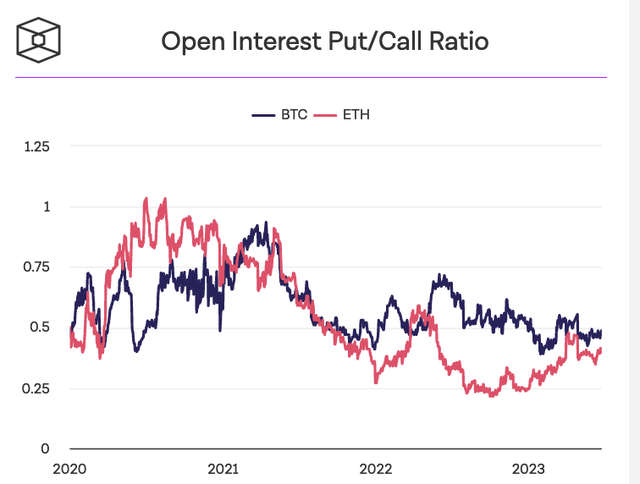

Spinoff Positioning (Choices + Futures)

There are a number of methods to find out sentiment primarily based on the Futures and Choices markets. I interpret these from a contrarian perspective. So if everyone seems to be shopping for comparatively extra Calls and fewer Places, that might be a adverse studying. Whereas the present Futures market appears adverse to impartial, the choices market is telling a unique story. Merchants have been shopping for name choices on Bitcoin (and NASDAQ tech shares) pretty aggressively. The chart under reveals open curiosity for Bitcoin and Ethereum. Bitcoin’s Put/Name ratio is buying and selling close to its lower-end of the three-year vary.

The Block

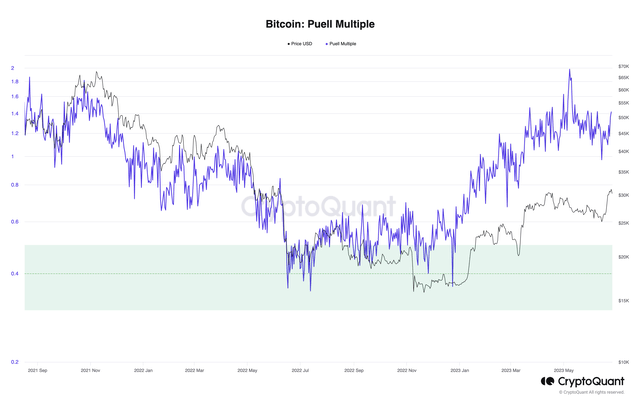

On-Chain Metrics

I preserve observe of a dozen metrics and most of them grew to become very bullish at Bitcoin’s Nov/Dec 2022 backside. Nonetheless, all of them have moved from Bullish to Impartial at finest. The Puell A number of (which is the day by day worth of Bitcoin Miner coin issuance divided by its Yearly Common) for instance, moved from simply 0.36x on December 2022 to over 1.2x over the last three months. For perspective, Bitcoin was buying and selling under $18k when the Puell was 0.36x and round $55k the final time the Puell traded at at this time’s stage. Scary, no?!

CryptoQuant

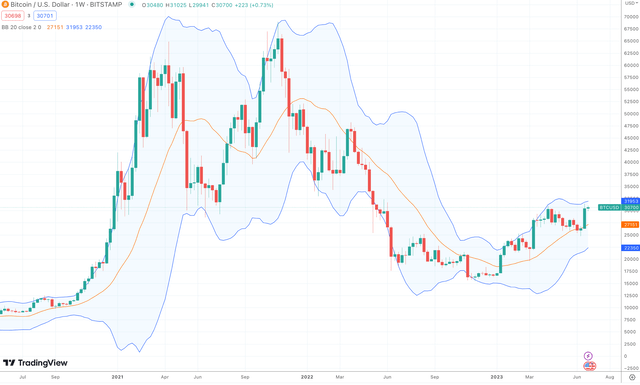

Weak Bitcoin Technicals

The best way Bitcoin has traded during the last 12 months leaves it weak to excessive promoting stress above $30k provided that there’s large resistance on this space (See chart). It’s also buying and selling towards its higher Bollinger Band.

TradingView

So why am I so Bullish long run?

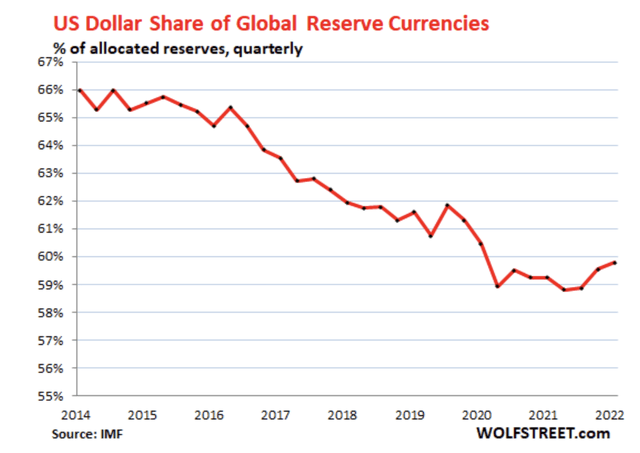

I’ll delve into particulars of my long-term bullishness, one Satoshi at a time, in an upcoming SA article. In abstract, these positives embody Bitcoin’s resistance to the debasement of the US greenback, makes an attempt by the BRICS international locations to destabilize the USD as reserve foreign money (chart under) and constructive on-chain-metrics similar to rising addresses (aka the “Community Impact”). There’s much more than a distant probability that the U.S. may assist Bitcoin. Just lately, the Worldwide Financial Fund (which is controlled by the U.S.) capitulated on Bitcoin bans saying, “banning may not be effective in the long run.” So there may be hope!

Wolf Road, IMF

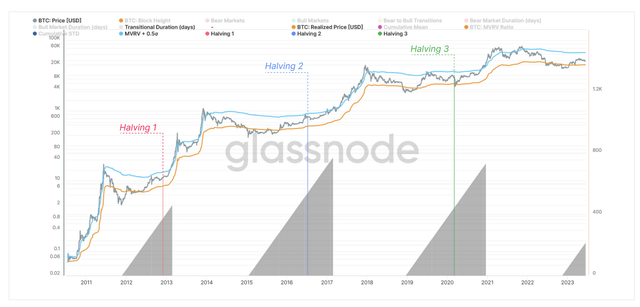

Lastly, I’ll talk about Bitcoin’s glorious Tokenomics, which is characterised by a restricted provide (21 million Bitcoin), excessive circulating provide (19.4 million), the upcoming halving cycle (chart under) great amount of inactive provide and misplaced cash.

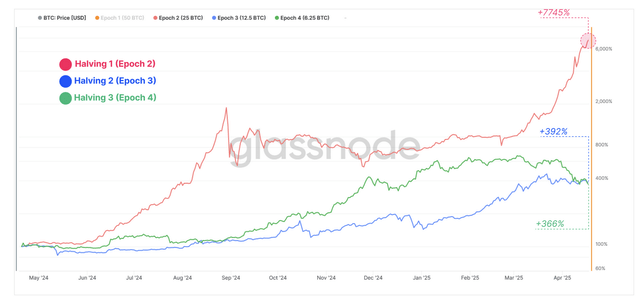

Glassnode

I’ve seen the media is giving little or no airtime to misplaced cash. These could possibly be Bitcoin wallets which are misplaced, cash despatched to improper addresses, hard-drive failures, pockets failures, misplaced seed phrases, or individuals dying with out plans. James Mullarney has estimated misplaced cash to be between 3-6 million Bitcoin and he says that it may quantity to 4% yearly. If such is the case, Bitcoin has ALREADY turn into deflationary. Beneath are the returns of Bitcoin one 12 months after every halving (aka Epoch). The final halving was in Might 2020 and the subsequent is predicted round April/Might 2024. Observe that the subsequent halving will possible happen in a interval of falling provide.

Glassnode

Conclusion

As you possibly can see from the multitude of indicators and fundamentals, Bitcoin appears to be buying and selling at a short-term high. Readers might discover it shocking that I’m bullish on Bitcoin given the (maybe) convincing case I’ve made. Bitcoin’s long-term case stays stronger than ever. Like Nicolas Darvas as soon as mentioned, I believe the short-term decline will probably be extra like a dancer’s crouching down earlier than she rises for a giant soar. I hope you loved this learn and I welcome any questions.

[ad_2]

Source link